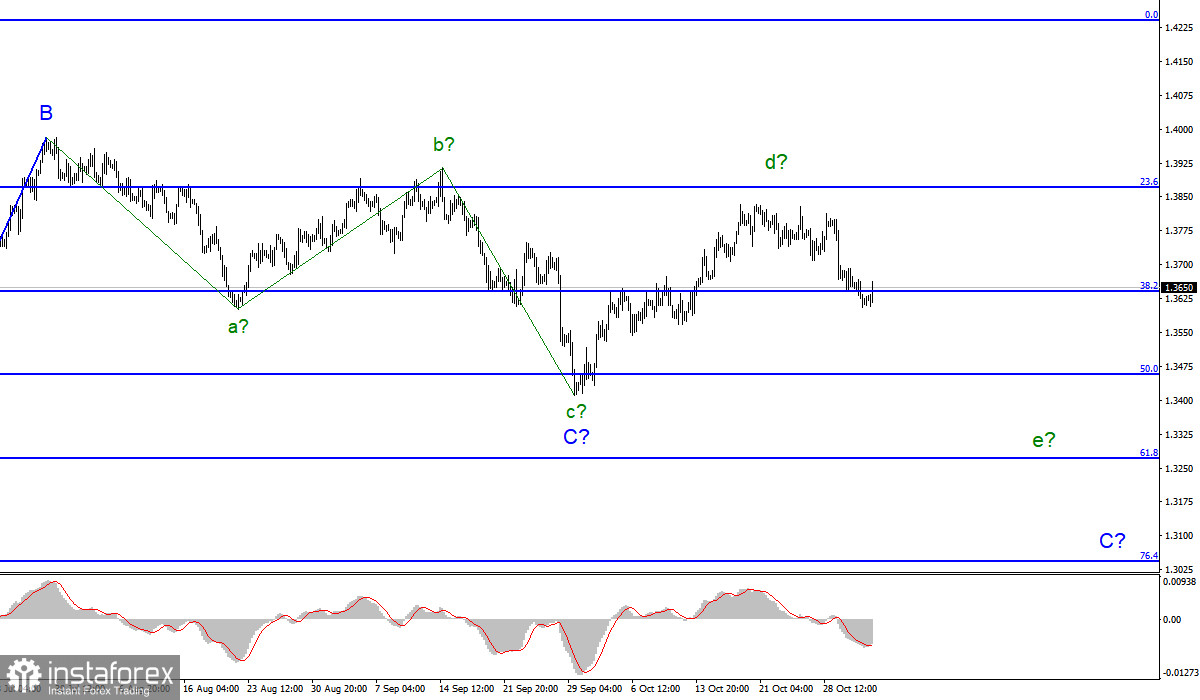

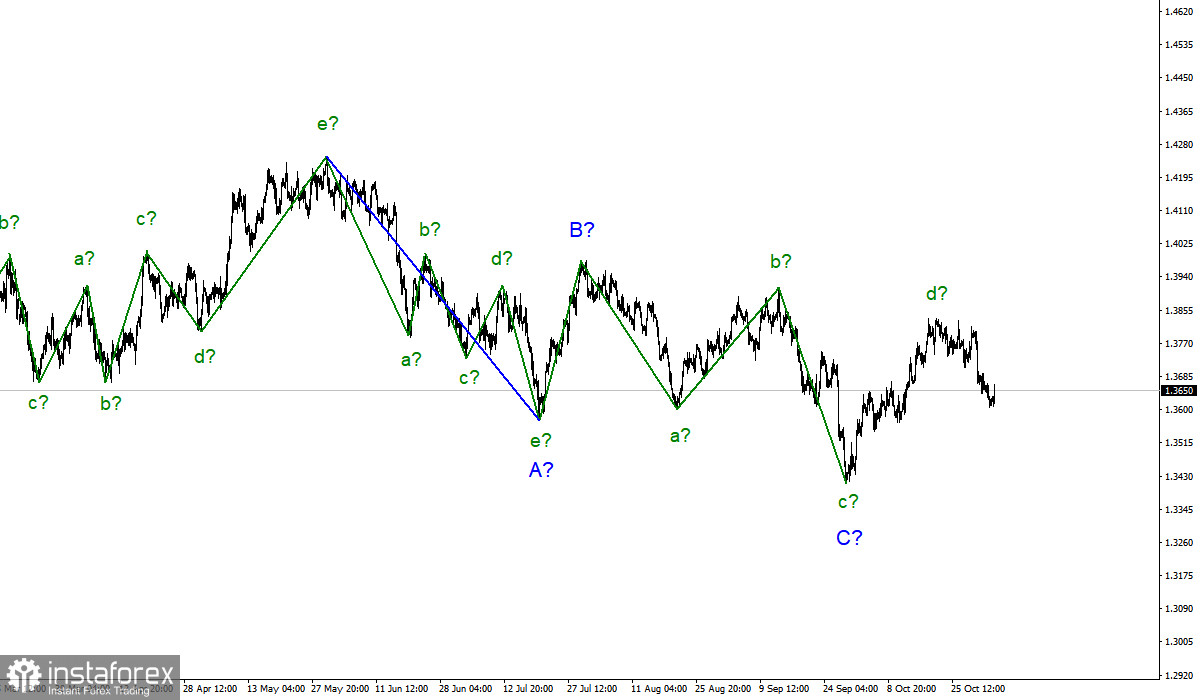

Wave pattern

The wave counting for the Pound/Dollar instrument continues to look quite complicated due to deep corrective waves as part of the downward trend section, but at the same time, it is quite convincing. Even inside the last wave C, presumably five internal waves are visible, and each subsequent one is approximately equal in size to the previous one. At the same time, wave C can already be completed if it has taken a three-wave form. If it does take a five-wave form, then wave d is completed, and now the decline in the quotes of the instrument within wave e will continue.

If this assumption is correct, then the decline of the instrument will continue with targets located near the minimum of wave c, that is, about 34 figures. A successful attempt to break through the peak of wave b will lead to the need to introduce new refinements to the current wave counting.

Wednesday started positively for the British pound, not for the dollar.

The exchange rate of the Pound/Dollar instrument decreased by 50 basis points on Tuesday and increased by the same amount in the first half of Wednesday. Thus, the information background in the first half of Wednesday worked in favor of the pound.

Based on the report, the UK's index of business activity in the service sector in October increased from 58.0 points to 59.1 points. And the composite index from 56.8 points to 57.8, which supports the increase in demand for the British pound.

However, if you look closely, the increase in the quotes of the pound began later than the release of these reports and occurred at a time (within one hour) when no news and reports came from the United States and Britain, and the European currency was declining at that time. That is, the pound and euro moved differently and also completely out of line with the current news background.

Meanwhile, in the US, the ADP report on the number of new employees in the private sector has already been released. It came out to be around 571,000, which is much better than markets' expectations. After this report, the demand for the US currency increased. However, it was only evident for the Euro/Dollar instrument, not the same was observed on the Pound/Dollar pair as the British pound outpaced the growth of the dollar.

But the situation was corrected upon the release of the indices of business activity in the United States for October. The standard index for the service sector rose from 58.2 points to 58.7 points. Composite from 57.3 points to 57.6 points. And the ISM business activity index in the service sector rose from 61.9 points to 66.7. After the release of these data, the demand for the dollar began to increase in both pairs. Now all that's left is the results of the meeting of the Fed and the Bank of England.

General conclusions

The wave pattern of the Pound/Dollar instrument looks quite convincing now. It received a downward view, but not an impulsive one. The expected wave d has completed its construction, so I advise you to sell the instrument based on the construction of the expected wave e in C with targets located near the level of 1.3270.

Starting from January 6, the construction of a new downward trend section began, which can turn out to be almost any size and any length. At this time, I'm still counting on building another downward wave, since wave A turned out to be a five-wave one. The peak of wave b has not been broken yet, so I am waiting for a new decline in quotes.