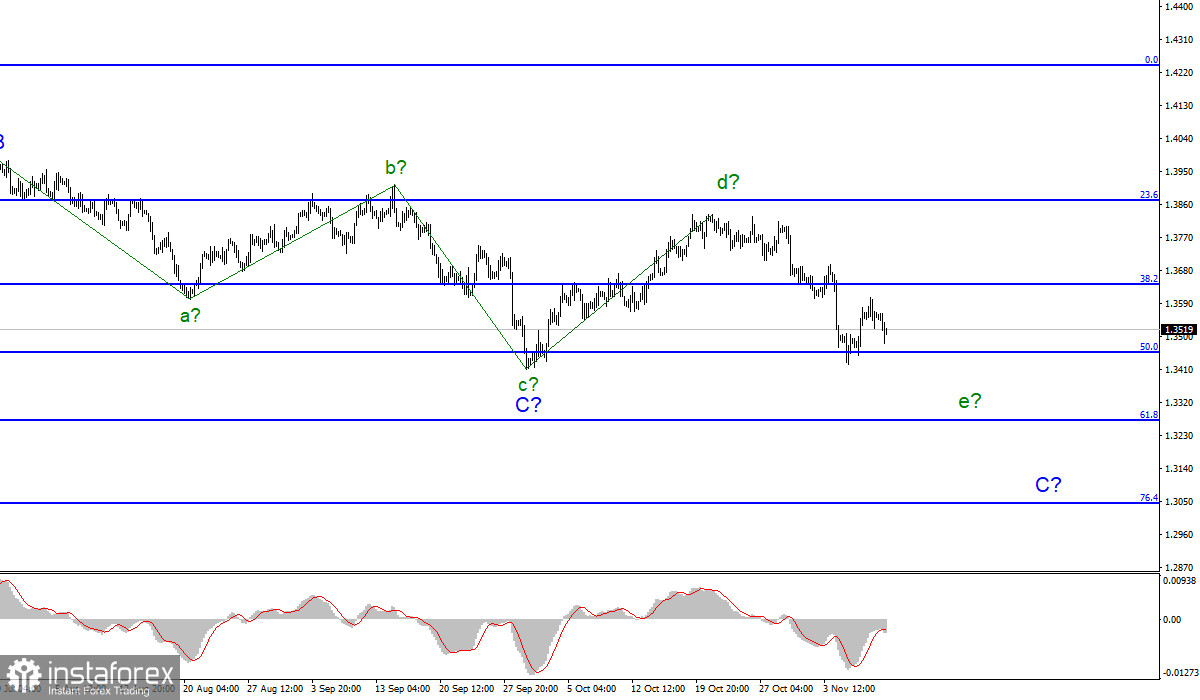

Wave pattern.

For the pound/dollar instrument, the wave marking continues to look quite difficult due to deep corrective waves as part of the downward trend section. However, at the same time, it is quite convincing. Inside the last wave C, presumably five internal waves are visible, and each subsequent one is approximately equal in size to the previous one. My assumption that wave C can already be completed has not yet been confirmed, but the frankly corrective wave structure may change once again. Moreover, it is so that the low of September 29 may become the starting point for a new upward section of the trend. In this case, the construction of the descending wave C has already been completed. And the two waves following it are the first and second waves of the new ascending section. At the same time, there is no confidence in the execution of this option either. An unsuccessful attempt to break the 50.0% Fibonacci level and an unsuccessful attempt to break the low wave c-C indicate that the instrument is ready to increase. But nothing prevents the markets from increasing demand for the dollar tomorrow, which will lead to an update of the low wave c-C, which will lead to the fact that the last descending wave will be recognized as the wave e-C.

The Briton stumbled again, this time because of the US inflation report.

The exchange rate of the pound/dollar instrument decreased by 80 basis points during Wednesday, but after the release of the US inflation report, it slightly moved away from the lows reached and is rising in the afternoon. However, I continue to expect a decline in the quotes of the instrument, as I consider the downward trend section incomplete. Another question is what can further increase the demand for the dollar in the market? Let's look at the news calendar for the rest of the week. Tomorrow, the UK will undoubtedly release important reports on GDP in September and changes in industrial production in the same month. The markets have not been reacting very actively to the British statistics packages lately, but maybe everything will be different this time. Gross domestic product may decrease to 1.5% 3m/3m, although the value of the previous month, August, was 2.9%. If the real value is even lower, then the British may fall under the decline in demand, which is exactly what is needed for further construction of the downward wave e-C. Thus, tomorrow, I am waiting for weak statistics from Britain. The GDP for the quarter may also decrease significantly. In the 3rd quarter, growth is expected to be only 1.5%, although, in the 2nd quarter, economic growth of 5.5% was recorded. This data may be a disappointment for the markets and the British pound.

General conclusions.

The wave pattern of the pound/dollar instrument looks quite convincing now. It has a descending form, but it is not impulsive. The expected wave e does not look complete yet, so I advise you to sell the instrument for each signal down the MACD indicator with targets located near the level of 1.3270, which equates to 61.8% Fibonacci.

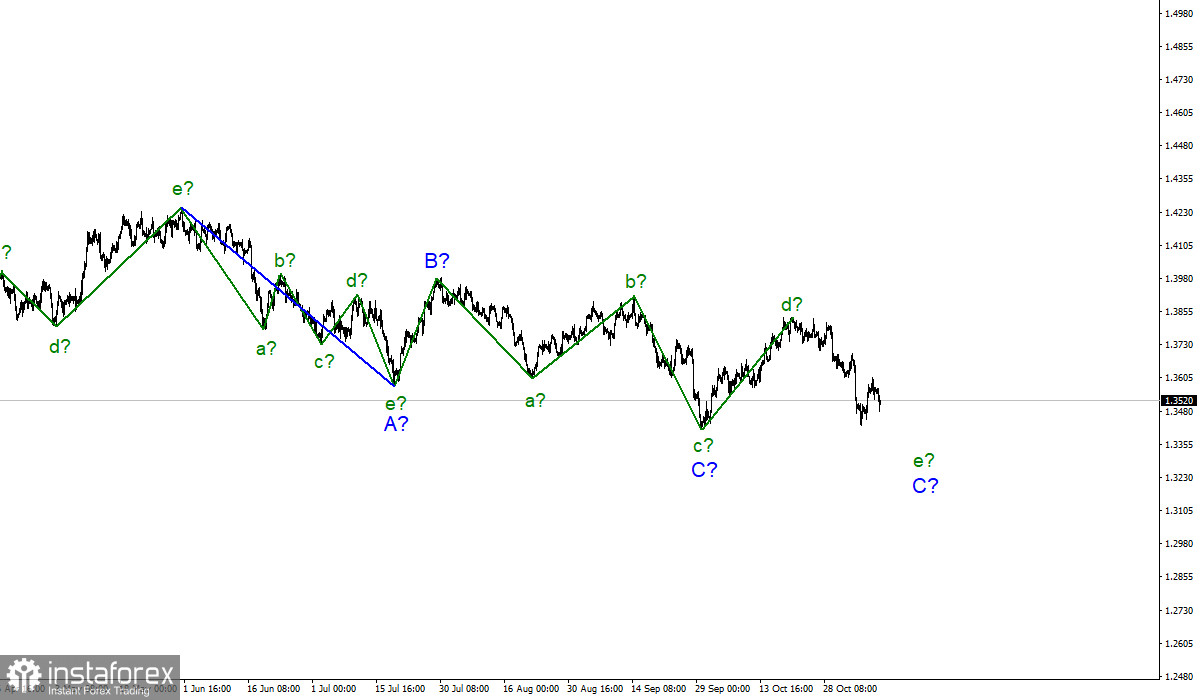

Senior schedule.

Starting from January 6, the construction of a new downward trend section began, which can turn out to be almost any size and any length. At this time, I still expect to build another downward wave, since wave A turned out to be a five-wave one. The peak of wave b has not been broken yet, so I am waiting for a decline in quotes.