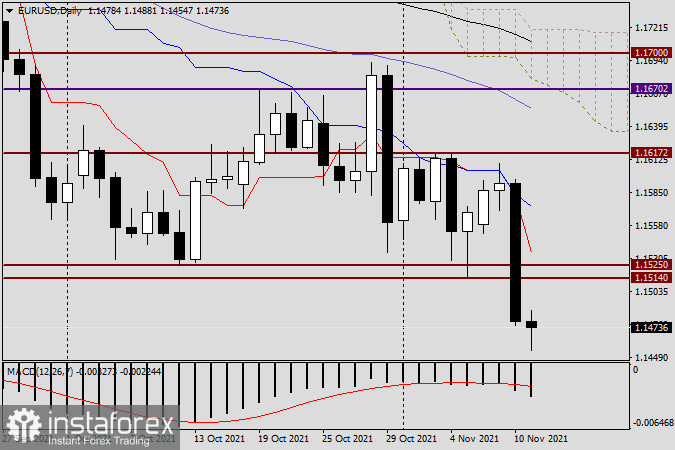

Well, looking at the results of yesterday's trading, we can conclude that the main currency pair of the Forex market has chosen its route, and it is likely to run in the south direction. At yesterday's trading, the euro/dollar pair showed a crushing drop, the main reason for which was the continued increase in inflation in the United States of America. Yesterday's data on the consumer price index, as well as consumer price growth excluding food and energy prices, rose above economists' forecasts. This factor confirms that the initial opinion of the heads of the US Federal Reserve System (FRS) that the increase in inflation will be a temporary phenomenon is not true at this point. This means that the Fed will have to take measures to tighten its monetary policy to stop the growth of inflation. As a rule, such steps lead to an increase in the national currency. In this case, we are talking about the US dollar. All the details in the form of specific figures for yesterday's publication of the US consumer price index can be seen in the economic calendar. Looking into it, today it is worth highlighting only the economic bulletin from the European Central Bank (ECB), as well as economic forecasts from the European Commission. No statistics are expected from the United States today.

Daily

So, yesterday's data on the consumer price index in the United States strengthened the confidence of market participants that the Federal Reserve will begin tightening its monetary policy in the very near future. In particular, the current head of the Fed, Jerome Powell, has repeatedly said this. If inflation continues to rise, the Fed will have no choice but to switch to a more stringent monetary policy. I dare to assume that the results of the fight against a sharp increase in inflation may determine the future of Powell himself. If the measures taken are correct and bring the desired result, Powell's chances of a second term in charge of the world's largest central bank will increase many times. If the current head of the Fed does not manage to curb the growth of inflation, most likely, this will be his first and last term at the helm of the Fed. If you look at the daily chart, the EUR/USD bears more than confidently fulfilled all the tasks assigned to them. They lowered the quote under the psychological level of 1.1500 and closed trading on October 10 at the level of 1.1478. As noted in one of the previous reviews, there is strong support at 1.1475, the breakdown of which, at the end of the article, the players are engaged in lowering the rate. Right here and now, the pair is already trading near 1.1463, which implies a subsequent decline in the exchange rate to such levels as 1.1450 and 1.1420.

H1

As has been repeatedly emphasized in many previous materials, it is best to look for points to enter the market on the hourly chart of a particular currency pair. Someone uses even smaller timeframes for this, but there is too much noise and false signals on them, so I will offer options on my system using the hourly chart. To begin with, we will stretch the grid of the Fibonacci tool to the fall of 1.1609-1.1455. As you can see, at the end of the article, the pair is trying to adjust to its previous collapse. As long-term practice shows, after such strong falls, corrective pullbacks (if they take place at all) are very insignificant and are limited to the first pullback level of 23.6 Fibo, which coincides with the 1.1490 mark. In case the pair rises to the psychological level of 1.1500 and bearish candle signals appear there, we try to open sales for euro/dollar. We are looking for more favorable prices for opening long positions near 1.1515, where the second pullback level of 38.2 Fibo passes. I suggest refraining from buying in the current situation, for the time being, yesterday's downward movement of the quote turned out to be very obvious and impressive. So, if we summarize and conclude, I consider selling after minor and short-term corrective pullbacks to be the main trading recommendation.