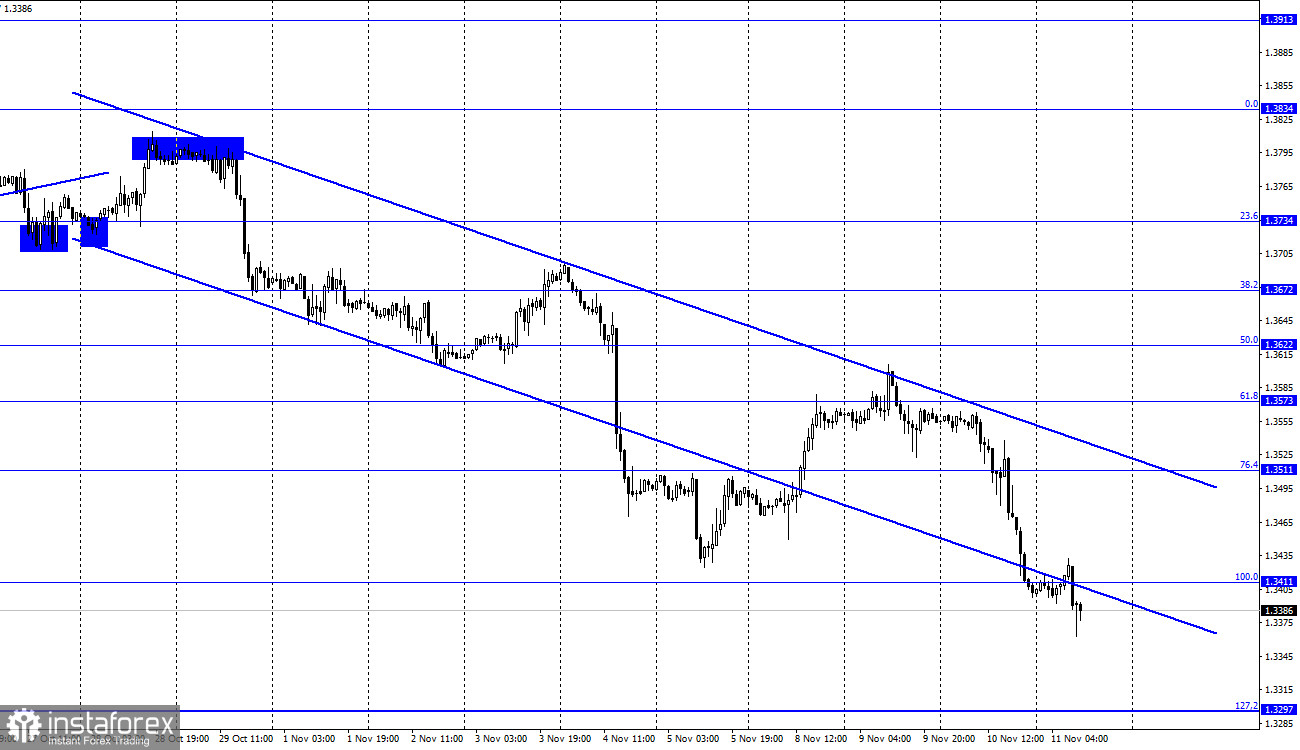

GBP/USD – 1H.

According to the hourly chart, the GBP/USD pair performed a reversal in favor of the US dollar yesterday and fell to the corrective level of 100.0% (1.3411), under which it secured today. Thus, the process of falling quotes can be continued in the direction of the next Fibo level of 127.2% (1.3297), although the pair also performed a close under the downward trend corridor. This corridor still characterizes the mood of traders as "bearish". As I said, yesterday the information background was very strong, but only thanks to one report in the USA. Inflation data in October turned out to be much higher than traders' expectations, which caused the growth of the US currency by more than 170 points.

And today a rather voluminous data package was released in the UK, which disappointed traders. GDP in the third quarter was only 1.3% q/q, as well as 6.6% y/y. Traders expected +1.5% q/q and +6.8% y/y. Industrial production declined by 0.4% m/m in September (forecast +0.2%), and the foreign trade balance showed a deficit of 14.7 billion pounds with expectations of 14.3 billion pounds. All three of the most important reports turned out to be worse than expected, so the fall of the British was obvious. However, will bear traders be able to continue to get rid of the British in favor of the dollar? Let me remind you that the Bank of England at its last meeting made it clear that the interest rate could be raised at the next meeting. The quantitative easing program may also begin to decrease. The British central bank may overtake the Fed in raising the rate. And this should already cause an increase in demand for the British. Therefore, in the current situation, I recommend considering a further fall of the pair before closing the quotes above the descending corridor. And look in the direction of purchases when the mood of traders changes to "bullish".

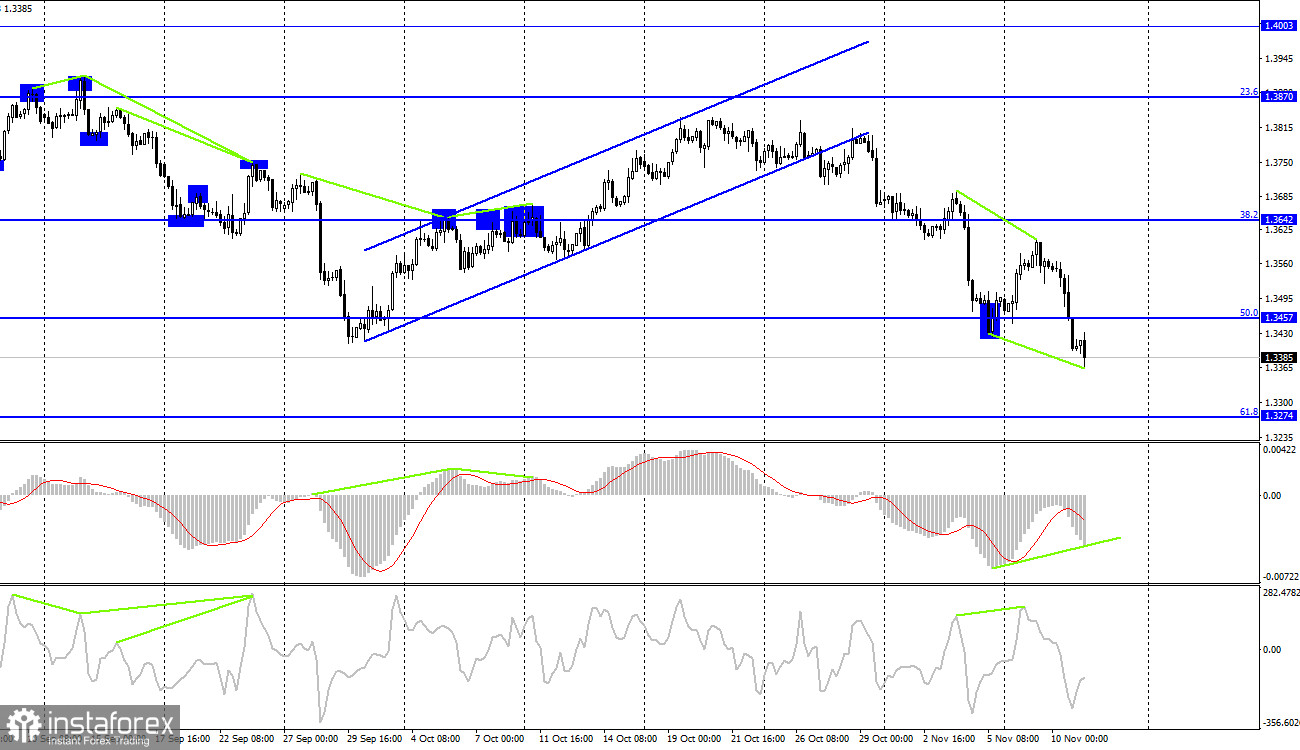

GBP/USD – 4H.

On the 4-hour chart, the quotes of the British continue the process of falling and closing under the corrective level of 50.0% (1.3457). Thus, the next target is the Fibo level of 61.8% (1.3274). However, bullish divergence is already brewing for the MACD indicator. If it forms, it will be a signal for a reversal in favor of the UK currency and some growth of the pair. Closing above the 50.0% level will also work in favor of the British.

News calendar for the USA and the UK:

UK - change in GDP (07:00 UTC).

UK - change in the volume of industrial production (07:00 UTC).

UK - the balance of visible trade (07:00 UTC).

On Thursday, all the economic reports of the day have already been released in the UK. In the USA today, the calendar of economic events is empty. Thus, there will be no background information for the rest of the day. But morning reports may continue to influence the mood of traders on Thursday.

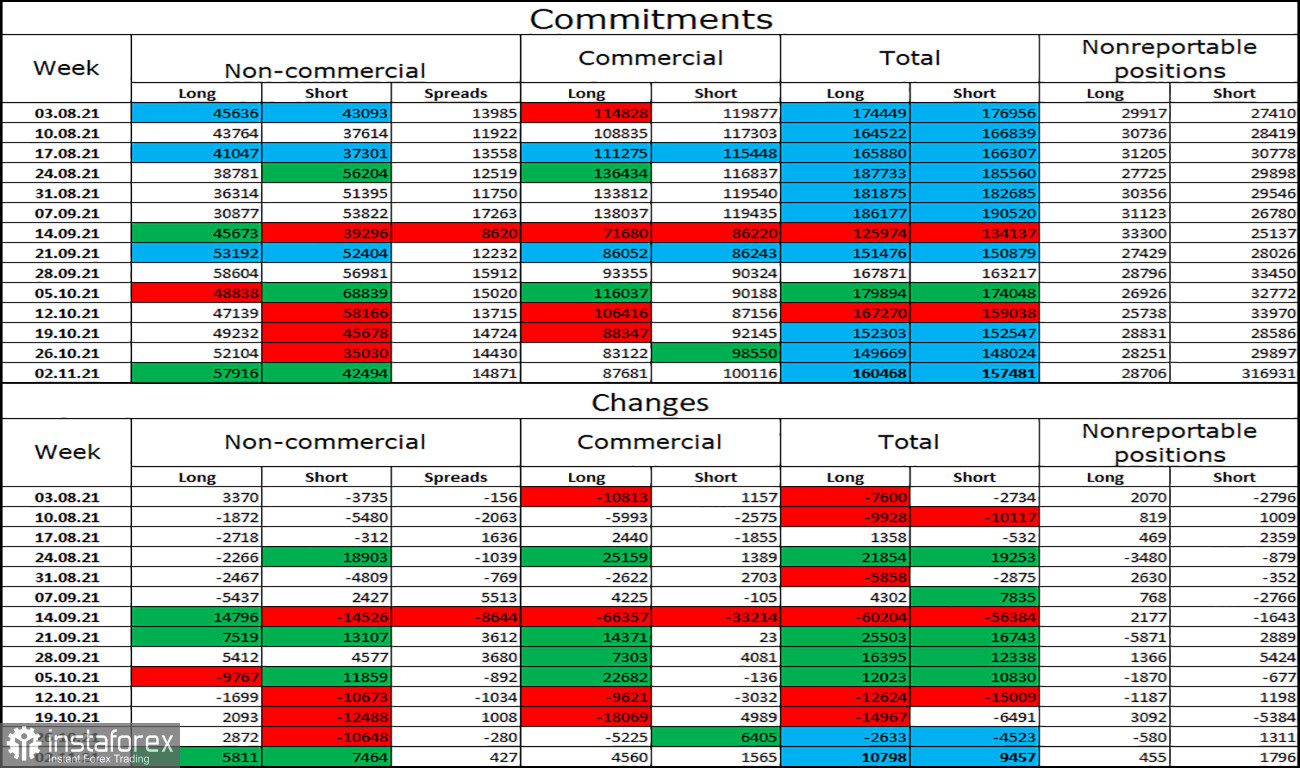

COT (Commitments of Traders) report:

The latest COT report from November 2 on the pound showed that the mood of major players has become a little less "bullish". In the reporting week, speculators opened 5,811 long contracts and 7,464 short contracts. Thus, the number of long contracts in the hands of major players still exceeds the number of short contracts by 17 thousand, but the gap is narrowing. In recent weeks, major players do not have any clear mood and then increase purchases, then increase sales, and the total number of long and short contracts for all categories of traders is the same (160K - 157K). Thus, after several weeks of an active build-up of longs, it may be the turn of shorts.

GBP/USD forecast and recommendations to traders:

Yesterday, I recommended selling pairs with targets of 1.3511 and 1.3411. Both goals have been fulfilled. New sales are possible, as the closing was made under the level of 1.3411. But given the bullish divergence, I wouldn't take any chances with new sales. I recommend buying a pound when closing above the level of 100.0% - 1.3411 with a target of 1.3511.

Terms:

"Non-commercial" - major market players: banks, hedge funds, investment funds, private, large investors.

"Commercial" - commercial enterprises, firms, banks, corporations, companies that buy foreign currency not to make speculative profits, but to ensure current activities or export-import operations.

"Non-reportable positions" are small traders who do not have a significant impact on the price.