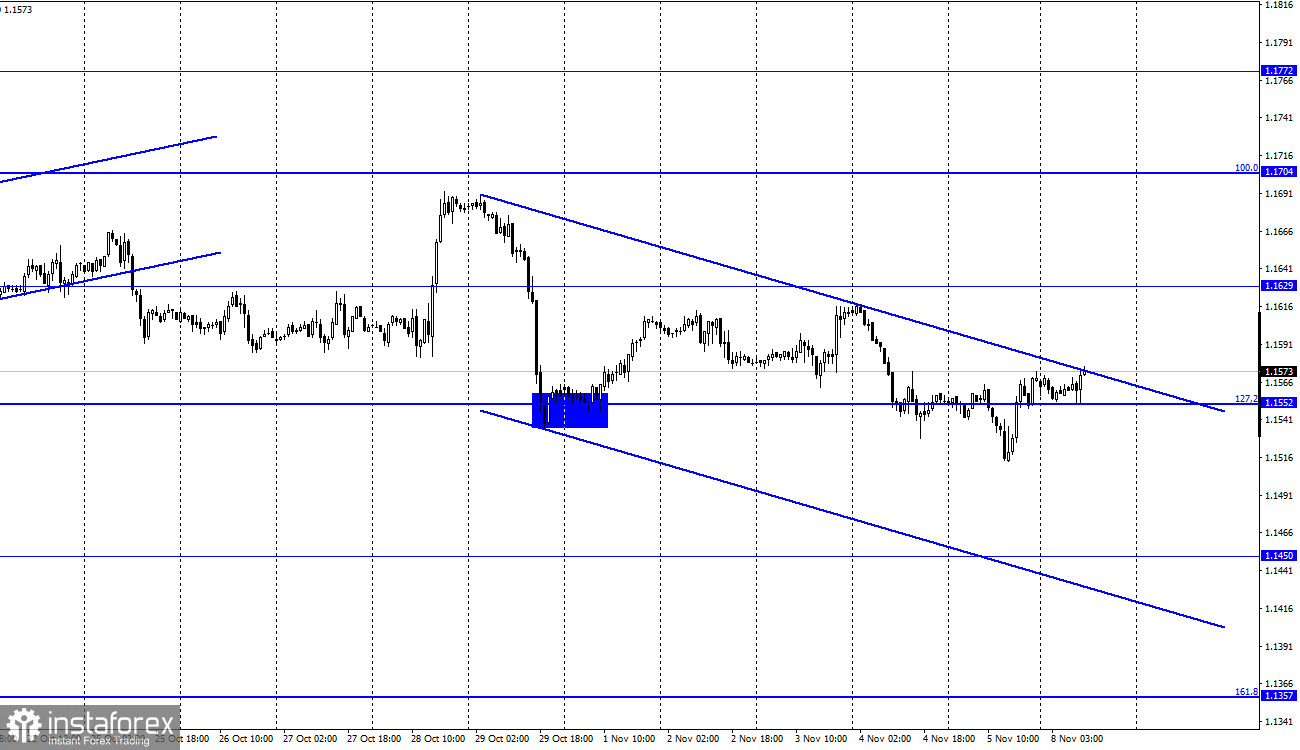

EUR/USD – 1H

Hello, dear traders! On Friday, EUR/USD fell to the 127.2% retracement level of 1.1552, reversed, and consolidated above 1.1552. Consequently, the pair incurred losses at the end of the previous trading week. Despite the Fed's tapering announcement and the greenback's sharp rise on Thursday, after the release of the strong jobs market and employment reports in the US, the dollar closed lower on Friday. It is hard to find an explanation for such price behavior. Let's assume that traders were prepared for QE tapering and decided not to increase demand for the greenback. Meanwhile, impressive Nonfarm Payrolls results came unexpectedly because the reading declined in the two previous months.

Friday kicked off with an increase in the US dollar. Later, however, the price went down, indicating bearish market sentiment. Since such crucial events as the FOMC meeting and strong Nonfarm Payrolls results have no effect on the market, it means that market sentiment is currently not bullish. Besides, the COT report also confirms this fact. On the H1 chart, there is a downward trend corridor. However, the pair is likely to close above it soon. As a reminder, Nonfarm Payrolls soared above 500K in October and the unemployment rate dropped to 4.6%. Anyway, bears ignored such positive results.

EUR/USD – 4H

On the H4 chart, the quote bounced from the 100.0% retracement level twice. It is now expected to fall to the 127.2% Fibonacci level of 1.1404. The pair's movement in recent weeks looks mixed, as well as traders' reaction to fundamentals. Technical indicators show no signs of divergence today. If the price closes above 1.1606, EUR/USD is likely to head towards the 76.4% retracement level of 1.1782.

Macroeconomic calendar:

United States - Chair Jerome Powell's speech (15-30 UTC).

The eurozone's macroeconomic calendar is empty on November 8. The only important event today will be Fed Chair Powell's speech.

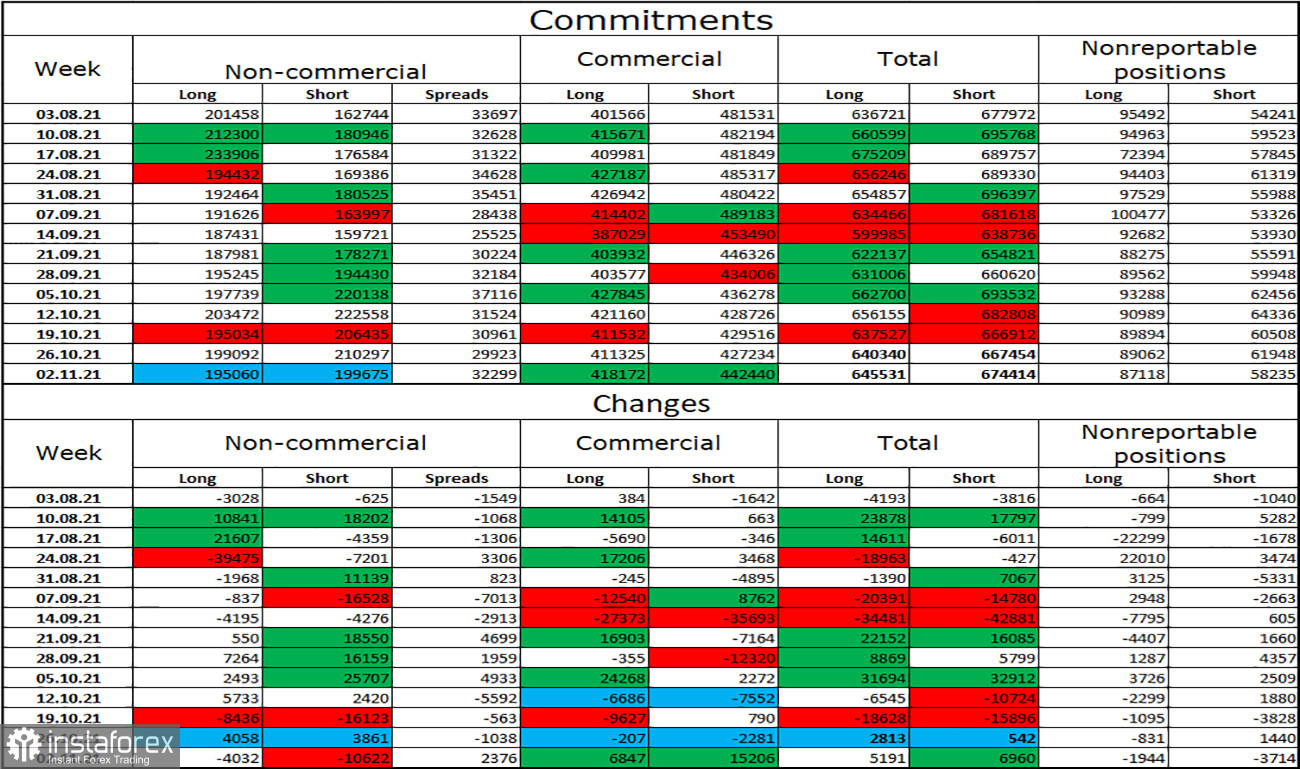

Commitments of Traders

EUR/USD outlook:

Since traders are ignoring important macroeconomic results and correction levels, it is not the best time for entering both long and short positions.

Terms:

Non-commercial traders are major market players: banks, hedge funds, investment funds, private, and large investors.

Commercial traders are commercial enterprises, firms, banks, corporations, and companies that buy currency not to yield speculative profit, but to ensure current activities or export-import operations.

Non-reportable positions are a group of small traders who do not have a significant impact on prices.