Following Monday's strong increase in demand for risky assets, Tuesday saw a sell-off in China and a decline in futures for major stock indexes in Europe and America. At the same time, the US dollar moves in different directions against major currencies in the currency market.

The two-day Fed meeting on monetary policy begins today, which is likely to be a turning point for world markets and for everyone. These expectations are related to the fact that the regulator is highly likely to make a decision on it to start the process of reducing the volume of asset repurchases. About $ 120 billion is secured corporate mortgage securities and government bonds, the repurchase of which has supported the national economy all the last pandemic time. It is assumed that after the beginning of the "narrowing" of asset repurchase volumes by the middle of next year, the so-called simulation program will be completely discontinued.

In this situation, one should expect a noticeable reduction in the volume of dollar liquidity, which will automatically increase the demand for the US dollar and support its exchange rate. Earlier, the yields of treasuries reacted to this with growth, but recently, they have pulled down precisely because of the expectation of the outcome of the Central Bank meeting, since, despite the high probability of announcing a reduction in incentives, there is still the possibility of adjusting the Fed's position on this issue amid the situation in the labor market in the country. It can be recalled that the latest employment data turned out to be noticeably lower than all forecasts. The yield of the benchmark 10-year treasuries is declining by 1.54% to 1.549%, which reached 1.705% earlier in October.

How will the market react to the announcement of a reduction in the volume of asset repurchases?

If everything goes according to the expected scenario, then it will be possible to assume an upward reversal to an increase in the yield of treasuries and a local appreciation of the US dollar, as well as a correction in the American stock markets and through it, in the world. However, it is still important to detail these measures, namely, by what volumes the reduction will begin and at what rate. Although according to the results of the October meeting, J. Powell also reported on the approximate timing of the end of QE – mid-2022. The emergency situation in the labor market may force the bank to adjust its aspirations. That is why there is a decrease in the yield of treasuries and a drop in futures on US stock indices.

In conclusion, it is worth noting that it is precisely the problems with US employment that may force the Fed to show a softer position, which will cause renewed growth in demand for Treasuries, company shares, and a weakening of the US dollar. Therefore, we believe that the reaction in the market will be the strongest on Wednesday after the publication of employment data from ADP.

Forecast of the day:

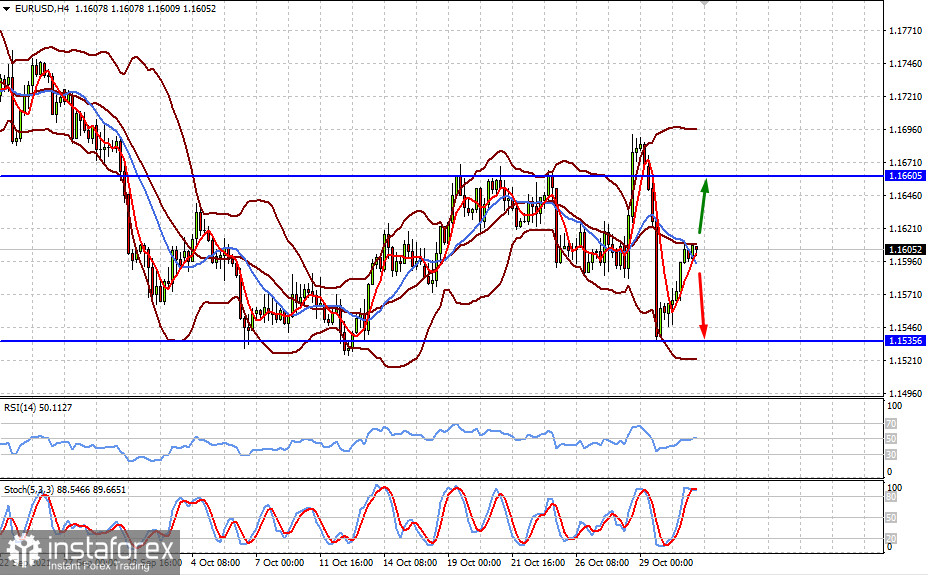

The EUR/USD pair remains in the range of 1.1535-1.1660 before the Fed meeting, in which it is likely to remain until Wednesday. From this area, it will either receive support amid a softer statement from the Central Bank and grow to 1.1660, or it will decline due to the regulator's tough stance on the prospects for monetary policy. In this case, the US dollar will receive support. The pair may decline to the level of 1.1535.

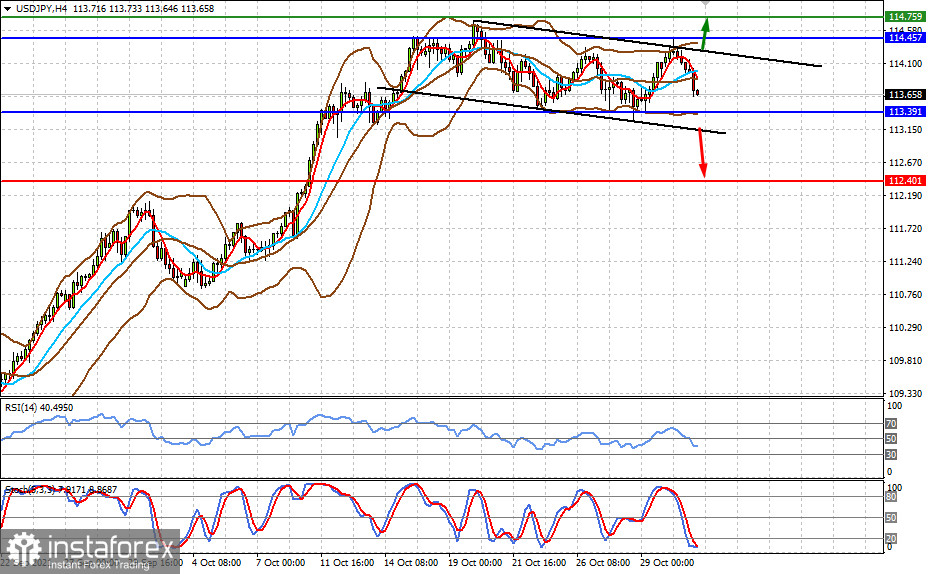

The USD/JPY pair is consolidating in the range of 113.40-114.45. Positive news for the US dollar will allow the pair to rise to the level of 114.75, while the negative one will lead it to 112.40. We can expect significant movements of the pair only in the case of a strong statement by the Fed and Powell, as well as data on the number of new jobs from ADP.