It would be wise to consider selling EUR/USD.

Hello, dear traders!

Today's review of the main currency pair in the forex market will start with the still burning issue of the COVID-19 pandemic. According to the WHO, the global death toll from COVID-19 topped 5 million. The 4th wave of the deadly virus is now tightening its grip on the world. A massive surge in new infections is recorded in Romania, the Netherlands, Austria, Poland, and Hungary. The authorities of these countries are doing their best to curb the spread of the virus, though it is not easy to do. The daily increase in COVID-19 cases in Greece is about 5,000, so the situation is also alarming in this Southern European country. Now, let's look at today's macroeconomic calendar and see what events could exert pressure on EUR/USD. Indeed, this is going to be an uneventful day in the market. For example, no reports are scheduled for release in the United States. Meanwhile, the eurozone will present its manufacturing PMI - the most important business activity index. Now, let's turn to charts, and analyze price movements. Today, EUR/USD technical analysis is carried out based on the lower time frames.

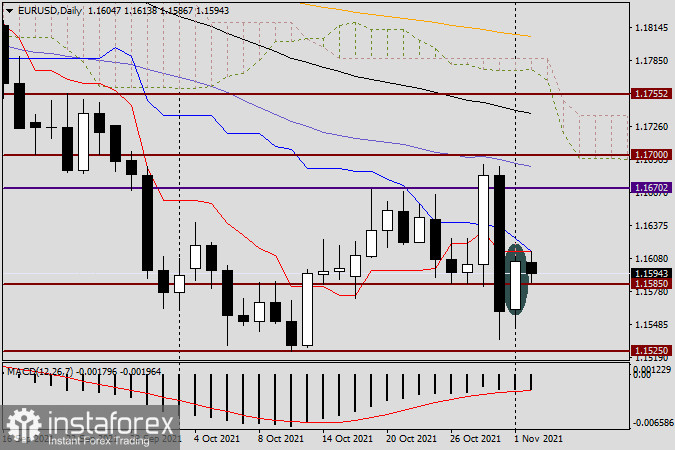

Daily chart

The euro/dollar pair traded higher yesterday. So far, this rise should be considered a correction relative to the previous sharp drop in price. Thus, there is a Harami candlestick pattern on the chart as yesterday's bullish candlestick is inside the previous large bearish candlestick. This pattern is far from being the strongest, which means it is not always priced by the market. Therefore, there should be confirmation that the price goes up today. Bulls and bears are trying to gain control of the important and strong level of 1.1600. The red Tenkan-sen and the blue Kijun-sen intertwined at 1.1614, preventing euro bulls from pushing the quote higher. The price bounced from this level yesterday as well as today. At the moment, the euro/dollar pair is trading lower, at around 1.1588. The bulls' task would be to break through 1.1614. Consequently, the quote might rise to the important resistance zone of 1.1670-1.1700. Meanwhile, bears should break through the resistance level of 1.1525 and push the pair below the psychological level of 1.1500.

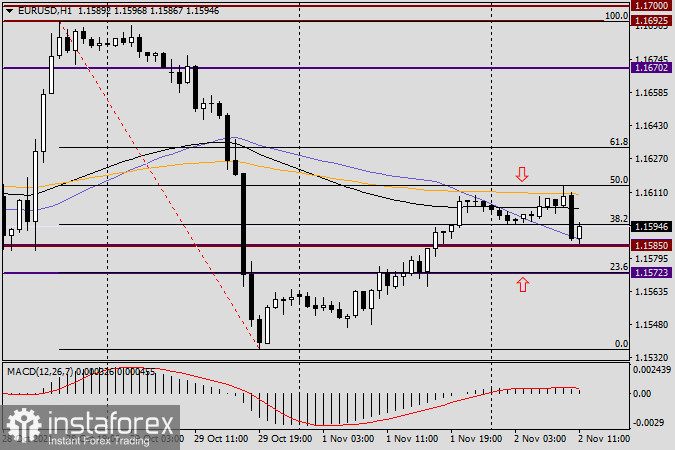

H1 chart

Based on a stretched Fibonacci grid in the range of 1.1692-1.1535, we can see that the price recovered half of its earlier losses. The quote encountered strong resistance from the black EMA (89) and the orange EMA (200), as well as the 50.0% Fibonacci level. In fact, the price plunged from the orange EMA (200). Anyway, the quote is expected to approach the EMA (200) today where a bearish pattern or Japanese candlestick pattern is likely to occur, generating a sell signal. Therefore, traders should consider selling EUR/USD at the moment.

Have a nice trading day!