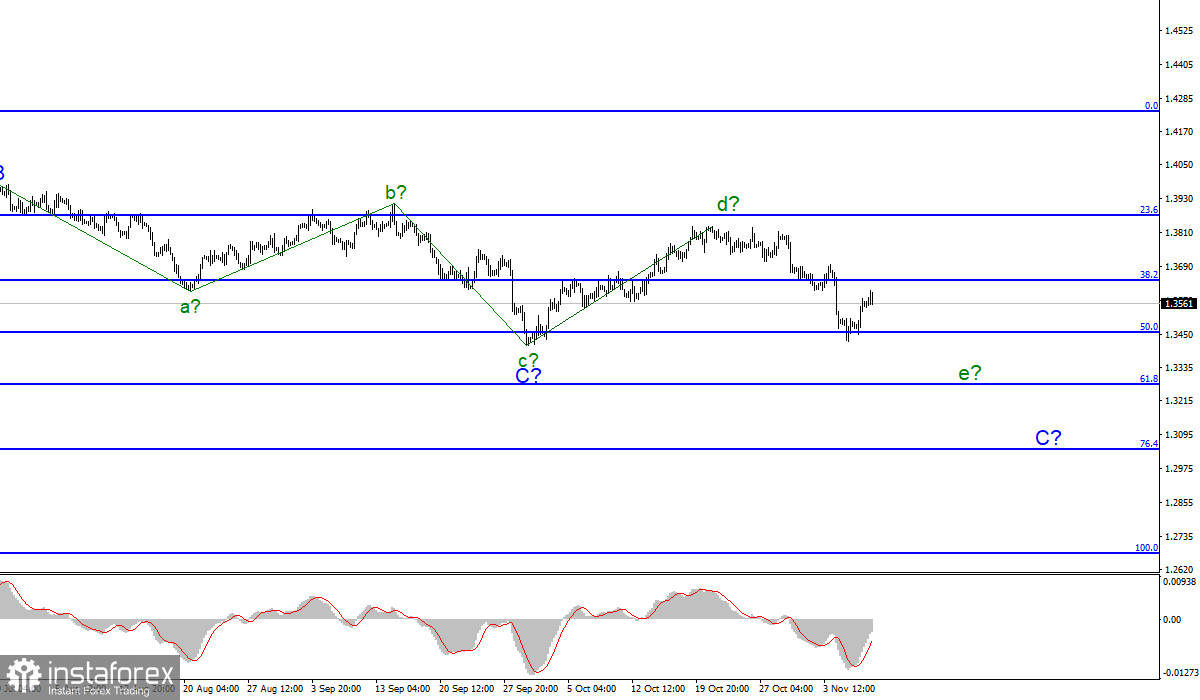

Wave pattern

The wave counting for the Pound/Dollar instrument continues to look quite complicated due to deep corrective waves as part of the downward trend section, but at the same time, it is quite convincing. Even inside the last wave C, presumably five internal waves are visible, and each subsequent one is approximately equal in size to the previous one. My assumption that wave C can already be completed has not been confirmed, but the frankly corrective wave structure may change once again.

Moreover, the low of September 29 may become the starting point for a new upward trend section. In this case, the construction of the downward wave C has already been completed. And the two following waves are the first and second waves of the new upward trend. At the same time, there is no confidence in the execution of this option either.

An unsuccessful attempt to break the 50.0% Fibonacci level and an unsuccessful attempt to break the low wave c in C indicates that the instrument is ready to increase. But nothing prevents the markets from increasing demand for the dollar on Wednesday, which will lead to an update of the low of wave c in C, which will lead to the fact that the last downward wave will be recognized as e in C.

The UK and the EU may terminate the Brexit agreement.

The exchange rate of the Pound/Dollar instrument increased by 70 basis points on Monday, and by 0 during Tuesday. The news background of today was rather poor, despite the speech of Jerome Powell and the speech of Andrew Bailey available in the news calendar. There was also a very weak amplitude during the day – only 30 basis points. Thus, the markets have not found any interesting economic news for themselves. However, this does not mean that there was no news at all.

Britain and the European Union continue to conflict over the Northern Ireland protocol. Let me remind you that London demands a complete revision from Brussels and, in case of refusal, threatens to include article 16, which allows it to unilaterally not fulfill certain points of the agreement. In turn, Brussels insists on Britain's compliance with all the points of the concluded agreement. The European Union respects London's position and offers certain solutions to the problem, however, they do not suit the pound.

Therefore, threats from the UK continue to flow like a river, which forces Europeans to respond in kind. In particular, the European Commission has already stated that if London activates Article 16, the European Union may completely withdraw from the Brexit agreement altogether.

In addition, there is already talk that the European Union may start a trade war with the UK. Irish Foreign Minister Simon Coveney believes: "The trade and cooperation agreement depends on the implementation of the Brexit Agreement, which includes the protocol on Northern Ireland. One depends on the other. If one protocol is canceled, there is a danger that the other (protocol or agreement) will also be rejected."

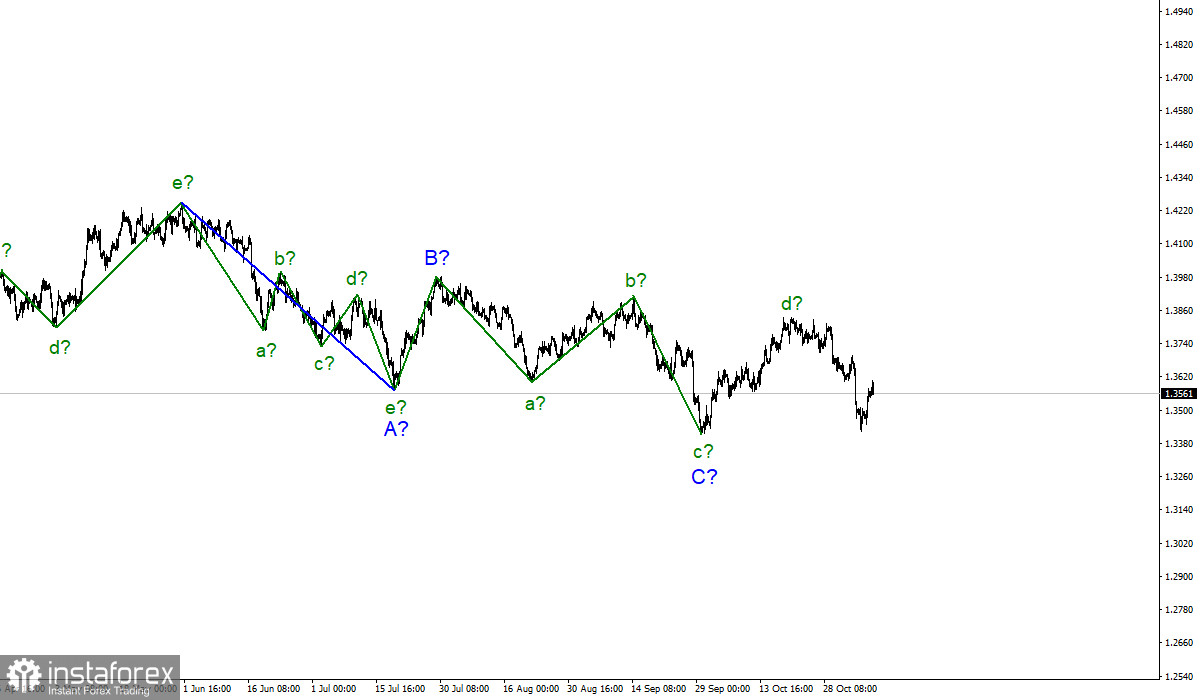

General conclusions

The wave pattern of the Pound/Dollar instrument looks quite convincing now. It has a downward form, but it is not impulsive. The expected wave e does not look complete yet, so I advise you to sell the instrument for each downward signal from the MACD indicator with targets located near the level of 1.3270, which equates to 61.8% Fibonacci level.

Starting from January 6, the construction of a new downward trend section began, which can turn out to be almost any size and any length. At this time, I'm still counting on building another downward wave, since wave A turned out to be a five-wave one. The peak of wave b has not been broken yet, so I am waiting for a decline in quotes.