The EUR/USD pair extended its sell-off as expected as the Dollar Index reached fresh new highs. The pair was trading at 0.9873 at the time of writing far below yesterday's high of 1.0050.

Fundamentally, the Euro-zone and the US data came in mixed yesterday. You knew from my analyses that the EUR/USD pair maintains a bearish bias as the FED is expected to continue hiking rates during the September meeting.

Today, the USD received a helping hand from the US Existing Home Sales indicator which came in at 4.80M above 4.69M expected. Later, the FOMC could really shake the markets. The Federal Funds Rate is expected at 3.25%. The FOMC Press Conference could bring sharp movements.

EUR/USD Massive Drop!

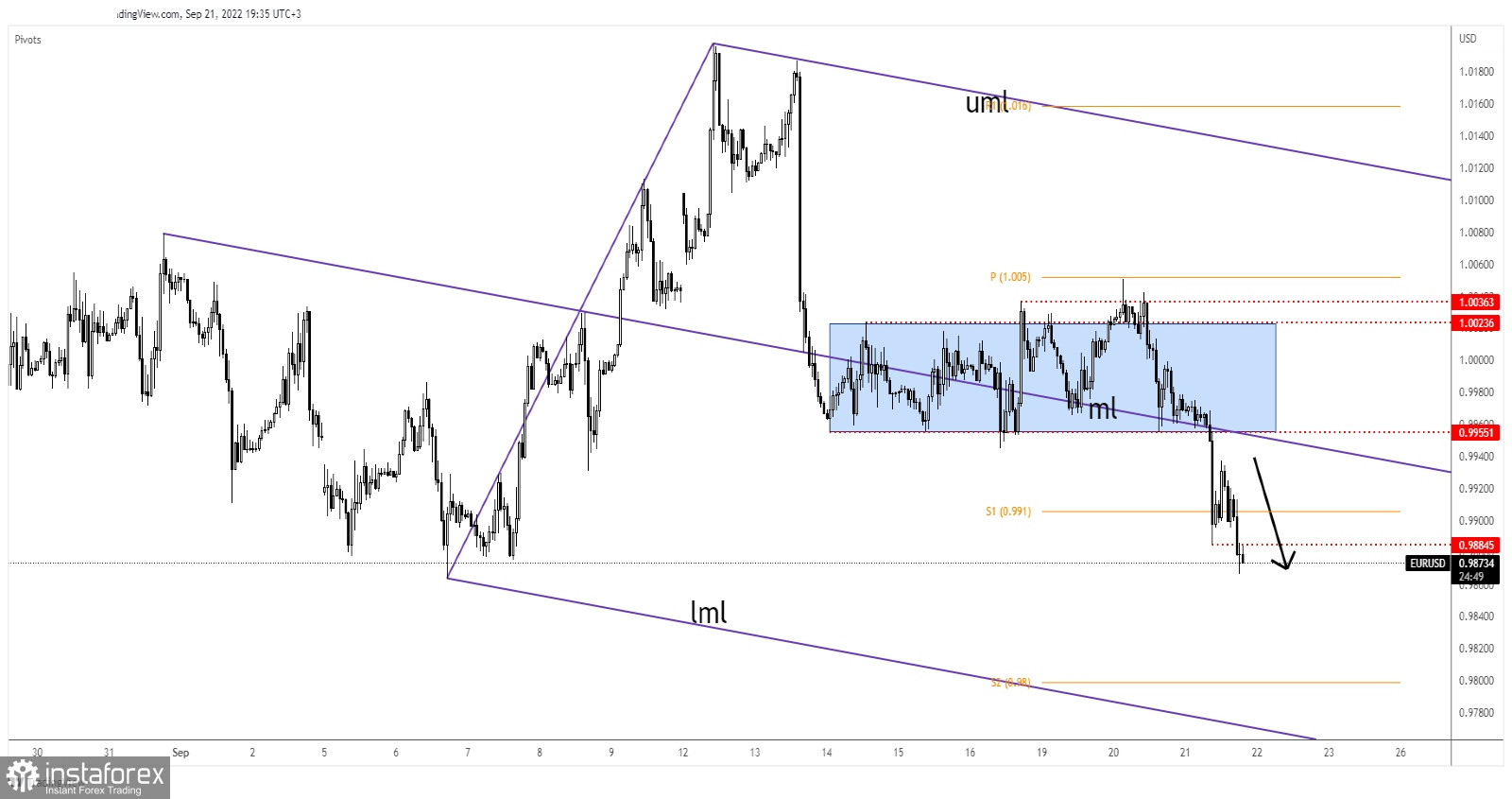

The EUR/USD pair crashed after closing below 0.9955 and under the median line (ml). Today, the price tried to rebound but its failure to reach and retest the median line of 0.9955 signaled strong downside pressure.

Also, failing to stay above the S1 (0.9910) announced more declines if the US Dollar Index resumes its growth.

EUR/USD Forecast!

The 0.9884 former low represented a downside obstacle. The current breakdown may activate further drop and represent a potential short opportunity. The bias is bearish as long as it stays under the S1 and below the median line (ml). The weekly S2 (0.9800) represents a major downside target.