The stock markets note the fixation of previously received profits after the results of the Fed meeting and the publication of strong figures on the number of new jobs before the publication of America's consumer inflation data. Against this background, the US dollar receives local support, which leads to its strengthening against major currencies, which is also reflected in the increase in the dollar ICE index above the level of 94.00 points.

According to the consensus forecast, consumer inflation in annual terms should rise to 5.8% against 5.4% for the previous period under review. As for monthly terms, it is expected to increase from 0.4% in October to 0.6%. The basic values of inflation are expected to grow to 4.3% from 4.0% in annual terms, and by 0.4% from 0.2% in monthly terms.

Seeing such forecasts, there is no doubt that investors do not want to take risks, which is reflected in the decline of stock indices in Asia before the start of trading in Europe. At the same time, Europe's index futures are supported by the publication of inflation data in Germany, which turned out to be in line with expectations, but this cannot guarantee that trading will take place in the "green" zone. Still, the significant influence of the American factor may force European investors to resume selling stocks, unless the data on consumer inflation turns out to be below expectations.

Why are the markets so focused on inflationary values from America?

This is due to the fact that the continued growth of inflation may force the Fed, despite its persistent unwillingness to face the truth and not yet consider the foreseeable prospects for raising rates, to think about it next year. This is characterized by the comment of J. Bullard, a member of the Fed. On Tuesday, he said that he expects two rate hikes in the second half of next year when the regulator will finally stop buying assets. However, he noted that his forecast will be adjusted based on the development of the situation in the country's economy.

How will the markets react to the negative news on US inflation?

We believe that its growth above the expected values will probably lead to a continued decline in stock indices both in America and around the world. Meanwhile, the US dollar will receive limited support since the probability of the Bullard scenario described above may be implemented On this wave, it will also be possible to observe the resumption of sales of treasuries, which will push up their profitability and stimulate the support of the US dollar in the currency market.

To sum everything up, it is worth noting that the consumer inflation data in the United States to be published today will clearly have an impact on the financial markets. This will become known at 13.30 Universal time.

Forecast of the day:

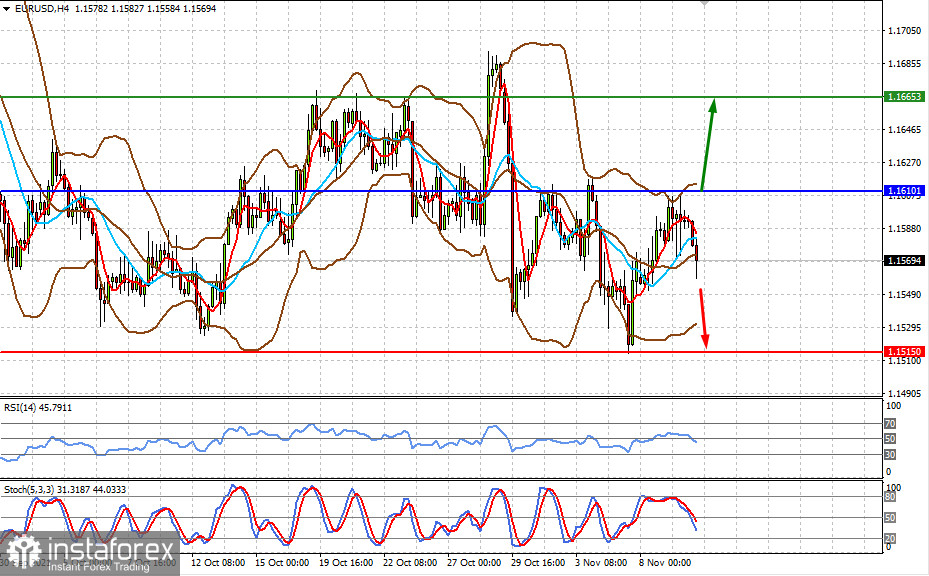

The EUR/USD pair remains in a sideways trend amid expectations of the release of US inflation data. Its strengthening will lead to the pair's decline to the level of 1.1515 and, conversely, its weakening will lead to the pair's growth to 1.1665.

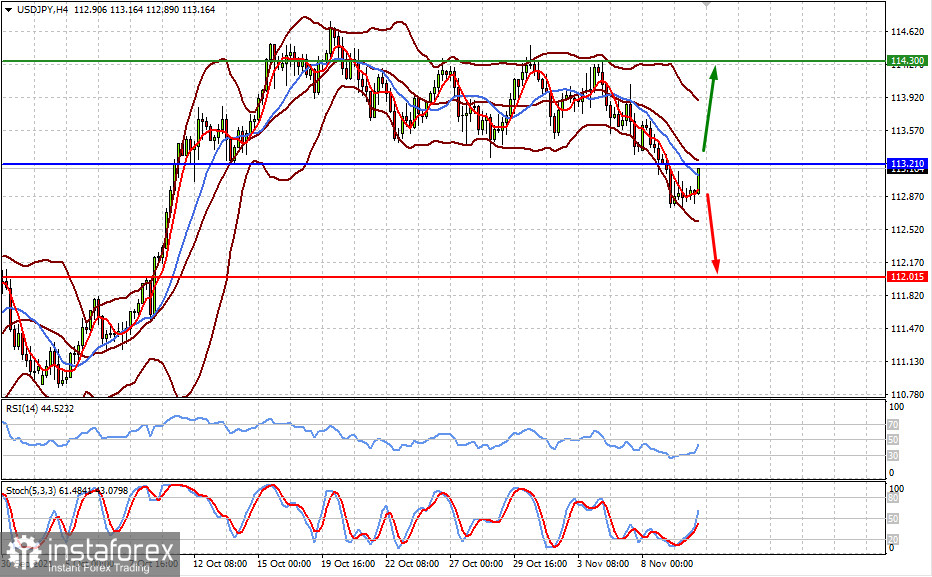

The USD/JPY pair is recovering on expectations of the US inflation data release. If it rises above expectations, it will push the pair above the level of 113.20 and head towards 114.30. If the values show its slowdown, we can expect the pair to make a downward reversal and further decline to 112.00.