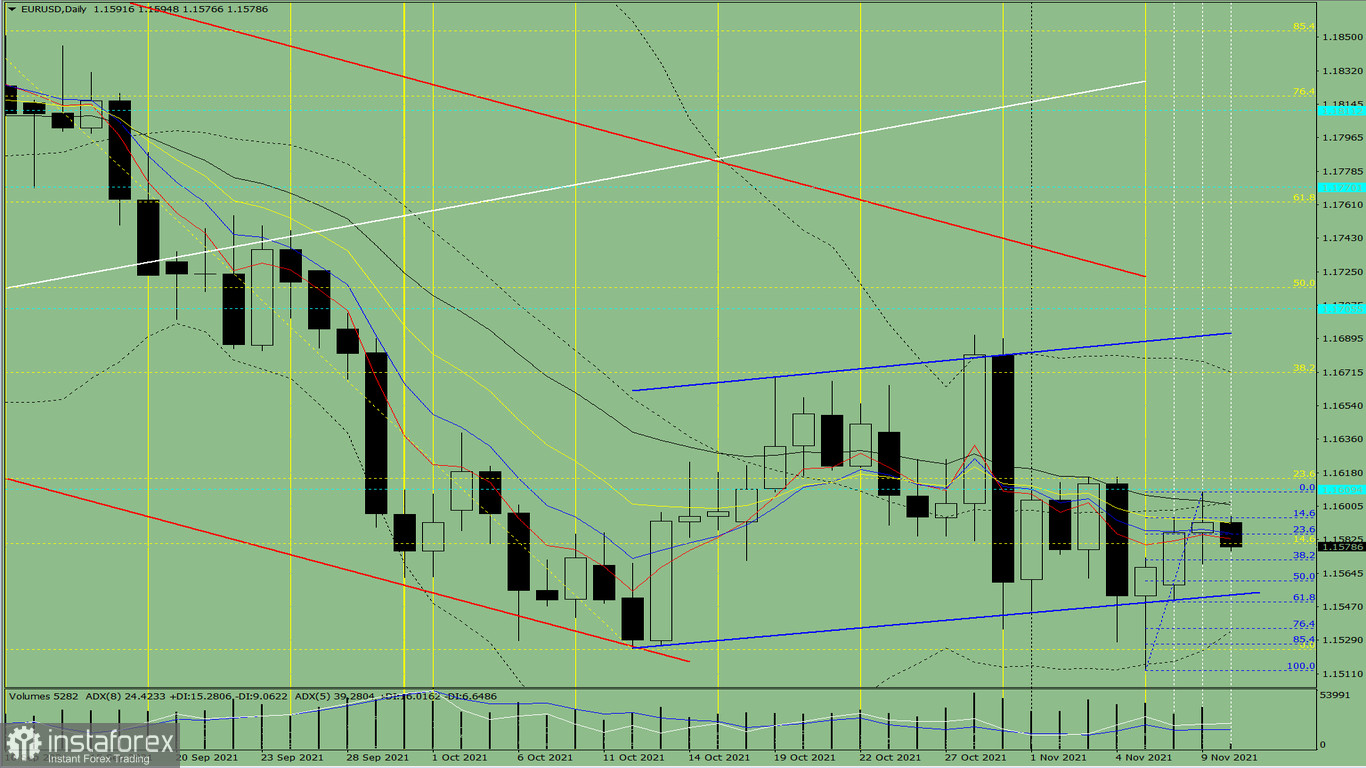

Trend analysis (Fig. 1)

The price from the level of 1.1592 (closing of yesterday's daily candle) is likely to decline to the level of 1.1560 – the pullback level of 50% (blue dotted line) today. After this level is tested, it may start rising to the target of 1.1615 – the pullback level of 23.6% (yellow dotted line) and then resume the upward movement to the target of 1.1671 – the pullback level of 38.2% (yellow dotted line).

Figure 1 (daily chart)

Comprehensive analysis:

- Indicator analysis - up

- Fibonacci levels - up

- Volumes - up

- Candlestick analysis - up

- Trend analysis - up

- Bollinger lines - down

- Weekly chart - up

General conclusion:

Today, the price from the level of 1.1592 (closing of yesterday's daily candle) may fall to the level of 1.1560 – the pullback level of 50% (blue dotted line). Once tested, it may start growing to the target of 1.1615 – the pullback level of 23.6% (yellow dotted line). After that, the upward movement may continue to the target of 1.1671 – the pullback level of 38.2% (yellow dotted line).

Alternatively, the price from the level of 1.1592 (closing of yesterday's daily candle) may continue to decline to the target of 1.1554 – the support line (blue bold line). After testing it, it may rise to the target of 1.1580 – the pullback level of 14.6% (yellow dotted line).