On Wednesday, Ethereum reached new record highs. Analysts are now studying its connection with the growth of inflation expectations. It is worth noting that the ETH token hit a record high of $ 4,642.48.

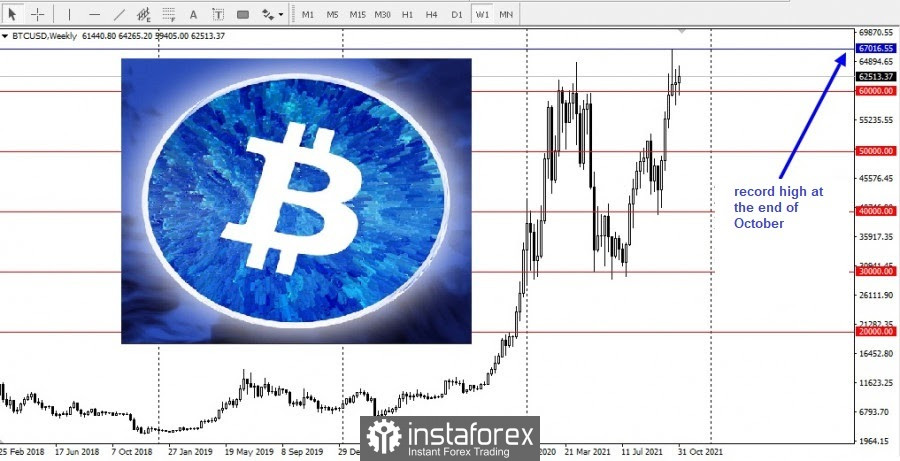

The cryptocurrency is following in the footsteps of Bitcoin, which reached its new record high of $67,016.5 at the end of October.

The wider adoption of blockchains supports the growth of Ethereum, which creates competition for Bitcoin.

It became clear that Bitcoin will face competition in the next half of the year. Ethereum and other Tier 1 assets are becoming more innovative, with use cases for DeFi and NFT.

According to Philip Gradwell, Chief Economist of Chainalysis (a company in the field of blockchain analysis), another 4 million Ethereum have flooded into DeFi since mid-April, bringing the total amount of Ethereum to 17.6 million, which is 15% of the total supply. All these are very positive changes for cryptocurrencies, respectively, their potential is now clearer than ever.

This year, Ethereum surpasses Bitcoin: the first has grown by 512% since the beginning of the year, and the latter did by 115% since the beginning of the year.

Bloomberg Intelligence Senior Commodities strategist Mike McGlone noted that by the end of the year, more and more institutional investors will invest in both Bitcoin and Ethereum. And with the approach of 2022, managers of global assets with zero distribution of Bitcoin and Ethereum will most likely have to rethink their approach when risks will begin to decrease against the background of the rapid evolution of digital assets.

The latest development was that the Commonwealth Bank of Australia (CBA) announced that it would be the country's first major bank offering cryptocurrency trading to retail customers. CBA said it is going to cooperate with Gemini Trust Company LLC, a New York-based exchange.

CME Group also announced that it will launch Micro Ether futures on December 6, pending regulatory review.

Ethereum also plays an important role in the NFT market and the development of the metaverse.

According to Goldman Sachs Managing Director for Global Markets Bernhard Rzymelka, ETH has a reason. If Ethereum continues to track inflation expectations, it will be able to reach $8000 by the end of the year. Goldman's analysis also showed that Ethereum, so to speak, closely monitors inflation.

Therefore, fans of Ethereum are beginning to consider cryptocurrency as a means of protection against inflation – a status that was previously assigned only to bitcoin due to its limited supply.

Overall, Rzymelka concluded that rising inflation could bring huge benefits to cryptoassets.

The data published by the blockchain tracking site watchtheburn.com showed that the gap between the number of tokens issued and the number of tokens burned became negative for the first time in the last week.

After the August update, Ethereum now has to go through a process called burning, when ether tokens are withdrawn from circulation. This was designed to handle more transactions and make fees more affordable.

This means that the Ethereum network must burn a small amount of ether tokens after each transaction. That's why there are days now when more coins are destroyed than minted, especially when transaction activity in the network itself increases dramatically.

However, some experts in the crypto space question such a new idea of inflation hedging.

Noelle Acheson, head of market research at Genesis Global Trading, said that there is a lot of misinformation about the deflationary nature of Ethereum.