There is low volatility in the markets with little interest in risk in anticipation of the results of the FOMC meeting on Wednesday and the employment report on Friday. The US stock markets are rising, pulling other regional markets with them, but in any case, one must proceed from the fact that the GDP of the United States and the Eurozone countries has not yet recovered to pre-dock levels. At the same time, inflation remains obscenely high, so it is necessary to wait for the reaction of central banks in order to correct long-term forecasts.

NZD/USD

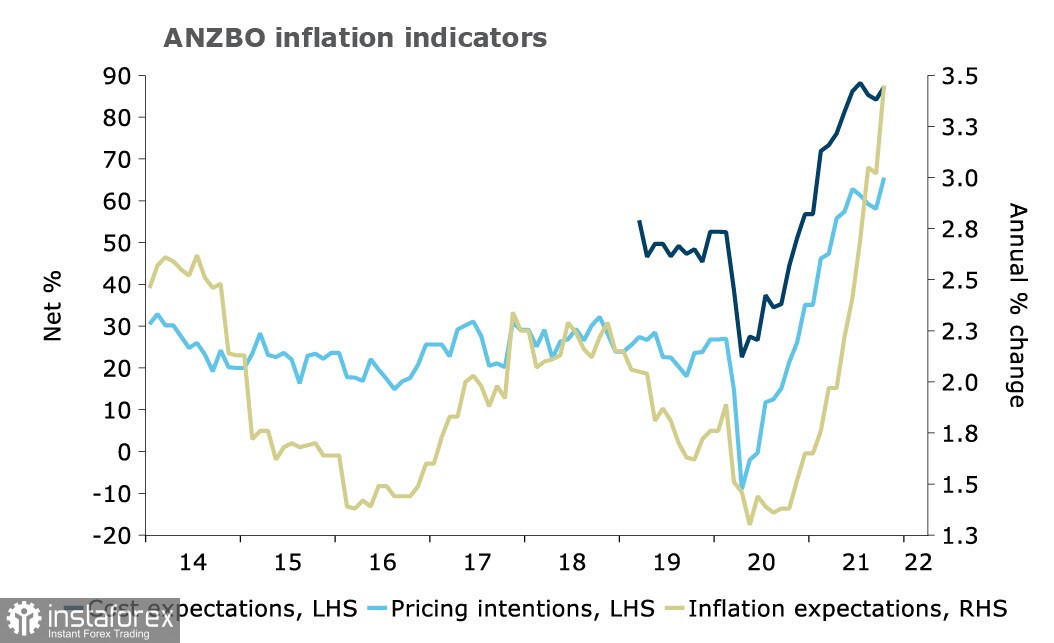

ANZ bank's survey of business sentiment showed a sharp increase in inflation expectations in October to 3.45% against 3.02% a month earlier, which is not surprising since official inflation in Q3 was 4.9%. In addition to inflation expectations, both cost expectations and selling prices are growing, that is, the basis for further growth in consumer prices has been thoroughly summed up.

If during the summer, there was full confidence that the RBNZ would raise rates, focusing on both high inflation and strong economic growth, then by November, such confidence had diminished. Large household purchases are declining, retail trade is also slowing down, and business confidence has noticeably fallen.

A key report on the labor market for the 3rd quarter will be published today, whose forecasts are ambiguous. The main focus will be on the change in the wage index, since it is important to understand whether income growth will lag behind the growth of inflation or not. Accordingly, there are different options for the RBNZ's response to the employment report – very strong data may provoke an increase in the RBNZ rate in November by 0.5% at once, while close to forecasts will mean a likely increase by 0.25%. Both options will lead to an increase in demand for the New Zealand dollar.

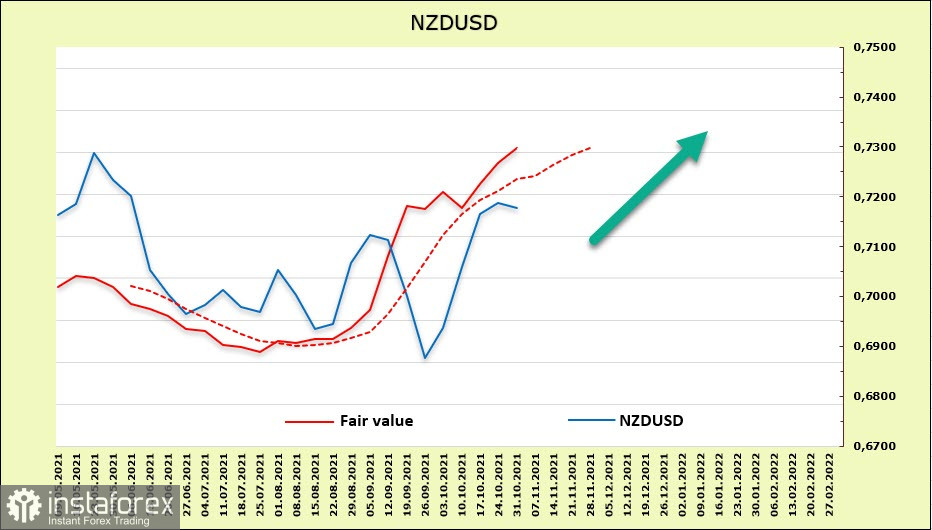

So far, we assume that the demand for NZD remains. The yields of 10-year T-bills are kept above 2.5%, which is noticeably higher than in other G10 countries. According to the CFTC report, the net long position of NZD increased by 177 million during the reporting week and reached 638 million. The estimated price is above the long-term average and is directed upwards. The trend remains bullish.

The 0.7200/10 resistance zone could not be broken on the first attempt. It is assumed that the key releases of the week, as well as the results of the FOMC meeting on Wednesday, will push the NZD up, and it will be able to consolidate above this zone. The next target is the level of 0.7312.

AUD/USD

The RBA expectedly left the current rate at 0.1% at the meeting that ended this morning. It continued to buy GKOs in the amount of $ 4 billion a week and will continue to do so at least until mid-February 2022. The Australian regulator also canceled the target for government bonds for April 2024

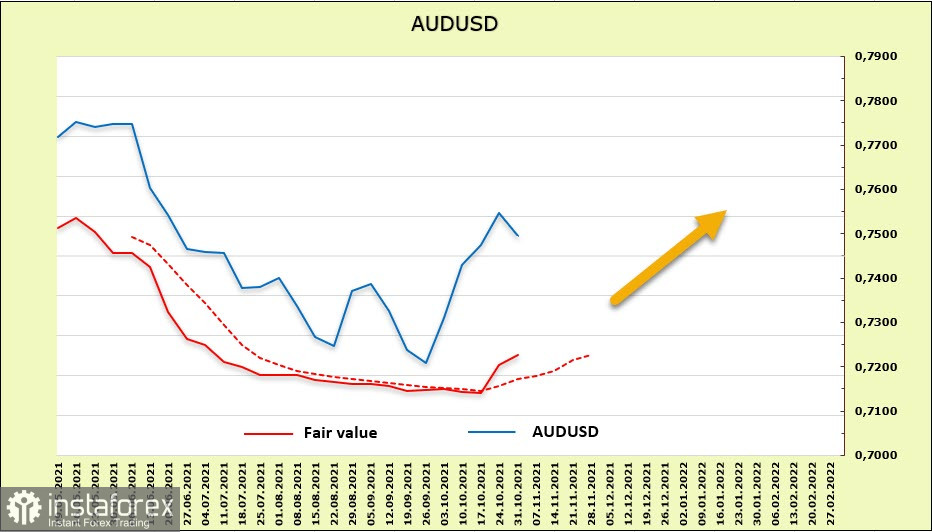

All these decisions were expected. The main focus was on the last point, which means the RBA's refusal to control the 0.1% yield curve. These decisions will be interpreted by the markets as dovish, so some depreciation of the AUD/USD pair is fundamentally justified.

At a press conference, the head of the RBA, Lowe, tried to mitigate the negative reaction of the market, saying that "it is likely that an increase in interest rates may be appropriate in 2023." Previously, the benchmark was 2024, that is, Lowe's words have a slightly bullish connotation, which he himself, however, immediately disavowed in the next comment, stating that the latest data and forecasts do not justify an increase in the cash rate in 2022. Therefore, it is quite possible that the interest rate will remain at the current level until 2024.

As a result, no bullish incentives were added for the Australian dollar.

The CFTC report is neutral. The net-short position fell by only 40 million, reporting to -5.644 billion, which is practically unchanged. The bearish advantage is significant. The estimated price makes an attempt to move up from the long-term average, which gives some chances for continued growth.

Technically, there is a high probability that AUD/USD will rebound from the upper border of the descending channel, where the resistance zone 0.7540/70 passes, and go lower towards the middle of the channel of 0.7250/60. If commodity prices continue to rise, and the results of the FOMC meeting on Wednesday are regarded by the markets as dovish, then an attempt to exit the channel upwards is not excluded in this case.