The S&P 500 index's upward momentum is strong. This allows us to keep purchases open at the end of the previous month. It should be noted that the significance of the impulse was confirmed by the growth yesterday.

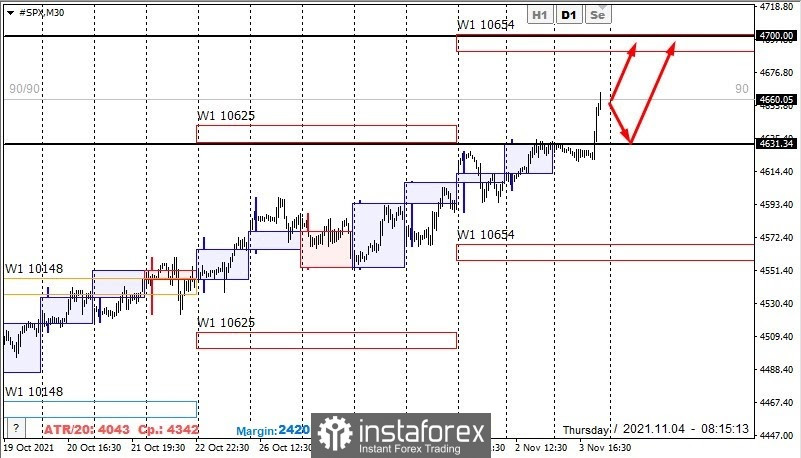

Buying at this week's high will not be profitable, so it is necessary to wait for a downward correction to find prices to open a long position. The nearest support will be the level of 4631.34. A return of the price to this level will allow us to consider the absorption pattern to buy the instrument.

The nearest round level that can be used to fix purchases is at around $4700. The growth can be continued from the current levels, but it is beneficial only for those who are already in the transaction. The target level coincides with the zone of the average weekly course, which makes consolidating on it mandatory.

If the S&P 500 reaches the level of $4700 today or tomorrow, then a corrective sell from this mark with a quick consolidation and a new entry into the purchase can be considered.