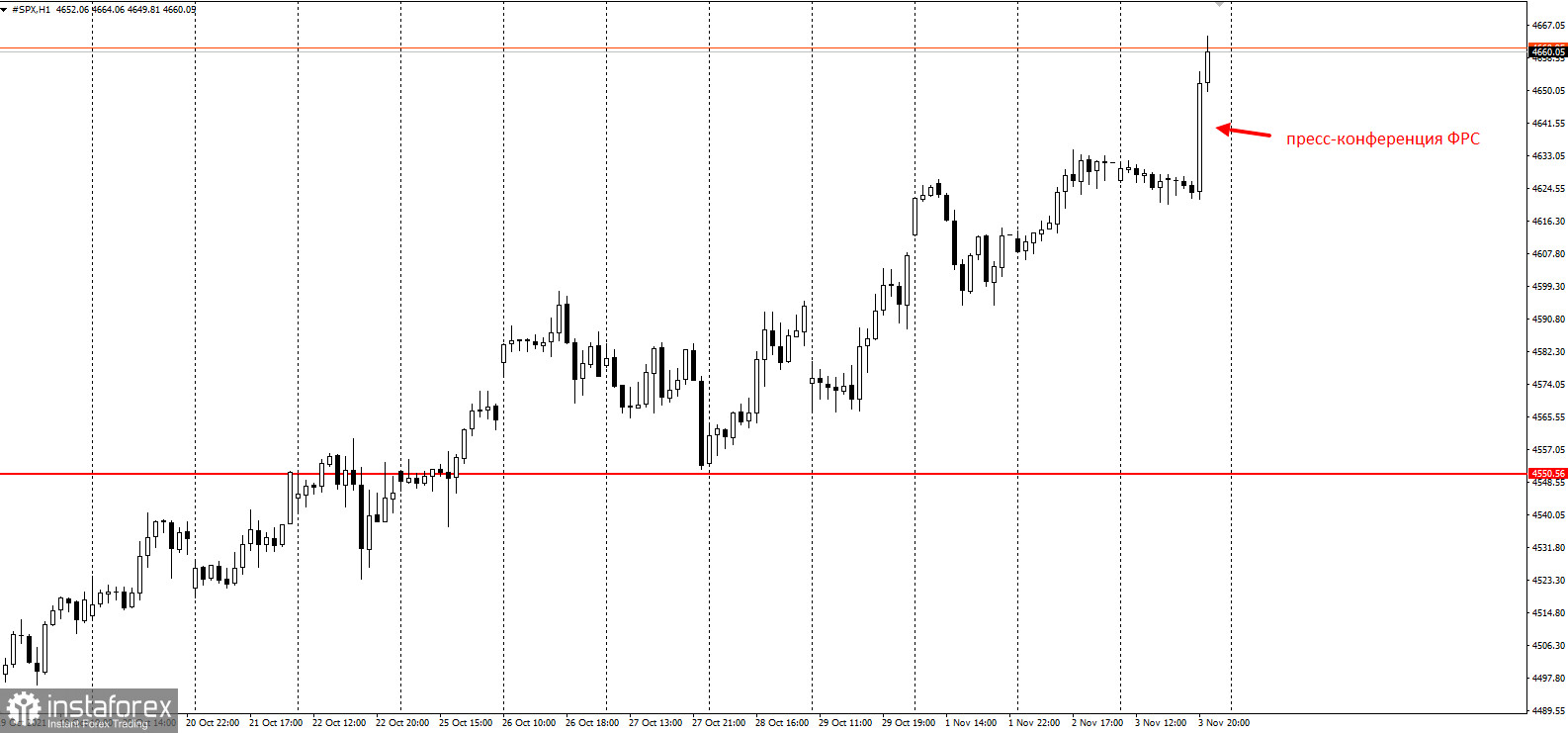

Stocks climbed to a record high after the Federal Reserve said monetary policy would remain accommodative, even as the central bank starts reducing its massive bond-buying programme this month.

In a feat not seen since January 2018, the S&P 500, Dow Jones Industrial Average, Nasdaq 100, and Russell 2000 closed at their record highs for the second straight day. The Treasury curve turned steep after Fed Chairman Jerome Powell tried to stress that tapering does not mean there will be a rate hike anytime soon. He said that officials could be patient on tightening but would not flinch from the action if warranted by inflation. The dollar fell amid this statement.

Seema Shah, Chief Global Strategist at Principal Global Investors, said: "Powell was very careful not to make any mis-steps today, sticking carefully to his script that their focus is on tapering, not raising rates. That's a shame, because interest rate hikes are all that markets want to talk about!"

Seema Shah, Chief Global Strategist at Principal Global Investors, said: "Powell was very careful not to make any mis-steps today, sticking carefully to his script that their focus is on tapering, not raising rates. That's a shame, because interest rate hikes are all that markets want to talk about!"

Traders largely maintained bets on the timing of rate increases from the level they were at before the Fed decision. Money-market derivatives show about 55 basis points of rate hikes by the end of 2022. The first one is seen coming around July, with about a 70% chance it happens the month before, as overnight index swaps show.

The Treasury announced the first reduction in its quarterly sale of longer-term debt in more than five years, reflecting diminishing borrowing needs as the wave of pandemic-relief spending is on the decline.

US companies added the most jobs in four months, suggesting employers are making progress in filling a near-record number of open positions. The data comes ahead of Friday's monthly employment report from the Labour Department, which is forecast to show private sector jobs rose by 408,000 in October. Service providers expanded at a record pace in October due to resilient demand and stronger business activity.

Here are some events to watch this week:

- OPEC+ meeting on output, Thursday

- Bank of England rate decision, Thursday

- US trade, initial jobless claims, Thursday

- US unemployment, nonfarm payrolls, Friday