Wave pattern

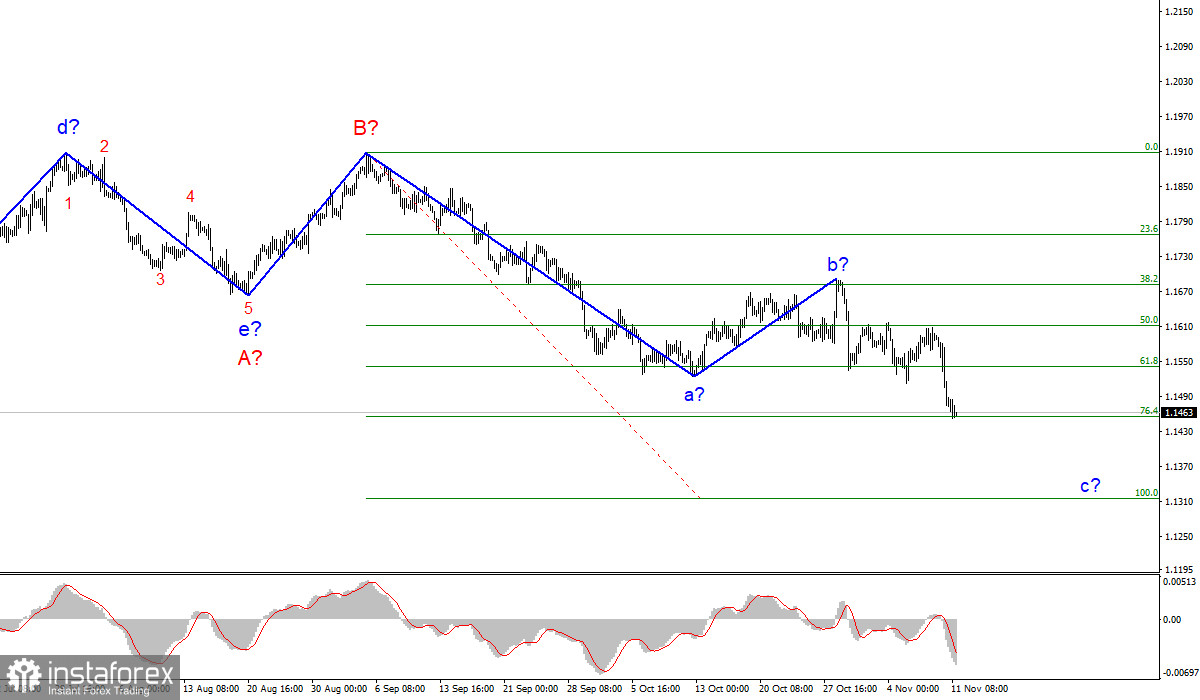

The wave counting of the 4-hour chart for the Euro/Dollar instrument looks quite integral now and continues to remain so. The plot a-b-c-d-e, which began to form at the beginning of the year, is interpreted as wave A, and the subsequent increase in the instrument is interpreted as wave B.

Thus, the construction of the proposed wave C is now continuing, which can also take a very extended form. Its internal corrective wave b has taken a more complex form than initially expected, however, the subsequent decline in quotes, which presumably waves c to C, preserves the integrity of the entire wave counting.

The assumed wave c can take no less extended form than wave a. Its targets are located below the 15th figure, up to the 13th. In order for this wave to continue its construction, a successful attempt to break through the 1.1455 mark is now required, which corresponds to 76.4% Fibonacci level. The whole wave C can also take a shortened form, but for now, we can consider this option to be a backup.

Joe Biden urges Congress to fight against inflation

The news background for the EUR/USD instrument was rather weak this week. And only the events of Wednesday forced the markets to trade much more actively, and in the currency market itself generated a whole lot of conversations.

Inflation in the US rose to 6.2%, and this news had the effect of an exploding bomb. Following the results of Wednesday, the dollar quotes increased by 140 basis points. Today, the decline of the instrument continues. The markets absolutely did not expect such a strong value of consumer prices. We did not expect it so much that even US President Joe Biden announced his intention to make the fight against inflation the number one goal for the American government.

Recall that in recent months, only the lazy do not talk about inflation. And not only in the context of the USA. Prices are rising all over the world. As you can see, for the dollar, whose country boasts much higher inflation than the EU or Britain, this news only works to your advantage.

The current wave count continues to suggest an increase in the US currency, which is happening, thanks to the latest news and reports. Joe Biden also said that ordinary Americans pay for high inflation and they need to be protected from rising prices.

Biden believes that the main reason for the strong price growth is the rise in energy prices. Therefore, plans are already being developed to stabilize oil prices in the United States. In particular, it is proposed to ban the export of oil and open strategic storage facilities with "black gold," which will help increase supply in the American energy market and lower prices.

General conclusions

Based on the analysis, I conclude that the construction of the downward wave C will continue, and its internal corrective wave b has completed its construction. Therefore, now I advise you to sell the instrument for each downward signal from the MACD, with targets located near the calculated mark of 1.1314, which corresponds to 100.0% Fibonacci level.

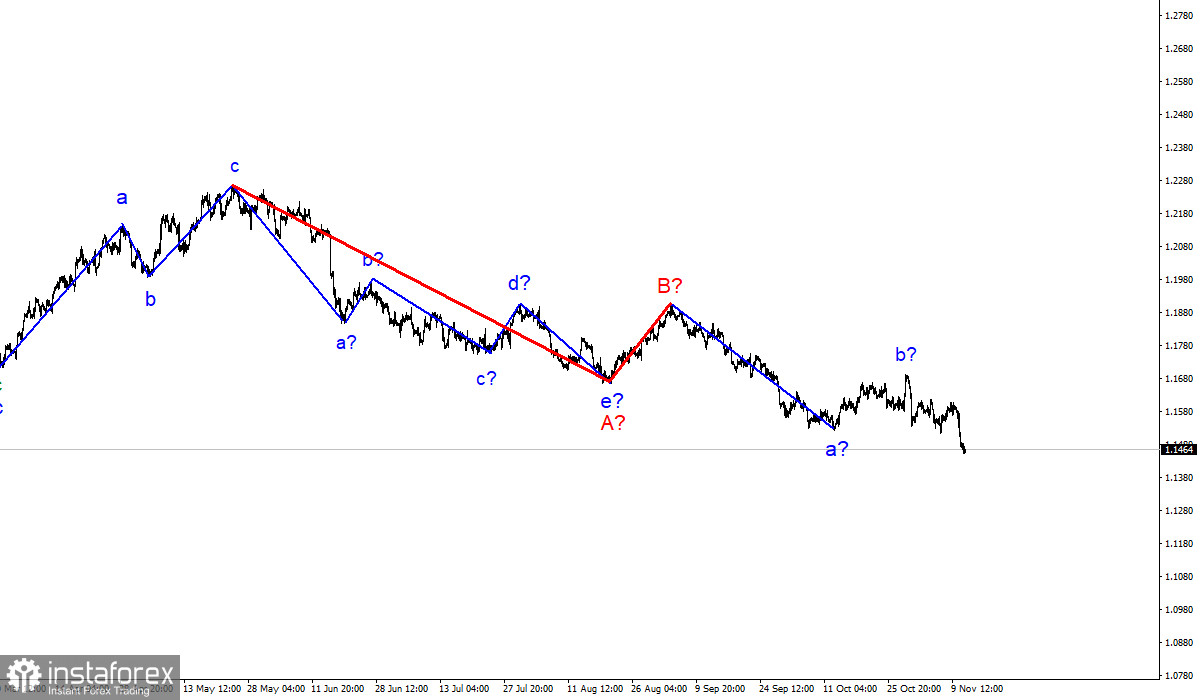

The wave counting of the higher scale looks quite convincing. The decline in quotes continues and now the downward section of the trend, which originates on May 25, takes the form of a three-wave corrective structure A-B-C. Thus, the decline may continue for another month or two until Wave C is fully completed.