Hello, dear colleagues!

I would like to start today's review of the main currency pair on the Forex market with the fact that yesterday's assumptions about the most likely scenario of the pair's growth were confirmed. It is possible to obtain more details about it in the technical part of the review. However, now it is time to depict the events related to the staff changes in the US Federal Reserve System (Fed). As mentioned in yesterday's article on EUR/USD, apart from inflation, the focus of the market participants has shifted to the next Fed head. To be more precise, the problem is whether the current Fed Chairman Jerome Powell will be appointed by the US President for a second term or Joe Biden will choose another US Central Bank.chief. If another Fed chief is appointed, the market will certainly react to this event. However, I believe its reaction will be quite restrained. Besides, there is also the inflation component and the national debt, the limit of which is ahead. As for inflation, the Fed leaders' views about its temporary factor can be already considered mistaken.

According to analysts of one of the largest global commercial banks, inflation may rise until February next year. Besides, it is still a minimum term. The main reason for the jump in inflation is usually considered to be supply disruptions, which should improve in the near future. Only this factor together with the reduction of the Fed's quantitative easing program (QE) will contribute to the normalization of inflationary pressures in the United States. If we observe the economic calendar today, we will find out that Christine Lagarde's speech and Jerome Powell's next speech are scheduled. However, I personally think that these events can have no serious effect on the EUR/USD price dynamics as the ECB and FOMC heads basically state the same theses, which are not new for markets. As for macroeconomic statistics, I recommend paying attention to the US PPI, which will be published at 16:30 MSK. Now let's turn to the price charts.

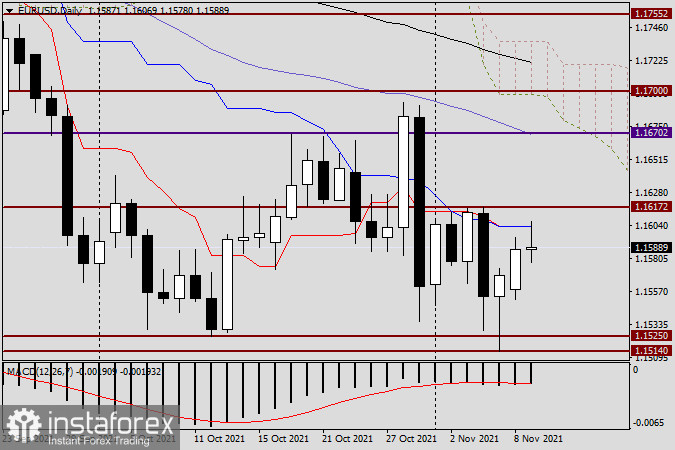

Daily

As expected, during yesterday's trading the EUR/USD pair continued to rise and reached the resistance area around the benchmark level of 1.1600. Monday's trading highs were at 1.1595, very close to 1.1600. Today, euro bulls tried to continue rising. However, after reaching the blue Kijun line and trying to break it, the pair rebounded. Therefore, at the time of completing the article it traded near 1.1586. A true breakdown of the Kijun line of the Ichimoku indicator with a further breakdown of the sellers' resistance at 1.1617 is obligatory to continue rising and strengthen the bullish sentiment. If it occurs and the pair is able to consolidate above the last level, the next target will be the resistance at 1.1670, where the 50MA is also located.

Bears have the same targets, i.e. to break the levels of 1.1525, 1.1514, 1.1500 and to secure the position below the last level.

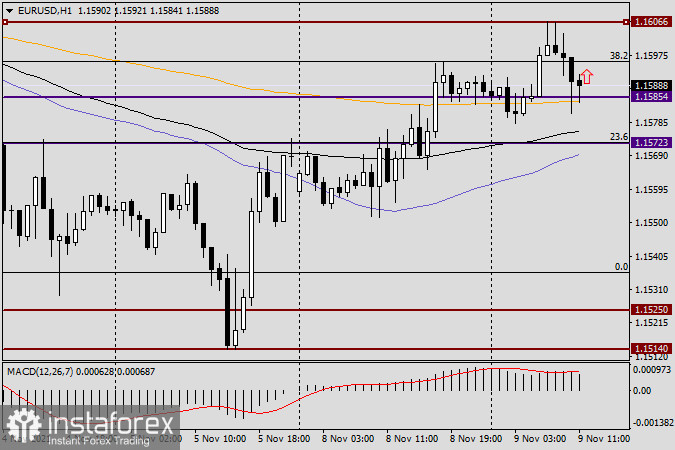

H1

As promised yesterday, today we will discuss smaller charts or a chart to try to find points to enter the market. Judging by the 1h timeframe, the pair found a strong support at the orange 200-EMA, which resulted in forming a candlestick with a long bottom shadow. As it can be observed, later there are growth attempts. Therefore, it is possible to try risky buying considering the current market prices. There are also options for selling. If one or more reversal patterns of candlestick analysis appear in the strong price resistance zone of 1.1600-1.1617, it is a sign for selling. In both cases of positioning I do not recommend to set large targets. That is all for today.

Good luck!