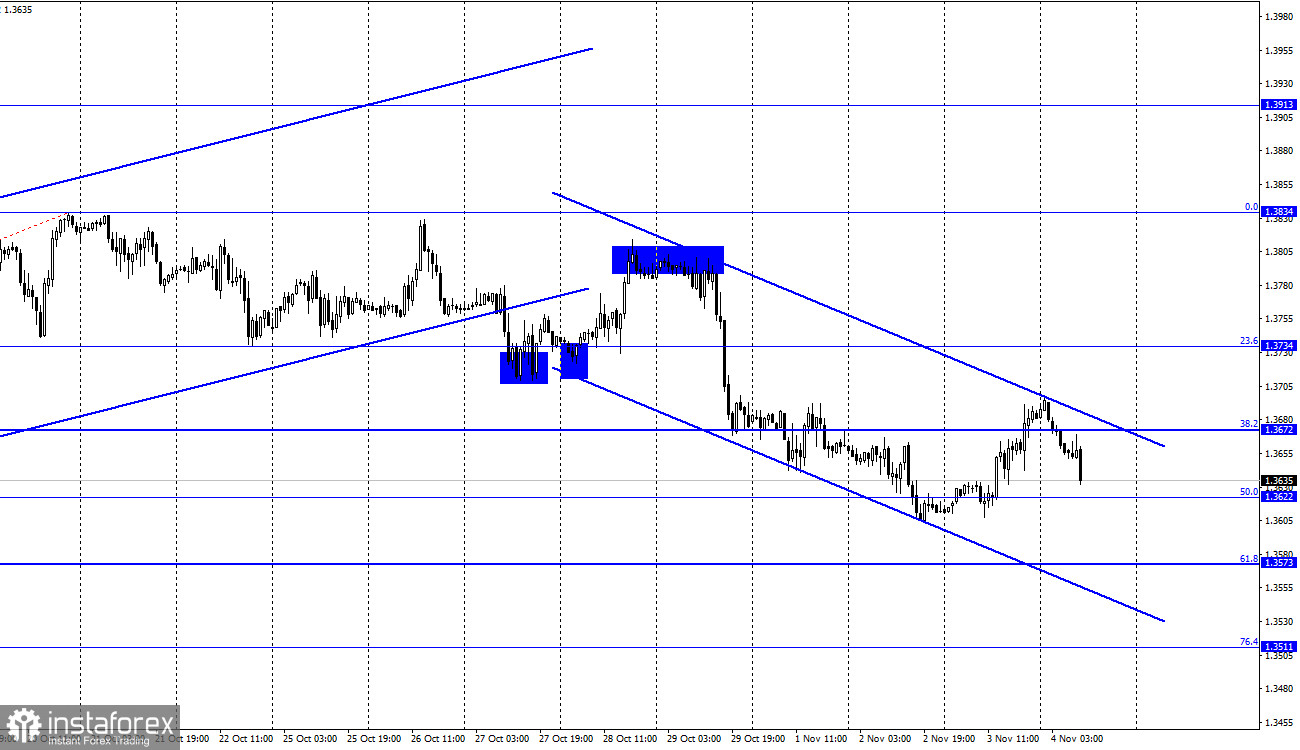

GBP/USD – 1H.

According to the hourly chart, the GBP/USD pair performed an increase last night similar to that shown by the EUR/USD pair. Today, the fall of quotes began, which allowed the formation of a downward trend corridor, which characterizes the mood of traders as "bearish". At the moment, the pair's quotes have performed a drop to the corrective level of 50.0% (1.3622). A rebound from this level will allow us to expect some growth towards the level of 38.2% (1.3672). Closing below it will increase the probability of continuing the fall in the direction of the next corrective level of 61.8% (1.3573). Meanwhile, traders are waiting for the next important event. Let me remind you that last night the Fed summed up the results of the meeting, and one of the most important decisions was to curtail the economic stimulus program. However, if the dollar against the euro eventually rose, then the pound did not. It just returned to the positions it was in before the Fed meeting.

Thus, traders are probably waiting for the results of the Bank of England meeting, which will be announced in a couple of hours. Expectations, it should be said at once, are weak. Traders do not expect any important decisions from the British central bank. The only thing that matters is the vote on the economic stimulus program. The Board of the Bank of England has nine members, and at the last meeting, two of them voted for reducing the volume of the program. If there are more of them this time, then the pound can cheer up and start growing. There will also be an important speech by the Governor of the Bank of England, Andrew Bailey, who, like Jerome Powell, can share forecasts on the economy, views on inflation, as well as a hint when to expect the full completion of the QE program and rate hikes. All this information is also important for traders and the British. Thus, today the activity of traders may remain high. In the morning, the index of business activity in the construction sector has already been released in the UK, which turned out to be better than forecasts. However, the pound did not receive much support.

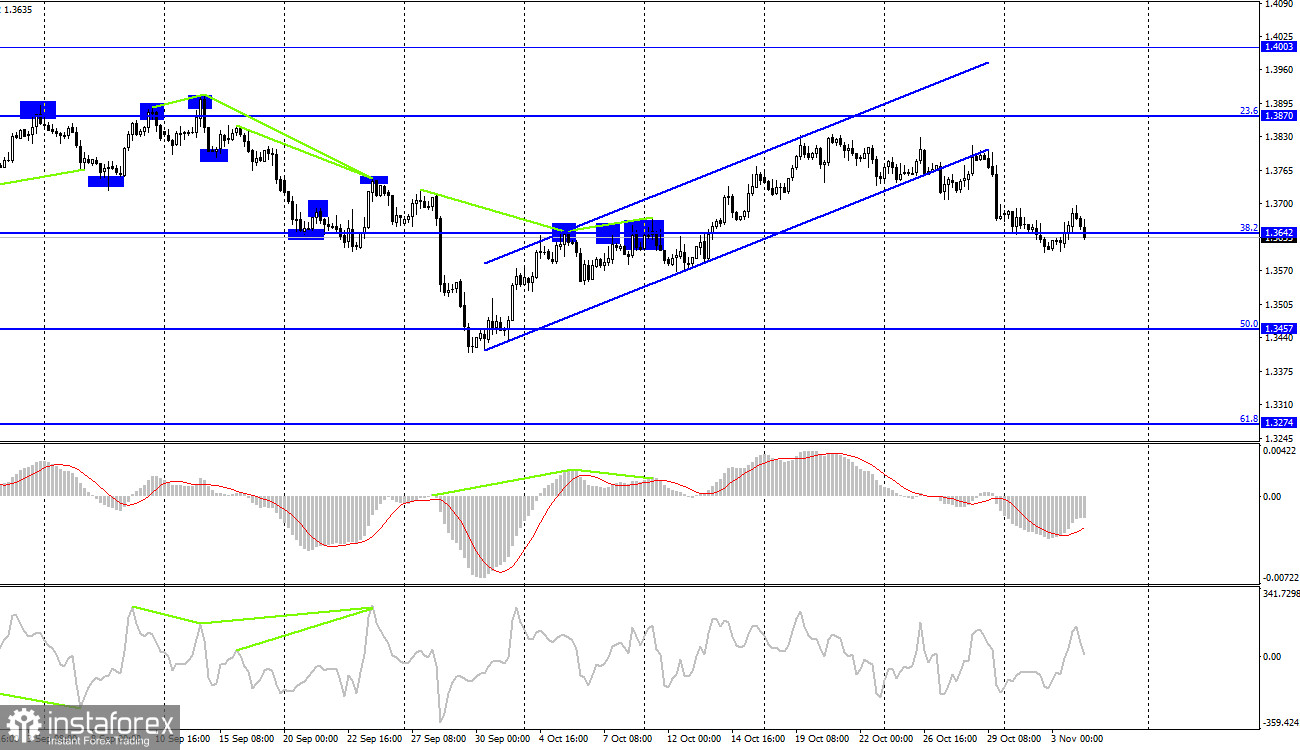

GBP/USD – 4H.

The GBP/USD pair on the 4-hour chart performed consolidation under the upward trend corridor and the corrective level of 38.2% (1.3642). Thus, the process of falling quotes can be continued in the direction of the next Fibo level of 50.0% (1.3457). But the situation may change in the next few hours. Everything will depend on the results of the Bank of England meeting. Emerging divergences are not observed in any indicator today.

News calendar for the USA and the UK:

UK - PMI index for the construction sector (09:30 UTC).

UK - decision on the main interest rate of the Bank of England (12:00 UTC).

UK - votes of the members on the planned volume of asset purchases (12:00 UTC).

UK - Bank of England monetary policy report (12:00 UTC).

US - number of initial and repeated applications for unemployment benefits (12:30 UTC).

UK - Bank of England Governor Andrew Bailey will deliver a speech (12:30 UTC).

On Thursday in the UK, all the attention of traders will be focused on the meeting of the Bank of England. All other events and reports will be secondary to them. The information background can be very strong.

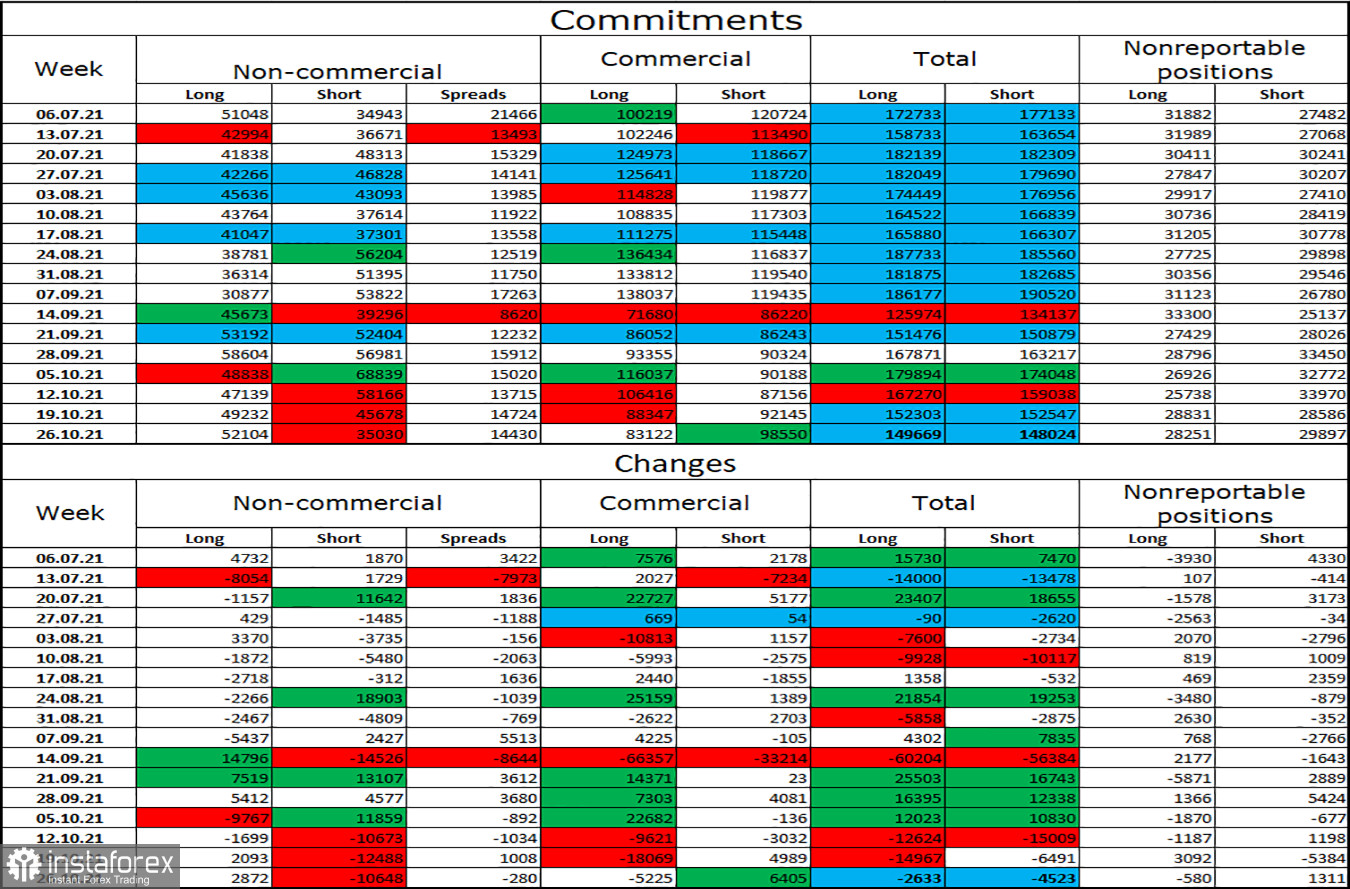

COT (Commitments of Traders) report:

The latest COT report on October 26 for the pound showed that the mood of the major players has become much more "bullish" again. In the reporting week, speculators opened 2,872 long contracts and closed 10,648 short contracts. Thus, the number of long contracts in the hands of major players now exceeds the number of short contracts by 17 thousand. Now we can say that the mood of the "Non-commercial" category of traders has become "bullish", but at the same time, the graphic picture suggests a possible drop in the quotes of the British, since two trend corridors were abandoned at once. In recent weeks, major players have not had any clear mood and are now increasing purchases, then increasing sales, and the total number of long and short contracts is the same for all categories of traders. Thus, after four weeks of the active build-up of longs, it may be the turn of shorts.

GBP/USD forecast and recommendations to traders:

I recommend new purchases of the pound if the rebound from the level of 50.0% (1.3622) on the hourly chart with a target of 1.3672 is completed. I recommended selling when closing quotes below the level of 1.3642 on a 4-hour chart with targets of 1.3622 and 1.3573. Now they can be kept open, but remember that there will be important events today, so the mood of traders may change.

Terms:

"Non-commercial" - major market players: banks, hedge funds, investment funds, private, large investors.

"Commercial" - commercial enterprises, firms, banks, corporations, companies that buy foreign currency not to make speculative profits, but to ensure current activities or export-import operations.

"Non-reportable positions" are small traders who do not have a significant impact on the price.