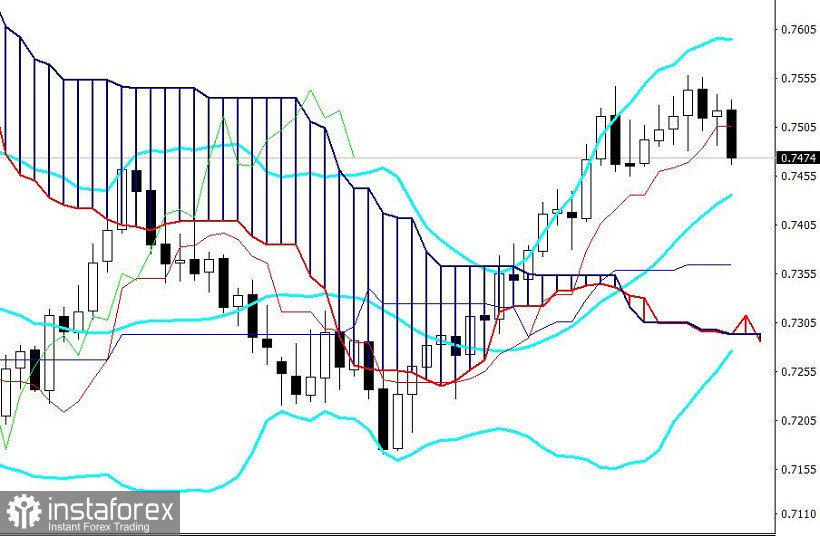

The Australian dollar reacted negatively to the results of the RBA's November meeting published today. The AUD/USD pair moved away from the previously reached price highs, returning to the area of 0.74.

Following the results of today's meeting, the Reserve Bank of Australia kept the key interest rate at the same level (0.10%), but at the same time, it abandoned the target level of yield on government bonds with an expiration date of April 2024, which was 10 basis points. Representatives of the Australian regulator also assured market participants that the RBA will continue to buy government bonds at the same pace ($4 billion per week) at least until mid-February next year.

In general, the rhetoric of the accompanying statement was optimistic. In particular, the regulator said that the decision to abandon control over the level of bond yields was due to "an improvement in the economic situation and progress towards achieving the inflation target." Given the general tone of the November meeting, some experts were quick to assume that the RBA would begin tightening monetary policy parameters earlier than the designated date – in 2023. The immediate reason for such assumptions was the wording of the final communique. If earlier, the regulator indicated that it would raise the interest rate no earlier than 2024, then today, the Central Bank is ready to do it until 2024. In general, this is the first "hawkish" hint from the Reserve Bank of Australia. But, in my opinion, this hint turned out to be too unclear, and the assumptions of some analysts regarding the prospects for 2023 are subjective. And traders clearly expected more, especially after the release of the latest data on inflation growth in the country. Therefore, the Australian dollar weakened its position throughout the market – inflated expectations did not coincide with mediocre reality.

In fairness, it should be noted that the Australian regulator still pays attention to the dynamics of inflationary growth. It can be recalled that the general consumer price index in the third quarter came out in accordance with the preliminary forecasts of most experts – both on an annual and quarterly basis. The indicator increased to 3.0% in annual terms, and to 0.8% in quarterly terms. According to the RBA (by the truncated average method and the weighted median method), the core inflation index also demonstrated positive dynamics, reflecting the recovery processes.

Commenting on these figures, the Reserve Bank noted that inflation still remains low despite the current recovery in growth, while its further growth rates will be quite slow. It also noted that the growth of inflation is not sustainable, and is largely due to temporary factors. A separate claim is for salaries. As noted in the statement, the growth rate of wages is of particular concern to the members of the Central Bank: "the labor market should generate wage growth at a pace significantly exceeding the current pace."

In general, the Australian dollar reacted relatively restrained to the publication of the accompanying statement and rather negatively to the main messages voiced by the head of the Central Bank, Philip Lowe. Firstly, he disappointed the hawkish-minded experts who drew attention to the change in the wording of the final communique. The head of the RBA stressed that this decision "does not indicate that the rate will definitely be raised before 2024." According to him, there is a high degree of uncertainty in this issue, so it is quite likely that the rate will remain at the current level until the 24th year. Moreover, Lowe categorically ruled out the option of tightening the parameters of monetary policy within the next year. He said that the hawkish expectations of the market "are extremely unrealistic."

In other words, the Reserve Bank of Australia hypothetically admitted today the possibility of tightening monetary policy earlier than 2024, but at the same time, stressed that this would not happen before 2023.

Such an extremely cautious approach disappointed traders, who clearly expected to hear other messages. It is obvious that the members of the Australian regulator will not follow the path of their colleagues from the Bank of England or the Bank of Canada, who declared the implementation of the "hawkish scenario" next year. Moreover, they obviously will not follow the path of their colleagues from New Zealand, who decided to raise the rate this year.

This categorical dovish nature of the RBA dissonates with the voiced praises of the Australian economy, which, according to Lowe, has demonstrated "stress resistance" and the ability to recover quickly after the coronavirus crisis. Despite the optimistic outlook regarding the prospects for the recovery of the national economy, the RBA remains committed to a soft monetary policy, "skipping ahead" of the Central Bank of other countries of the world, including the United States. Therefore, the apparent "hawkish nature" of the November meeting of the Reserve Bank is an illusion: the regulator is still not ready for decisive action.

Despite such disappointing conclusions for the Australian dollar, it is risky to make any trading decisions on the AUD/USD pair today. Dollar pairs are waiting for this week's main event (and possibly the month), which will take place tomorrow. On Wednesday, the results of the Fed's November meeting will be announced, which can completely "redraw" the fundamental picture for many pairs, including for AUD/USD.

If the US regulator disappoints the dollar bulls, the Australian dollar will not only return to the area of the 75th mark but will also move towards the resistance level of 0.7590 (the upper line of the Bollinger Bands indicator on the daily chart). Otherwise, AUD/USD will continue to decline to the support levels of 0.7430 (the average line of the Bollinger Bands on the same timeframe) and 0.7360 (the Kijun-sen line on D1).