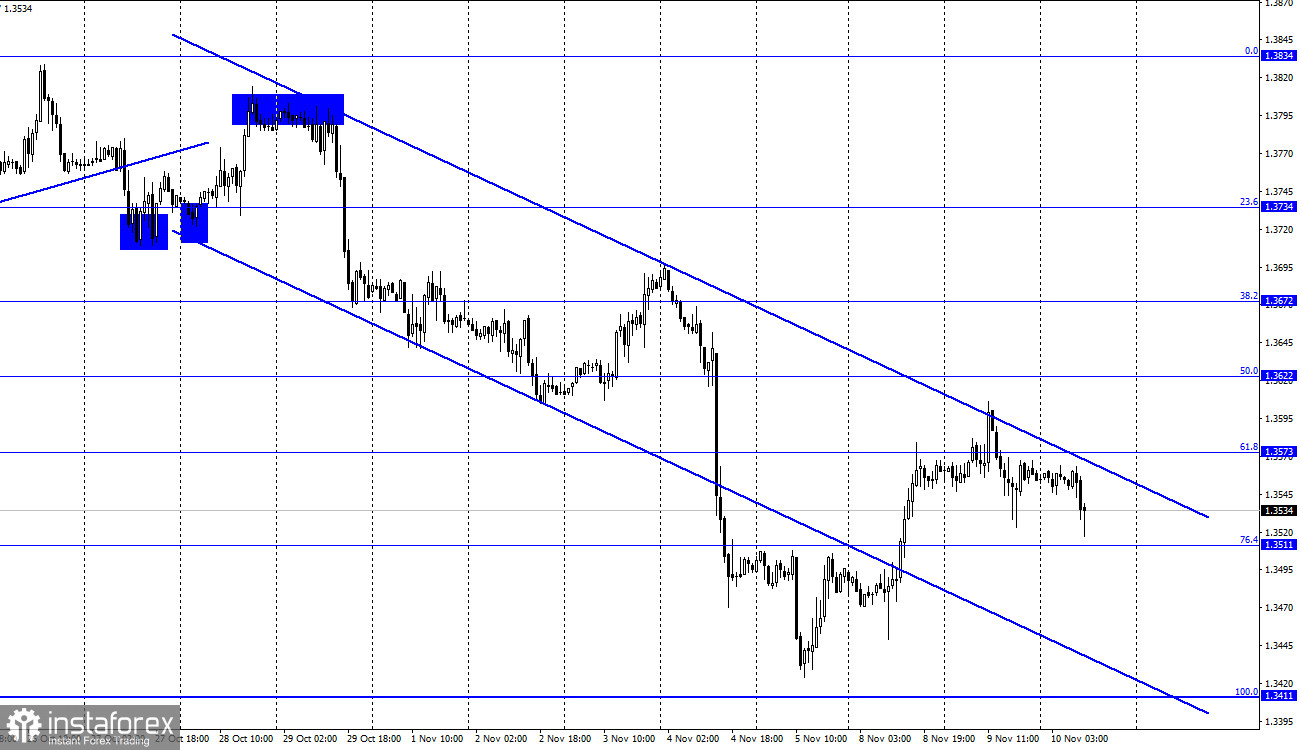

GBP/USD – 1H.

Greetings! On the 1H chart, the GBP/USD pair performed an upward reversal to the upper boundary of the descending corridor and retreated from it. Thus, the pound sterling gave in to the US dollar, falling to the correction level of 76.4% - 1.3511. Yet, the rebound from the level of 1.3511 leaves room for possible growth of the pound sterling to the Fibo level of 61.8% - 1.3573. Closing below the level of 1.3511 will increase downward pressure. So, the pair may drop the next level of 100.0% - 1.3411. As the economic calendar remains almost empty, it is important to pay attention to other news, not economic. There are plenty of them now. The UK and the European Union are holding talks on the Northern Ireland protocol. So far, the parties have not been able to find a compromise.

Moreover, London threatens to trigger Article 16, which allows them to refuse to fulfill certain clauses in the withdrawal agreement. The European Union warns the UK that in this case, it will suspend the entire post-Brexit deal if London uses Article 16. In general, parties are now only escalating the conflict rather than trying to find a consensus. At the same time, the Fed published a semi-annual financial stability report. According to this report, US investors are more worried about rising inflation than coronavirus woes amid monetary policy tightening in the next 12-18 months. The Fed notes that risk appetite is now at its highest level since 2001, but things could change very quickly if economic growth stops or the pandemic situation worsens. The situation in financial markets around the world is unsteady and dangerous.

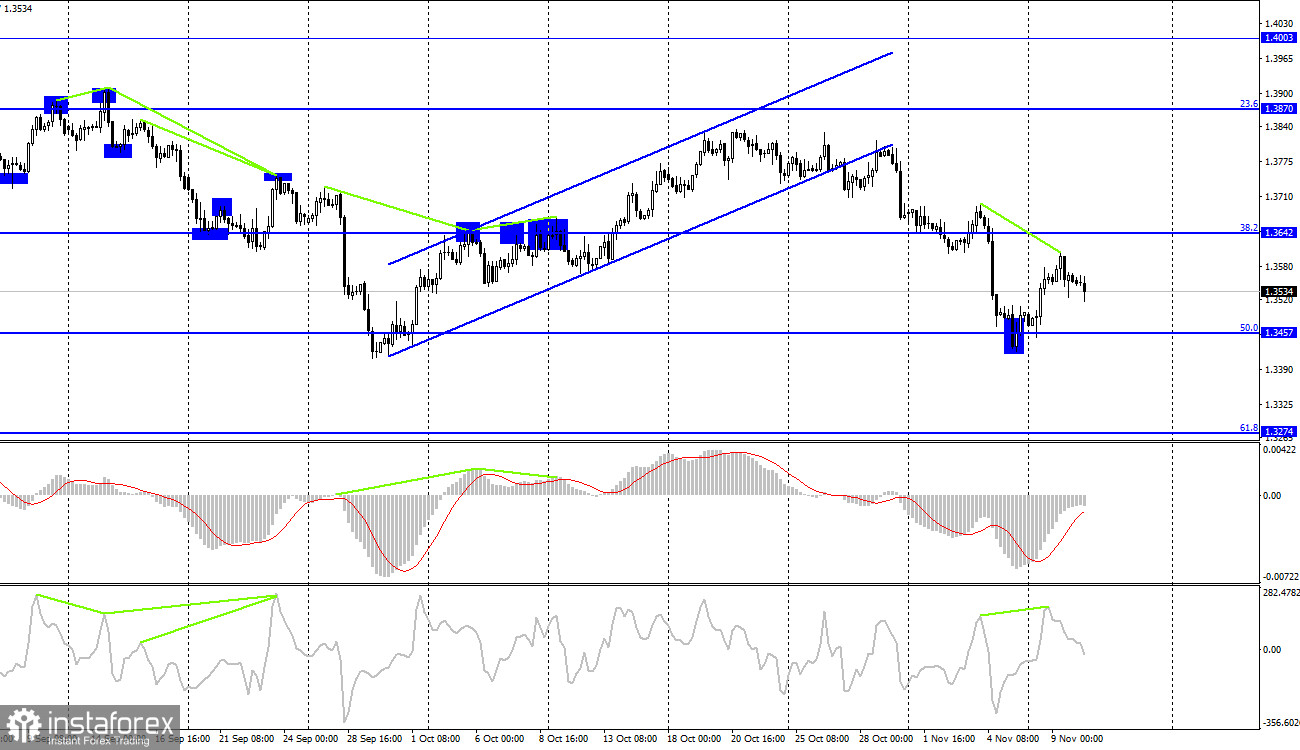

GBP/USD – 4H.

On the 4-hour chart, the pound sterling weakened against the US currency after the formation of a bearish divergence at the CCI indicator. It fell to the correction level of 50.0% - 1.3457. In case of a rebound from this level, the pound sterling may regain ground, rising to the correction level of 38.2% - 1.3642. Closing below the level of 1.3457 will increase the probability of a further fall towards the next level of 61.8% - 1.3274. Closing below the level of 1.3457 may trigger a further fall to the next level of 61.8% - 1.3274.US- CPI Index (13:30 UTC).

The economic calendar for US, UK:

US – Initial Jobless Claims (13:30 UTC).

UK- BOE member, Silvana Tenreyro, will deliver a speech (13:30 UTC).

On Wednesday, Silvana Tenreyro will deliver a speech. However, the US will unveil crucial economic data - the US inflation report. Today, the economic calendar is empty.

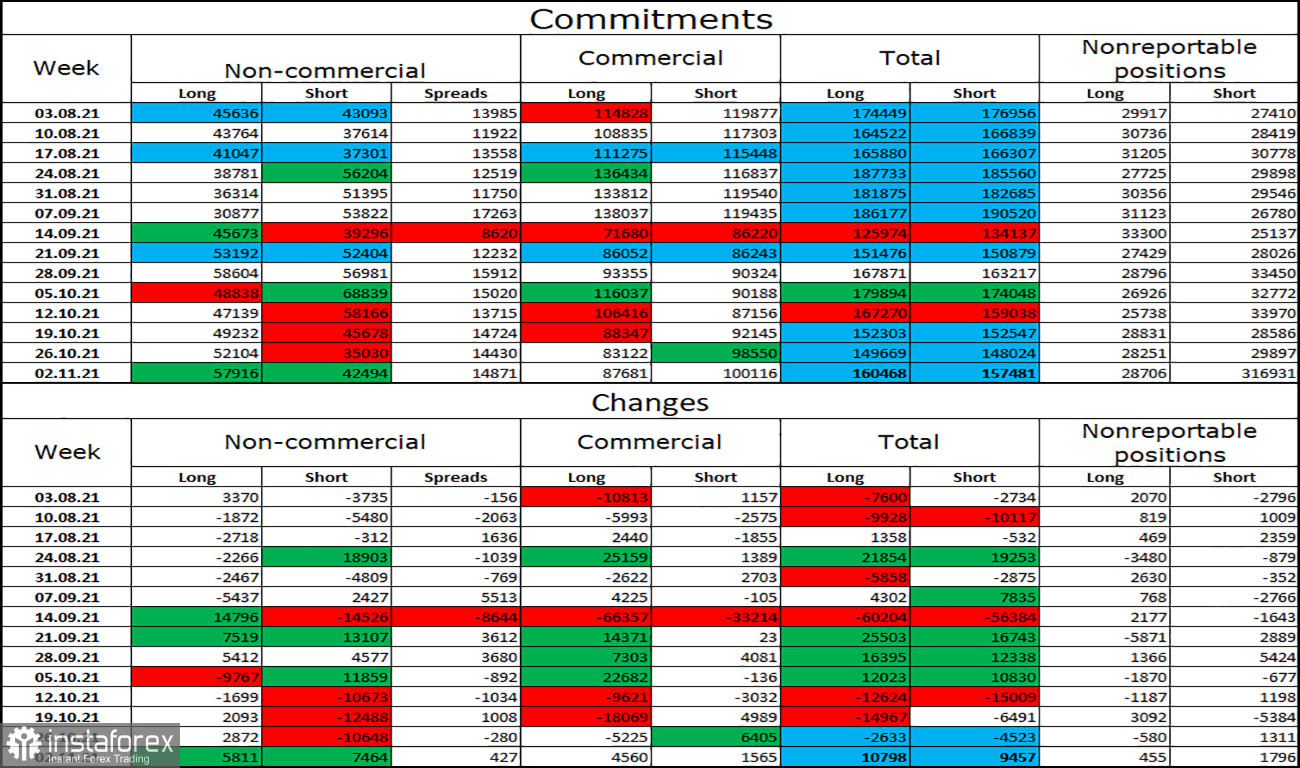

COT report (Commitments of traders):

The latest COT report released on November 2 showed that the mood of major market players has become a little less bullish. In the reporting week, speculators opened 5,811 long contracts and 7,464 short contracts. Thus, the number of long contracts in the hands of major players still exceeds the number of short contracts by 17,000. However, the gap is narrowing. In recent weeks, market sentiment has remained muted. The total number of long and short contracts for all categories of traders is the same (160K - 157K). Thus, after several weeks of large volumes of long contracts, traders may switch to short contracts.

Outlook for GBP/USD:

It is recommended to open long positions on the pound sterling if the price rebounds from the level of 76.4% - 1.3511 on the 1H chart with the target levels of 1.3573 and 1.3622. One may also open long trades if the price closes above the corridor on the 1H chart. It is better to open short positions if the piece retreats from the upper border of the channel on the 1H chart with the target levels of 1.3511 and 1.3411. It is recommended to close short positions after a rebound from the 1.3511 level.

TERMS:

"Non-commercial" - major market players: banks, hedge funds, investment funds, private, and large investors.

"Commercial" - commercial enterprises, banks, corporations, companies that buy foreign currency not to make speculative profits, but to ensure current activities or export-import operations.

"Non-reportable positions" are small traders who do not have a significant impact on the price.