According to the weekly review of gold prices, Wall Street is expecting the prices to decline this week. The previous week was difficult for gold with mixed economic data and a hawkish statement from the Bank of Canada, diverting attention from the precious metal.

Markets were also busy digesting the sharp slowdown in the US economic growth recorded in the third quarter. In addition, the Bank of Canada made a surprise by ending the quantitative easing program and advancing the timing of rate hikes.

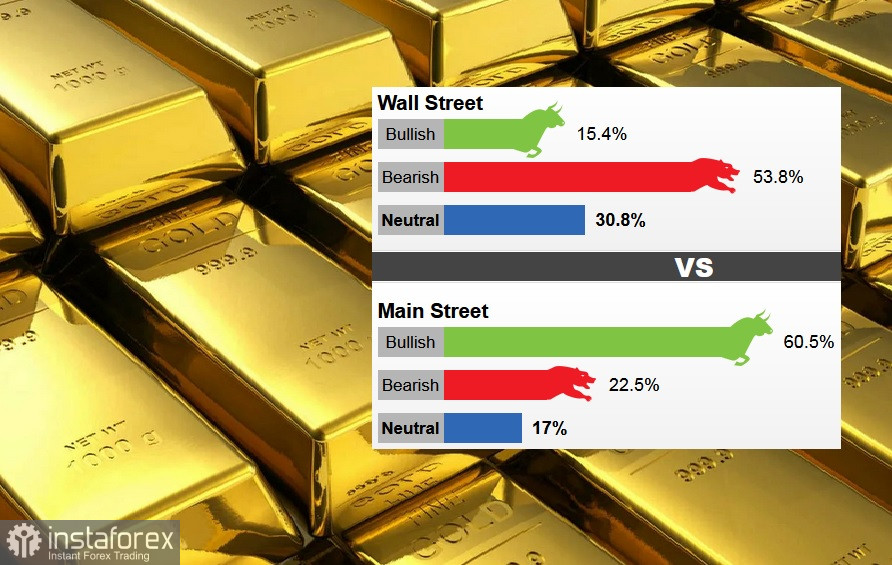

The results of the gold price survey showed that 53.8% of 13 Wall Street analysts are set to lower prices during the week. The other 30.8% were neutral, and only 15.4% voted for a price increase.

Meanwhile, the Main Street side remained more optimistic. Of the 745 participating retail investors, 60.5% were optimistic, 22.5% voted for a reduction, and 17% remained neutral.

The strengthening of the US dollar is another reason why analysts are so bearish about gold prices.

However, almost all Friday's decline in gold was bought out on Monday, amid positive news in the American manufacturing sector.

The ISM manufacturing index was 60.8% last month, exceeding the consensus forecast of 60.5%, but the monthly indicator declined by 0.3% compared to the September value of 61.1%. The report said that such an indicator shows the growth of the economy as a whole for the 17th month in a row after the April recession in 2020.

Readings of such diffusion indices above 50% are considered a sign of economic growth. Conversely, the further the indicator is from 50% – higher or lower, the greater or less the rate of change.

Gold prices rose above the daily highs after the publication of the data.

In October, the employment index rose to 52%, which is 1.8% higher than the previous month. The index of new orders decreased to 59.8% from 66.7%, and the index of production decreased to 59.3% from 59.4%.

The report also noted that companies continue to face a large number of supply barriers due to growing demand.