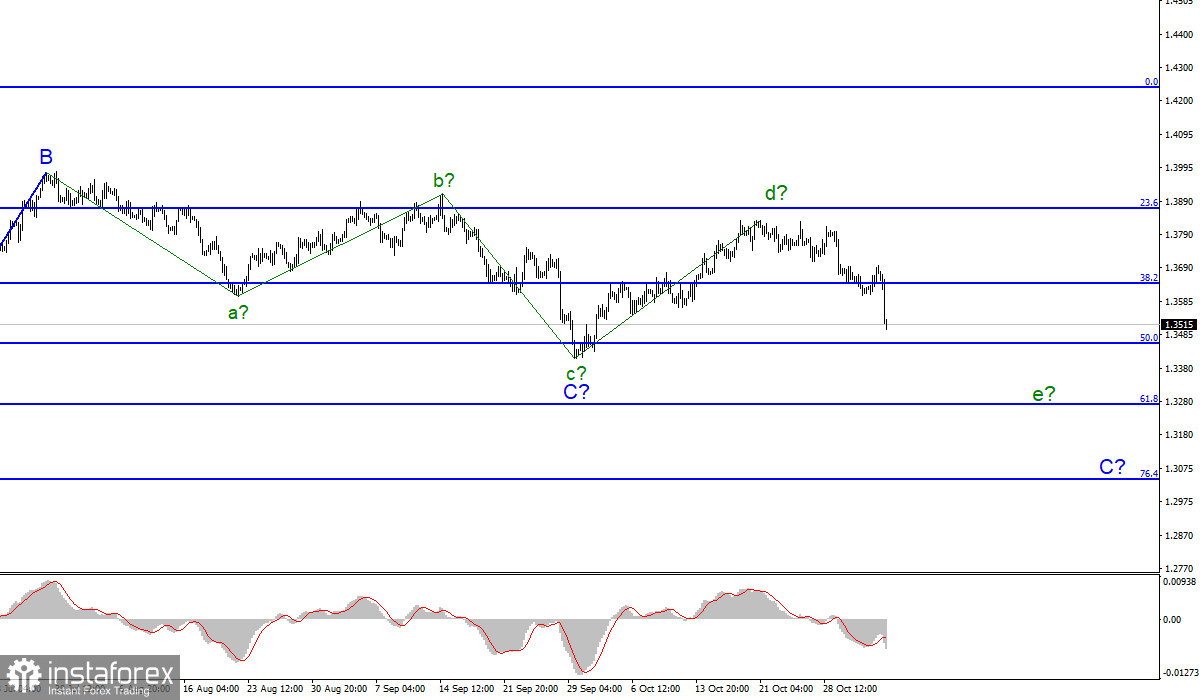

Wave pattern

The wave counting for the Pound/Dollar instrument continues to look quite complicated due to deep corrective waves as part of the downward trend section, but at the same time, it is quite convincing. Even inside the last wave C, presumably five internal waves are visible, and each subsequent one is approximately equal in size to the previous one. My assumption that wave C can already be completed has not been confirmed in practice. Most likely, this wave will still be a five-wave one. In this case, its internal wave d is completed, and now the construction of the wave e in C continues.

If this is indeed the case, then the decline of the instrument will continue with targets located near the minimum of wave c, that is, about 34 figures, and below. However, I also want to note that two meetings of central banks supported the US currency, which was required for the current wave counting. Without this support, wave e could have been more complex.

Thursday was a real "black day" for the pound.

The exchange rate of the Pound/Dollar instrument managed to rise by 80 basis points on Wednesday, but on Thursday its quotes began to decline (even at night, that is, before the Bank of England meeting) and in total, the British pound lost about 200 points in one day. Given that the decline of the pound began at night, it is unlikely that the entire movement can be attributed to the disappointment of the markets with the results of the meeting of the BoE. There was a similar movement at night for the Euro/Dollar instrument.

What did the Bank of England say that the pound fell so much? Nothing really. The rhetoric of the BoE was quite aggressive, but at the same time, just a few hours before the results were summed up, information appeared that the markets expected a rate increase of 0.15% with a probability of 60%. Although there were no prerequisites for this before.

Bank of America analysts said they expect 6 votes in favor of a rate hike. However, in reality, only two members of the monetary policy committee voted for an increase. Thus, the market immediately began to get rid of the British pound, which caused its strongest decline. However, the same analysts from Bank of America believe that the rate may also be raised in December, and the decline of the pound amid disappointment with the November decisions will be short-lived. Well, let's see what will happen in reality.

So far, I am convinced to fall to the 34th figure, and maybe even lower. I also note that three members of the committee voted to reduce the volume of the QE program, but this news also did not impress the buyers of the pound sterling.

General conclusions

The wave pattern of the Pound/Dollar instrument looks quite convincing now. It received a downward view, but not an impulsive one. The expected, wave d has completed its construction, so I advise you to sell the instrument based on the construction of the expected wave e in C with targets located near the level of 1.3270, which equates to 61.8% Fibonacci level.

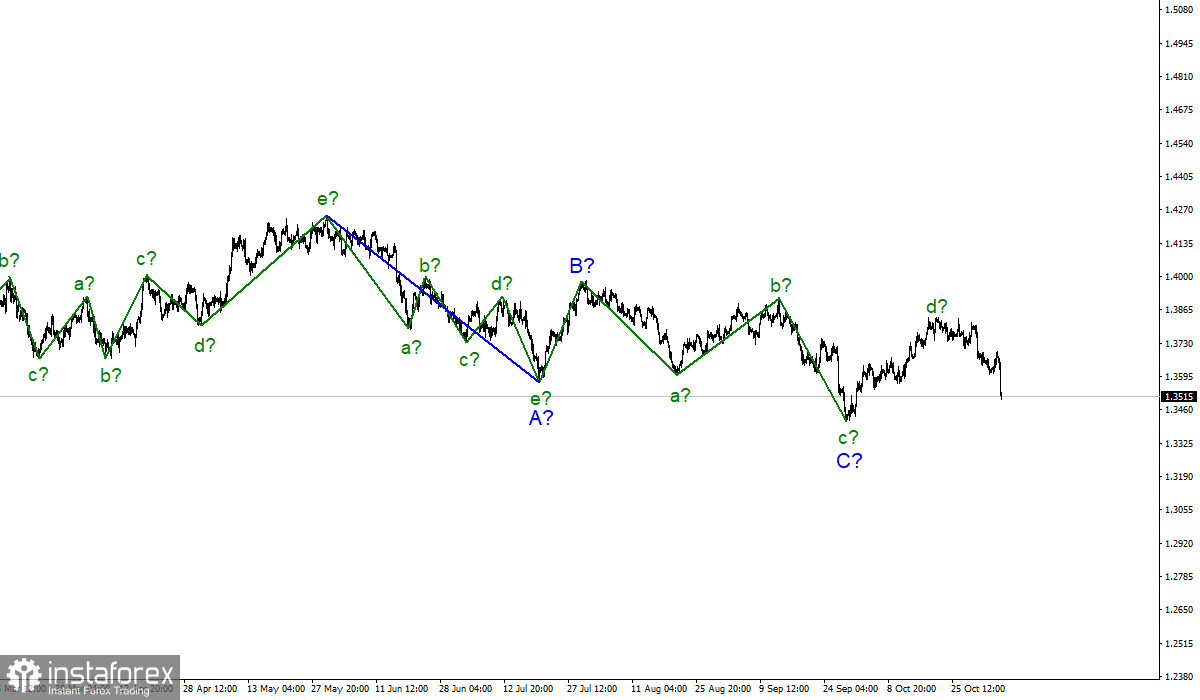

Starting from January 6, the construction of a new downward trend section began, which can turn out to be almost any size and any length. At this time, I'm still counting on building another downward wave, since wave A turned out to be a five-wave one. The peak of wave b has not been broken yet, so I am waiting for a decline in quotes.