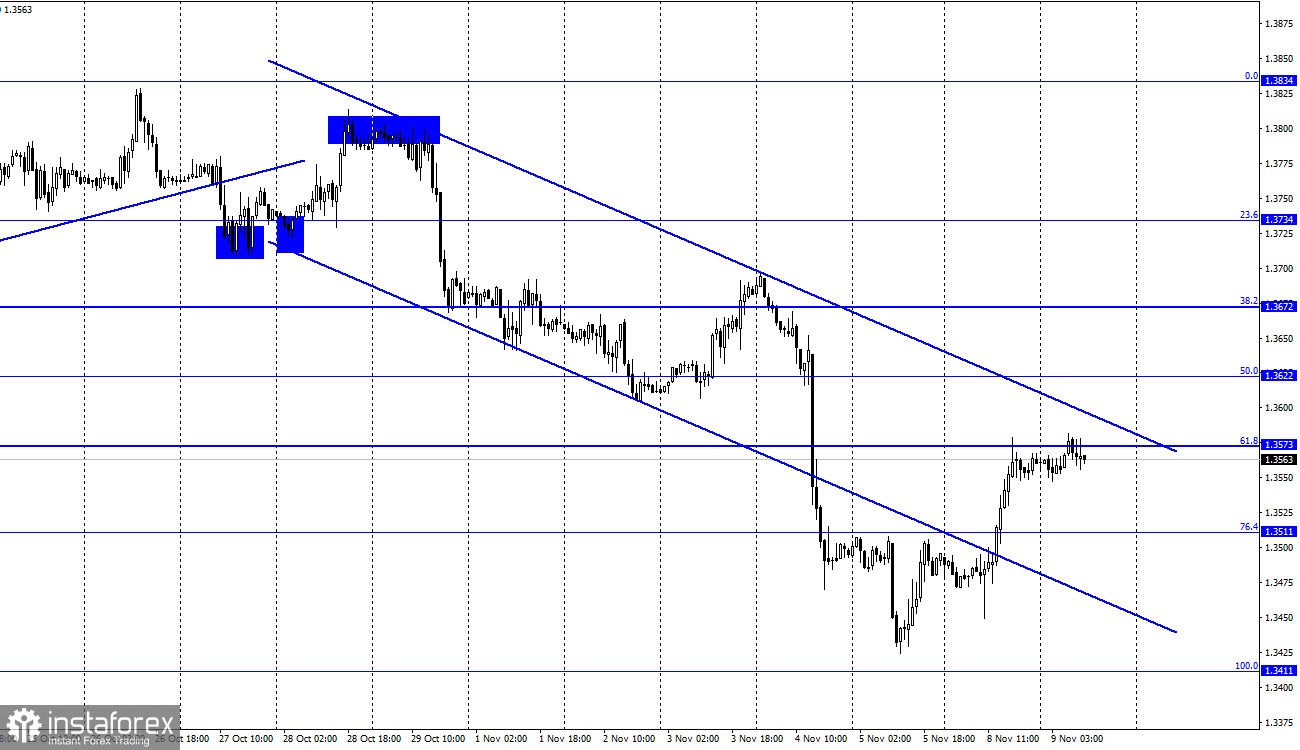

GBP/USD – 1H.

According to the hourly chart, the GBP/USD pair performed an increase on Monday to the corrective level of 61.8% (1.35730, and on Tuesday morning - to the upper limit of the downward trend corridor. Thus, the rebound of quotes from this line will allow us to count on a reversal in favor of the US currency and a new fall in the direction of the corrective levels of 1.3511 and 1.3411. However, closing the pair above the descending corridor will significantly increase the probability of further growth towards the next Fibo levels of 50.0% (1.3622) and 38.2% (1.3672). At the same time, the probability of an increase in the key rate by the Bank of England at the last meeting this year is also growing.

Let me remind you that just a few days before the November meeting, several respected publications and analytical agencies unexpectedly announced that their analysts expect a rate increase of 15 basis points in November. The key rate has not been raised by the Bank of England, but more and more analytical agencies and experts believe that the rate will be raised at the December meeting, and already by 0.2%. It is reported that the probability of such a decision by the British regulator is about 70%. I cannot say how true this information is. Still, there were similar statements before the November meeting. I believe that the time has not yet come for a rate hike in the UK. However, if the rate is still raised, then the pound can get tangible support from traders. Moreover, if the traders themselves already believe that the rate will be raised, then before the next meeting of the Bank of England, the pound may show growth. To begin with, it needs to perform a closure over the descending corridor. Andrew Bailey's speech yesterday gave nothing to traders, as it was dedicated to "climate change".

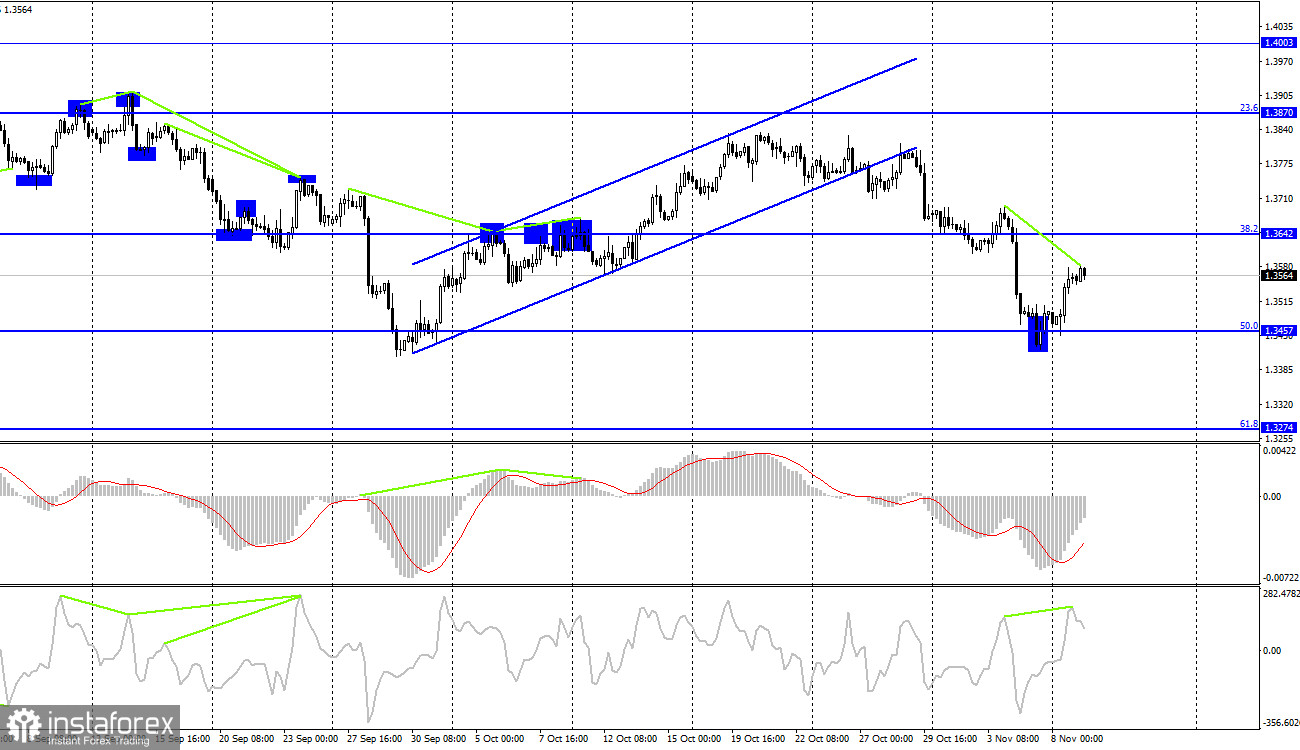

GBP/USD - 4H.

On the 4-hour chart, the British quotes performed a rebound from the corrective level of 50.0% (1.3457), a reversal in favor of the British currency, and began to grow in the direction of the corrective level of 38.2% (1.3642). At the moment, a bearish divergence has matured for the CCI indicator, but the process of price growth is still ongoing. A rebound from the level of 1.3642 will allow us to expect a reversal in favor of the US currency and some fall, and a close above the level of 1.3642 will increase the chances of further growth in the direction of the Fibo level of 23.6% (1.3870).

News calendar for the USA and the UK:

US - Chairman of the Fed Board of Governors Jerome Powell will deliver a speech (14:00 UTC).

UK - Ben Broadbent, Deputy Governor of the Bank of England for Monetary Policy, will deliver a speech (15:30 UTC).

UK - Bank of England Governor Andrew Bailey will deliver a speech (16:00 UTC).

New speeches by the presidents of the Bank of England and the Federal Reserve will be held in the UK and the US on Tuesday. They can cause a reaction among traders, but the probability of this is not too high.

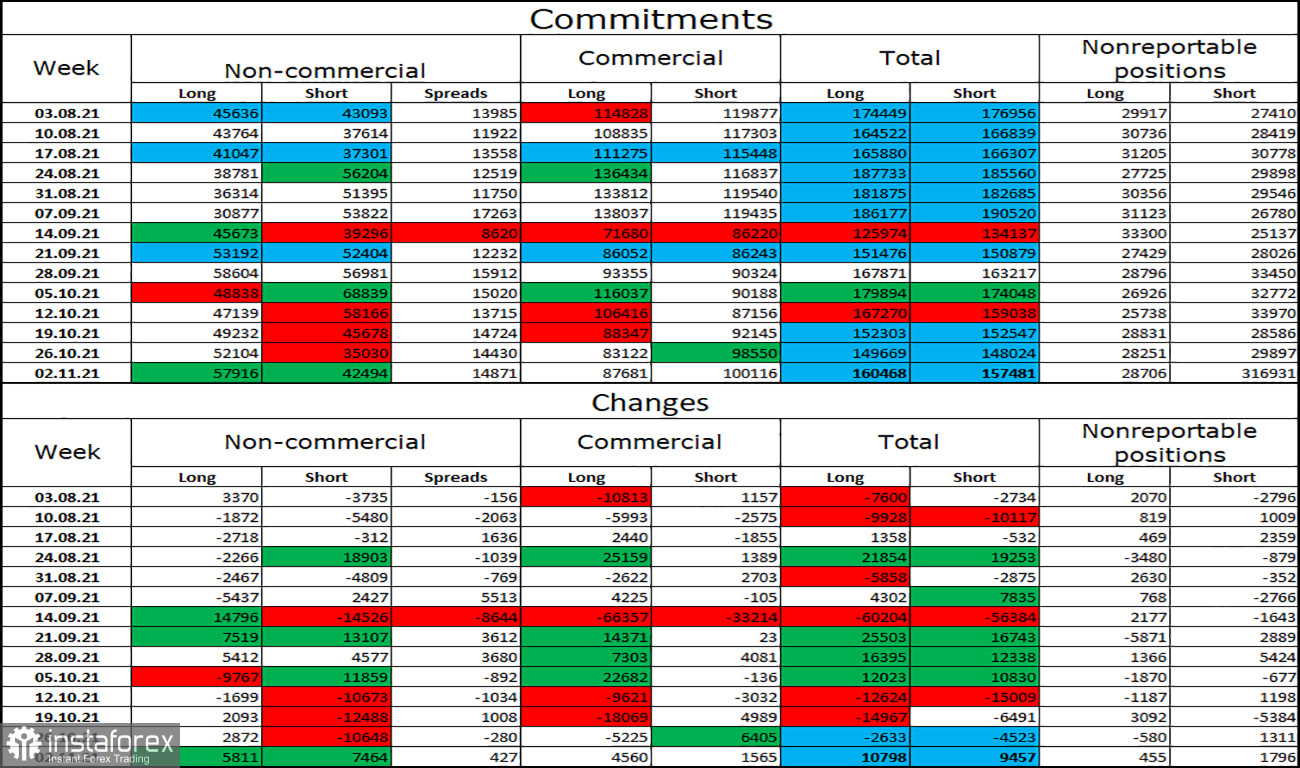

COT (Commitments of Traders) report:

The latest COT report from November 2 on the pound showed that the mood of major players has become a little less "bullish". In the reporting week, speculators opened 5,811 long contracts and 7,464 short contracts. Thus, the number of long contracts in the hands of major players still exceeds the number of short contracts by 17 thousand, but the gap is narrowing. In recent weeks, major players do not have any clear mood and then increase purchases, then increase sales, and the total number of long and short contracts for all categories of traders is the same (160K - 157K). Thus, after several weeks of an active build-up of longs, it may be the turn of shorts.

GBP/USD forecast and recommendations to traders:

I recommended buying the British if the rebound from the level of 50.0% (1.3457) on the 4-hour chart is completed, with targets of 1.3511 and 1.3573. Now, these trades can be held with targets of 1.3642 and 1.3672. I recommend selling if there is a rebound from the upper limit of the channel on the hourly chart, with targets of 1.3511 and 1.3411.

Terms:

"Non-commercial" - major market players: banks, hedge funds, investment funds, private, large investors.

"Commercial" - commercial enterprises, firms, banks, corporations, companies that buy foreign currency not to make speculative profits, but to ensure current activities or export-import operations.

"Non-reportable positions" are small traders who do not have a significant impact on the price.