So the next trading week on the Forex currency market has ended, following which the main EUR/USD pair managed to demonstrate, although initially, trading took place with the advantage of bears. Let's talk about this in more detail in the technical part of this article. In the meantime, let us briefly talk about the market sentiment that currently affects the minds of investors. Since the November meeting of the US Federal Reserve System (FRS) did not bring any drastic changes and surprises for market participants, their attention switched to who will become the next chairman of the Fed. This issue has stirred the minds of investors before, but recently this topic has become even more topical. American President Joe Biden has not yet decided on a candidate who will head the most powerful bank in the world. According to experts, there are two real candidates: the current head of the Fed, Powell, and his colleague Brainard. At the same time, both were seen at the White House, where they had meetings either with the US president himself or with someone from high-ranking officials of his administration. The main expectations are that Jerome Powell will be appointed for a second term, and Brainard will become head of banking supervision. Let's see, time will tell. If you look at today's economic calendar, the main event of the first trading day of the new week will certainly be the speech of the current head of the Federal Reserve Jerome Powell, which is scheduled for 16:30 London time. Well, now it's time to move on to considering the EUR/USD price charts, and today we'll start with the daily timeframe. According to the author's personal opinion, there is a more distinct picture.

Daily

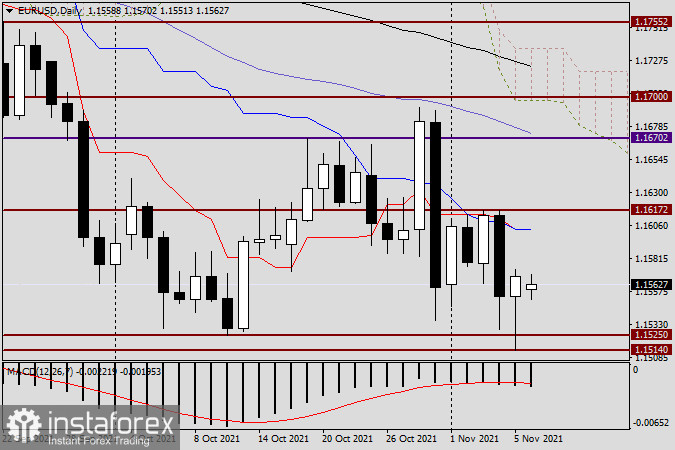

The assumption that the euro bears will try to break through the key and very strong support zone of 1.1525-1.1500 at all costs has been fully justified. However, the thoughts were confirmed that this price zone can repel the attacks of players on the rate increase and turn the quote up. As you can see, during Friday's trading, the pair fell to 1.1514, where it found the expected and strong enough support to change its direction. As a result, trading on November 5 ended with an increase in the euro /dollar, and the closing price of the week was 1.1569. This is below another landmark mark - 1.1600, but the rather long lower shadow of the last weekly candle and the actual reversal of the course of trading force us not to discount the continuation of the upward trend of EUR/USD. If this happens, the nearest and extremely important target for passing the euro bulls will be the price area 1.1600-1.1617, where the Tenkan and Kijun lines of the Ichimoku indicator converge, and the maximum trading values of the previous two days are also passing. I dare to assume that in case of passing 1.1600 and fixing above 1.1620, the main currency pair of the Forex market will have all the prerequisites for continuing the implementation of the bullish scenario. Bears still have the same tasks for the instrument, this is a true breakdown of the 1.1525, 1.1514 marks and subsequent consolidation under the psychological level of 1.1500. Since EUR/USD is currently trading flat at smaller time intervals, I suggest waiting for the results of today's trading, and tomorrow, taking into account their completion, we will make trading plans and put forward the most optimal recommendations.