After reaching a new all-time high, the small price pullback did not scare the large Bitcoin holders. Glassnode reports show that holders continue to hold positions, and the illiquid supply of bitcoins has reached a record of 14.52 million.

Other data from Chainalysis show that the bulk of purchases come from large market participants. Whales have bought 142,000 BTC in the last week. The report also says that addresses of whales with more than 1,000 BTC have the highest supply rate in all of 2021.

Bitcoin Whales had 185,000 coins in February, but they were sold in May when BTC was near the previous all-time highs. But during the last week of October, the whales acquired another 142,000 BTC, bringing the total reserves to over 200,000.

It is worth noting that the last week, when the sideways dynamics of BTCUSD was observed on the market, was also distinguished by a sharp increase in the activity of bitcoin addresses. Over a period of five days, over a million addresses have been interacting on the bitcoin blockchain.

The market is waiting for new drivers of growth

The jump in BTC prices in October was triggered first by the anticipation and then by the actual approval of Bitcoin futures ETFs. Now the euphoria in the market about this has calmed down a little. The next question is with spot ETFs for the main cryptocurrency.

This time the initiative came from two US congressmen, Tom Emmer and Darren Soto. They sent letters to Gary Gensler, Chairman of the Securities and Exchange Commission, asking:

"We question why, if you are comfortable allowing trading in an ETF based on derivatives contracts, you are not equally or more comfortable allowing trading to commence in ETFs based on spot Bitcoin. Bitcoin spot ETFs are based directly on the asset, which inherently provides more protection for investors."

A request for a spot Bitcoin ETF from legislators could speed up the approval process for new funds. And this will be a new impetus for the market. In parallel, the demand for Ethereum Futures ETF is growing.

Institutions and developing countries - two drivers for the growth of BTC to $760,000

Such an interesting statement was made by the head of Ark Invest Cathie Wood. She is known as an active supporter of Bitcoin. Wood made her prediction that Bitcoin may well be worth $760,000 per coin based on the assumed calculations of interest from two large demand groups: developing countries and institutional investors.

The first, following El Salvador, may begin to approve bitcoin as a national currency. Demand will be driven by distrust of the financial system and corrupt government. If such a chain reaction occurs, according to Wood, Bitcoin could rise by about $200,000.

On the other hand, institutional adoption will continue to grow. The beginning has already been made, the continuation in the form of ETFs opens up new opportunities for institutions to invest in cryptocurrency. Don't forget the "carrot" ahead in the form of spot ETFs and yields, and the "whip" behind in the form of rising inflation.

Wood believes that if institutions send at least 5% of their portfolios to bitcoin, demand could push BTC another $500,000 higher. That is a total of 700,000 dollars to the existing 62,000 - 67,000 on the market.

Globally is beautiful, local is indefinite

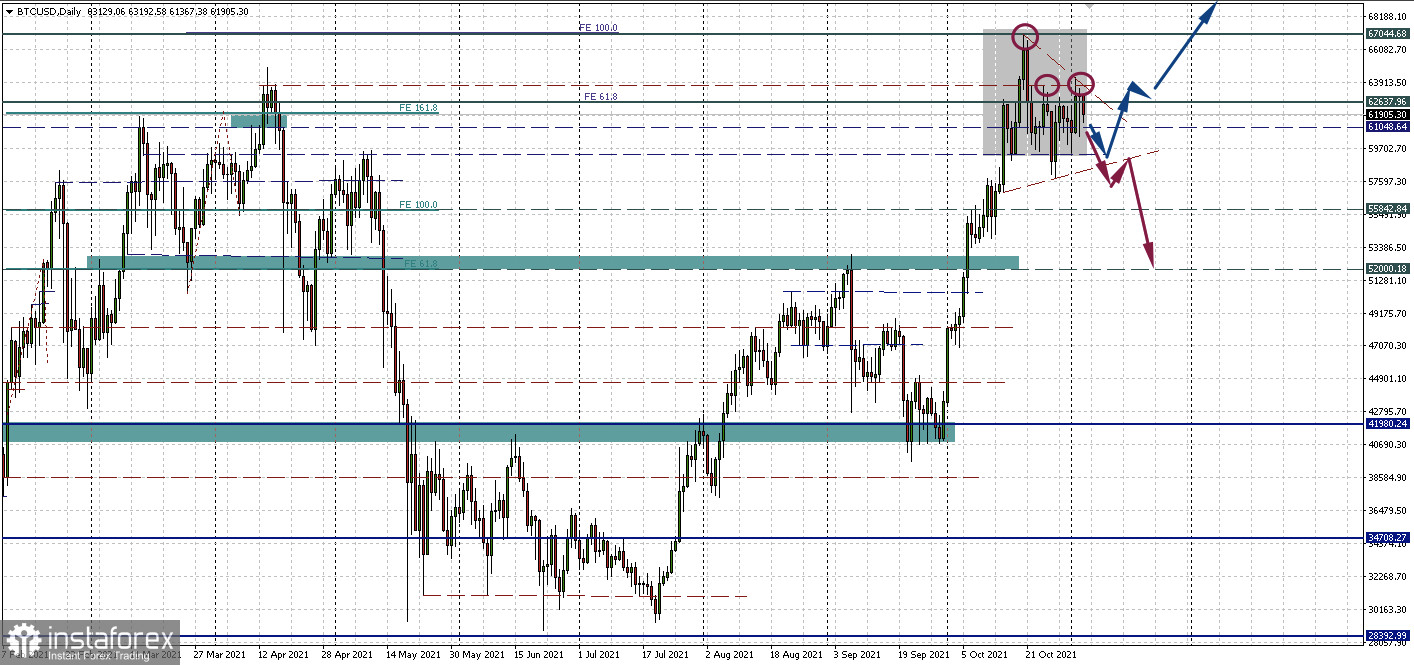

While we are discussing global and long-term drivers for Bitcoin's growth, the local technical landscape remains unchanged. And no matter how we evaluated the technical picture, through the triangle, or sideways 59,383.67 - 62,637.96 (both true), a local uncertainty remains.

For those who like to trade sideways, you can still have time to sell from the resistance of 62,637.96 (although the stop will already be too big). For the rest, the prognosis remains the same, as does the need to be patient.

With the current technical landscape, a deeper correction is still possible. The downside potential of the triangle will be $52,000 per coin. And the potential of upside work is the achievement and update of the historical maximum.