Opening long positions in the GBP/USD pair requires:

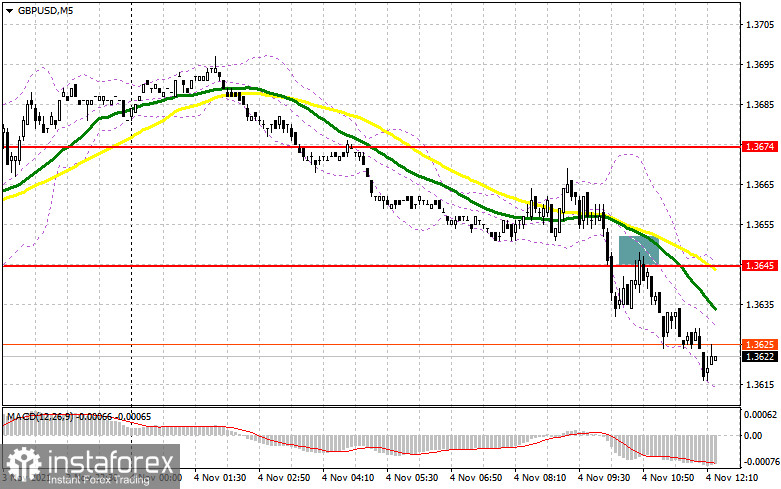

In my forecast this morning I paid attention to the level of 1.3645 and recommended entering the market using it. Let's look at the 5-minute chart and consider the entry point. It is seen that the breakout and the reverse test of 1.3645 from the bottom to the top are likely to create a convenient entry point for short positions. Immediately thereafter, the pound drops by 30 pips, slightly above the nearest support at 1.3608, which the bears will be targeting in the second half of the day. Most likely a surge in UK construction activity limited the downtrend of the pair in the first half of the day.

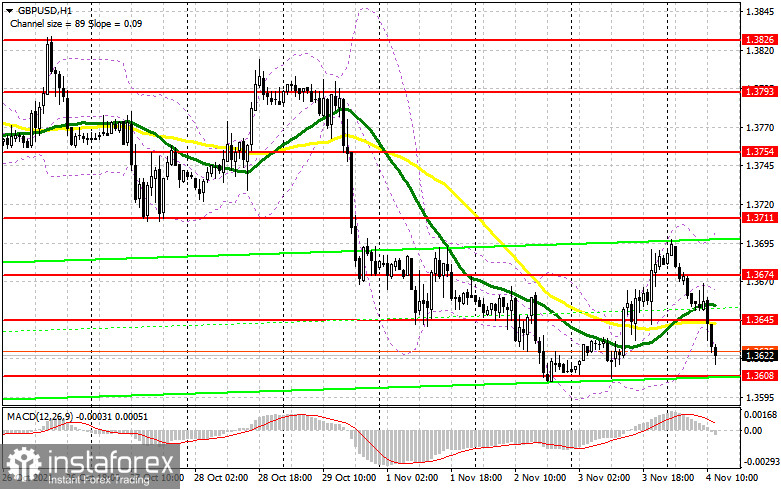

In the second half of the day, we have a lot of economic data to pay attention to. Bulls' main target, for now, is to regain control above 1.3645, as above this level the moving averages are on the bears' side. Weak data on the balance of foreign trade and the number of initial jobless claims in the US are likely to allow a breakout above this range, and the reverse test of this level from top to bottom may create an entry point for opening long positions. That would open the way to 1.3574, above which the bulls may go to 1.3711 as well. The highs at 1.3754 and 1.3793 are the long-term targets. However, this scenario is possible only in case the Bank of England will make considerable changes in its monetary policy. If the pair declines in the second half of the day after the UK central bank's decision is announced, an important task for bulls will be holding the price above support at 1.3608. Only the formation of a false breakdown may increase the chance of the pound for the upward correction. If bulls do not take active actions around 1.3608, the best option to buy the pound may be a test of the next support at 1.3580. However, opening long positions there would only be better after a false breakout. Buying GBP/USD on the rebound is possible from a new low at 1.3546, or even lower - from support at 1.3491, counting on the correction of 25-30 pips during the day.

Opening short positions in the GBP/USD pair requires:

Bears have plenty of chances to keep the market under their control. They need the Bank of England to leave the monetary policy unchanged. In this case, bears are likely to push the pound below the weekly lows. A false breakout of resistance at 1.3645, which the pair has almost approached, may become the first signal for the opening of short positions with the target at support 1.3608. A breakout of 1.3608 and the reverse test from the bottom to the top will signal to sell GBP/USD expecting the price to fall to a new monthly low of around 1.3580, and also to the level of 1.3546 and 1.3491, where you may generate profit. However, such a scenario is possible in case there will be released strong data on the American labor market and foreign trade balance. If the GBP/USD pair grows in the second half of the day and there is the absence of activity of bears at 1.3645, you might sell the pound only after the formation of a false breakout around 1.3674. You may also open short positions after a rebound from 1.3711, or even higher from a new high in the area of 1.3754, counting on the pair to go down by 20-25 pips during the day.

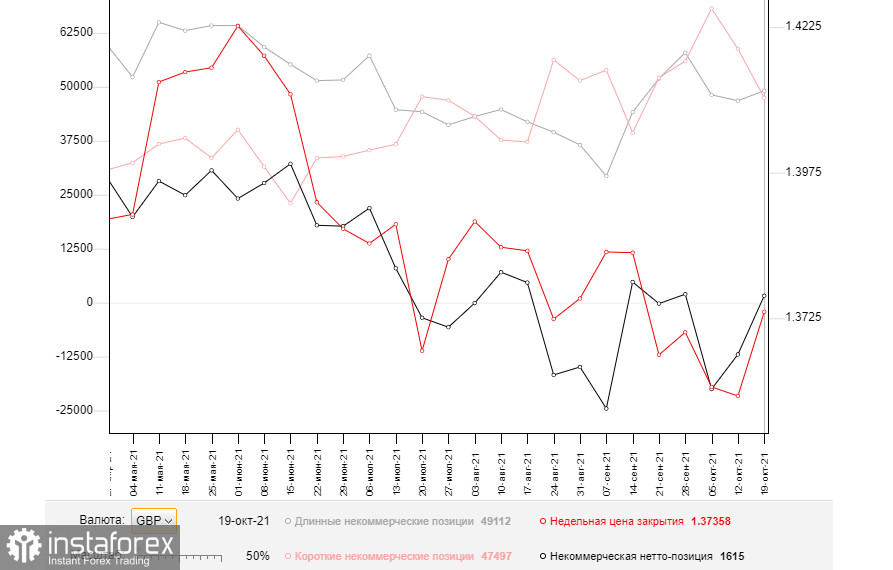

The COT (Commitment of Traders) reports for October 19 show a decline in the volume of short positions and growth of long positions, which reflects an upward trend in the pound, observed in the middle of this month. The decision of the Bank of England is likely to determine the trend of the pound for the near future. Most likely, after the downward correction, the bulls will take a chance and will buy the pound at more attractive prices again, even despite the decisions of the regulator, which will affect GBP/USD only in the short term. Governor of the Bank of England Andrew Bailey's speech might have a positive effect on the market as the inflationary pressure problem may force the central bank to take measures sooner than expected. One may count on the strengthening of the pound and make use of any decline in the short term, which can be formed in case of weak fundamental data. The COT report shows that long non-commercial positions rose from 46,794 to 49,112, while short non-commercial positions fell from 58,773 to 47,497. This led to a change in the nonprofit net position from the negative to positive zone. However, the delta was at 1615 against -11,979 the week before. The closing price of the GBP/USD pair increased significantly from 1.3591 to 1.3735.

Signals of indicators:

Moving averages

Trading is conducted above 30 and 50 daily moving averages, which indicates the pressure put on the pound.

Note: The author considers the period and prices of the moving averages on the hourly chart H1 and it differs from the general definition of the classic daily moving averages on the daily chart D1.

Bollinger Bands

A breakout of the lower border of the indicator at 1.3632 may trigger the pair to fall. If the pair grows, the support is located in the area of 1.3711.

Description of indicators:

- Moving average (moving average determines the current trend by smoothing out volatility and noise). Period 50. The 50MA is marked in yellow on the chart.

- Moving average (moving average determines the current trend by smoothing out volatility and noise). Period 30. The 30MA is marked in green on the chart.

- MACD indicator (Moving Average Convergence / Divergence - moving average convergence/divergence) Fast EMA period 12. Slow EMA period 26. SMA period 9 Bollinger

- Bollinger Bands. Period 20

- Non-profit speculative traders, such as individual traders, hedge funds, and large institutions that use the futures market for speculative purposes and meet specific requirements.

- Long non-commercial positions represent the total long open position of non-commercial traders.

- Short non-commercial positions represent the total short open position of non-commercial traders.

- Total non-commercial net position is the difference between the short and long positions of non-commercial traders.