The result of the Fed's monetary policy meeting was not as tough as, probably, many expected. The regulator has taken a neutral position, which will surely backfire on the markets.

Forecast that the Fed will take a neutral position, trying not to shake the financial markets, turned out to be correct. After predictably announcing the beginning of the process of reducing by $ 15 billion a month the program for the repurchase of assets – government bonds and secured corporate mortgage securities, the bank, represented by its leader J. Powell, made it clear that he still continues to hope that inflationary pressures will be temporary and eventually ease. He only cares about normalizing the supply of goods and improving the situation in the labor market. He believes that these issues will be resolved eventually and economic growth will increase in the short term.

But how will the position of the American regulator affect the financial markets and what can be expected in the near future?

The half-heartedness of the Fed's actions, namely the expected decision to reduce QE, the lack of specifics regarding the continuation of the process of normalization of monetary policy, and the actual timing of the start of interest rate hikes will negatively affect the US dollar, which will lose all its upward momentum. Nevertheless, it will not be under serious pressure due to the smooth reduction of stimulus measures, which will support the yield of treasuries, and through them the dollar exchange rate.

In addition, any radical measures regarding monetary policies from other world central banks should not be expected. It is unlikely that they will want to take action right after the actual decisions of the Fed. Therefore, the ECB, and possibly other major world banks, will most likely begin to gradually reduce their own stimulus measures, which will have a supportive effect on their national currencies, and in turn, this will compensate for their weakness against the US dollar. Based on this, we believe that the outlook of the currency markets will not change noticeably in the near future.

Regarding the prospects for stock markets, it can be noted that the outcome of the Fed meeting will support demand for stocks due to the still generally soft monetary exchange rate, and this despite the beginning of a smooth reduction in QE.

The commodity market will be on its own, reacting to the supply and demand ratios. Strong demand for energy resources will not allow oil and gas prices to drop significantly, and perhaps, even support quotes.

Assessing the results of the Fed meeting and the market reaction, we believe that the situation in the markets will not change. Investors will already react to the publication of important economic statistics, for example, tomorrow's employment figures in the US. By its decision, the American regulator still remains in the paradigm of the past although it began to take adequate regulatory measures. It fears destroying interest in American assets, while trying not to contribute to the growth of the yield of treasuries amid the unprecedented public debt.

Forecast of the day:

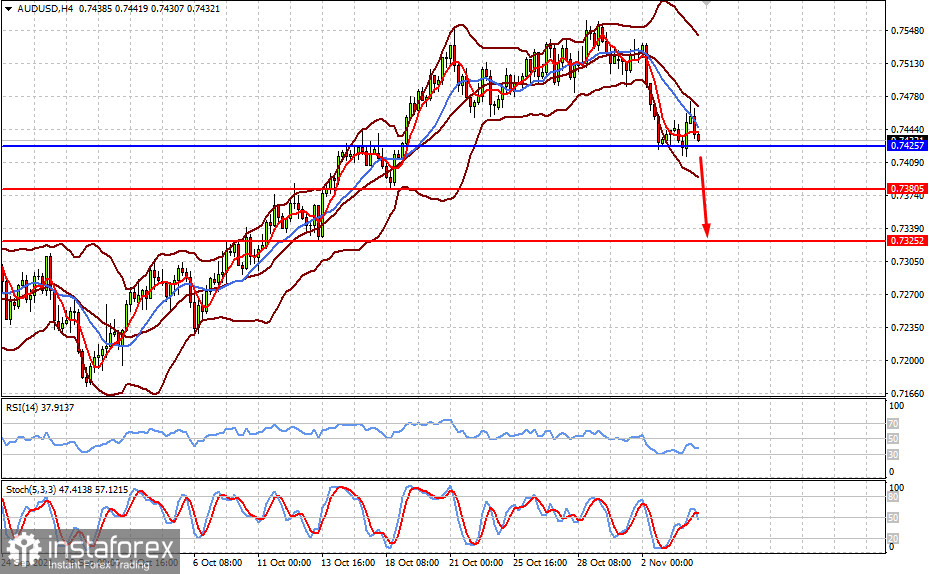

The AUD/USD pair is consolidating above the level of 0.7425. If the US employment data turns out to be higher than the consensus forecast, the pair will decline locally to 0.7380, and then, possibly to 0.7325.

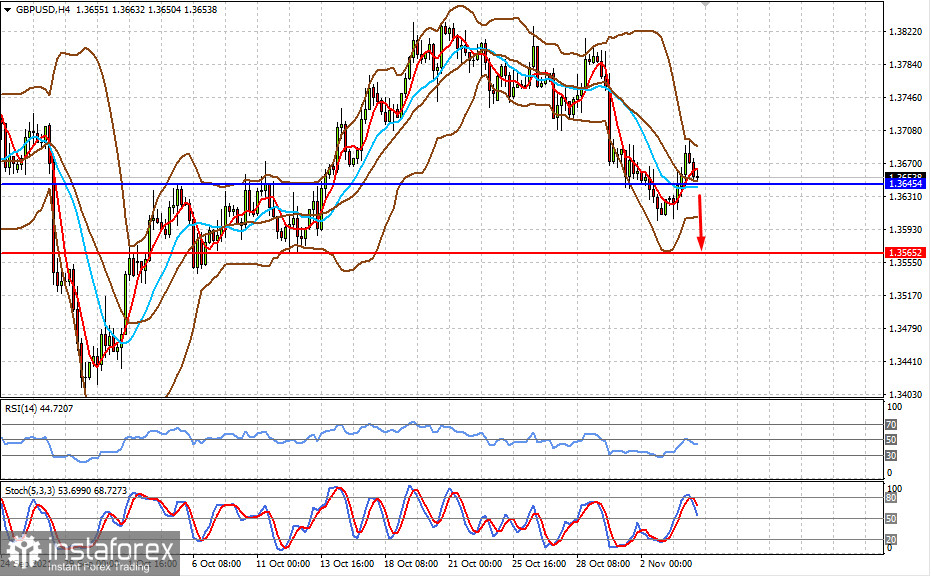

The GBP/USD pair is trading above the level of 1.3645. The preservation of all the parameters of the monetary policy of the Bank of England following the meeting may lead to the pair's local decline to the level of 1.3565 if it goes below 1.3645.