The only thing that interests market participants today is the results of the Federal Open Market Committee. Everything else does not matter at all. Fortunately, practically no macroeconomic data is published. So investors can calmly concentrate all their attention exclusively on the Federal Reserve meeting. And there are three possible scenarios for the development of events. The first two are that the US central bank announces the beginning of the curtailment of the quantitative easing program. The only difference is that this process can begin either in November or in December. In both cases, the dollar will start to grow steadily. The only question is the scale of its growth. If the reduction of the program begins only in December, then the dollar will grow a little more slowly. It should be noted that yesterday, after the opening of the US trading session, the dollar strengthened its position somewhat, so that investors are more likely to prepare for exactly one of these two scenarios. The third scenario is fundamentally different from the first two, and it consists in the fact that consideration of the issue of scaling down the quantitative easing program will be postponed to the December meeting of the FOMC. The likelihood of such a development of events is rather small, but in no case can it be ruled out. And in this case, the market will behave in a completely different way. The dollar will probably start to actively lose its positions.

The US dollar has partially recovered its lost positions against the euro, but price changes are insignificant. To a greater extent, there is a stagnation in prices due to a key economic event.

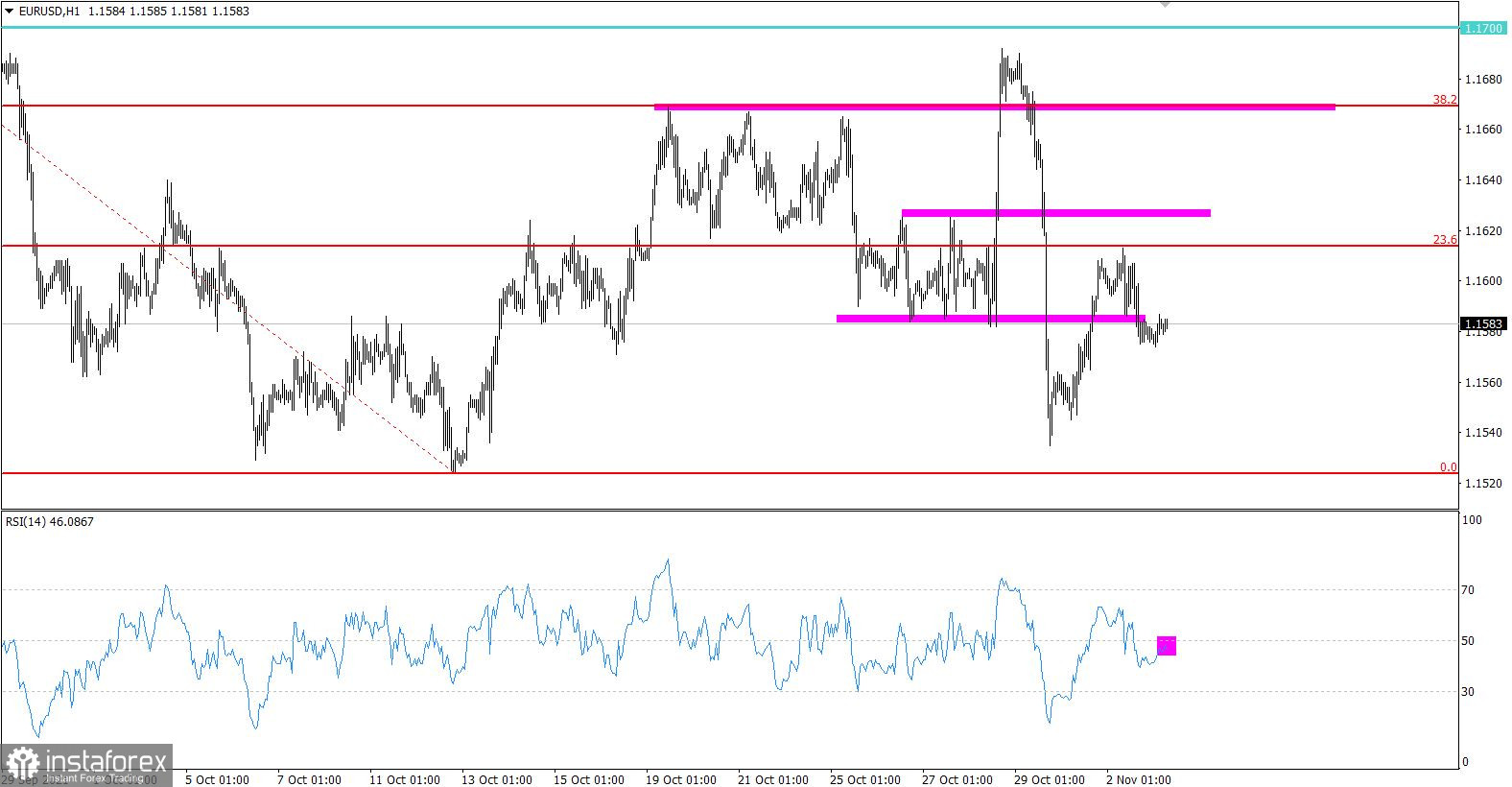

The technical instrument RSI in the hour period follows the level of 50, which confirms the signal of stagnation in price.

From the point of view of market cycles, the price is fully recovering relative to the corrective move 1.1530 ---> 1.1692.

Expectations and prospects:

Due to the fact that the FOMC results will be announced today, the market may initially stagnate, and after speculative leaps, depending on the decision of the central bank. Traders consider the current year's local low of 1.1524 as a reference point of support. The current level of 1.1700 can play the role of resistance.

Complex indicator analysis has a variable signal based on short-term and intraday periods due to price stagnation. Technical instruments in the medium term have a sell signal in the form of a downward cycle.