GBP/USD

Analysis:

The latest incomplete section of the English pound's market-dominating uptrend has been running since September 29. The pair's price has been declining over the past three weeks, forming a correction (B). The price is approaching the upper boundary of the potential reversal zone of the large TF.

Forecast:

In the first half of the day, we can expect a flat trend for the pair. An upward vector is possible, with a gradual rise to resistance zone levels. By the end of the day, there is an increased probability of rising volatility, reversal, and a renewed decline.

Potential reversal zones

Resistance:

- 1.3530/1.3560

Support:

- 1.3460/1.3430

Recommendations:

Pound trading is rather risky today. Short-term selling from the resistance zone is possible. It is better to not trade until there are strong buying signals in the area of the support zone.

AUD/USD

Analysis:

Since last March, the pair's market has been dominated by an up-trend. The uptrend from August 20 has reversal potential. From the intermediate resistance, the price has been forming a correction during the last two weeks. Its structure at the time of the analysis does not look complete.

Forecast:

In the upcoming European session, the pair's price is expected to move sideways. There could be a short-term price increase, not further than the resistance zone. A return to a bearish rate can be expected by the end of the day.

Potential reversal zones

Resistance:

- 0.7420/0.7450

Support:

- 0.7350/0.7320

Recommendations:

There are no buying conditions in the Australian dollar market today. Short-term selling from the resistance zone with a smaller lot is possible.

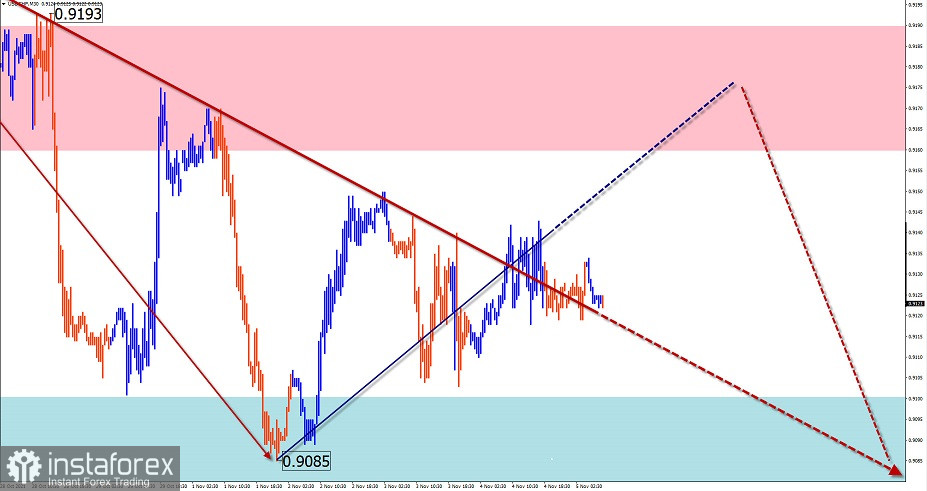

USD/CHF

Analysis:

On the chart of the Swiss franc against the American currency incomplete wave structure at the time of analysis is the descending wave from June 18. Within its final part (C), the price has been forming a flat pullback since the end of last month.

Forecast:

The general sideways movement is expected to continue today. The upper boundary of the price swing is in the area of settlement resistance. At the end of the day, there is a high probability of a return to a bearish course.

Potential reversal zones

Resistance:

- 0.9160/0.9190

Support:

- 0.9100/0.9070

Recommendations:

Trading in the Swiss franc market today could lead to losses. It is recommended not to enter into the market until the current pullback is over, looking for selling signals around the resistance zone.

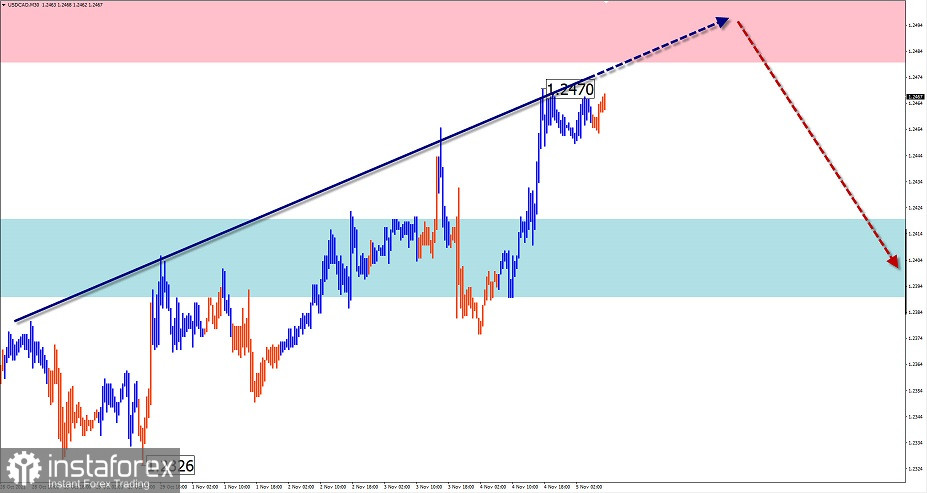

USD/CAD

Analysis:

The downward wave of the main Canadian dollar pair chart, which started in August, continues its formation. The bullish section from October 21 forms an intermediate pullback in the final part (C).

Forecast:

In the next 24 hours, the entire upward movement is expected to end, reverse and start a counter decline. The boundaries of the expected daily range are indicated by the settlement zones.

Potential reversal zones

Resistance:

- 1.2480/1.2510

Support:

- 1.2420/1.2390

Recommendations:

There are no conditions for buying in the Canadian dollar market today. It is recommended to follow all emerging signals to sell the instrument in the area of settlement resistance.

Explanations: In simplified wave analysis, waves consist of 3 parts (A-B-C). The last unfinished wave is analyzed. The solid arrow background shows the formed structure, the dotted background shows the expected movements.

Attention: The wave algorithm does not take into account the duration of instrument movements!