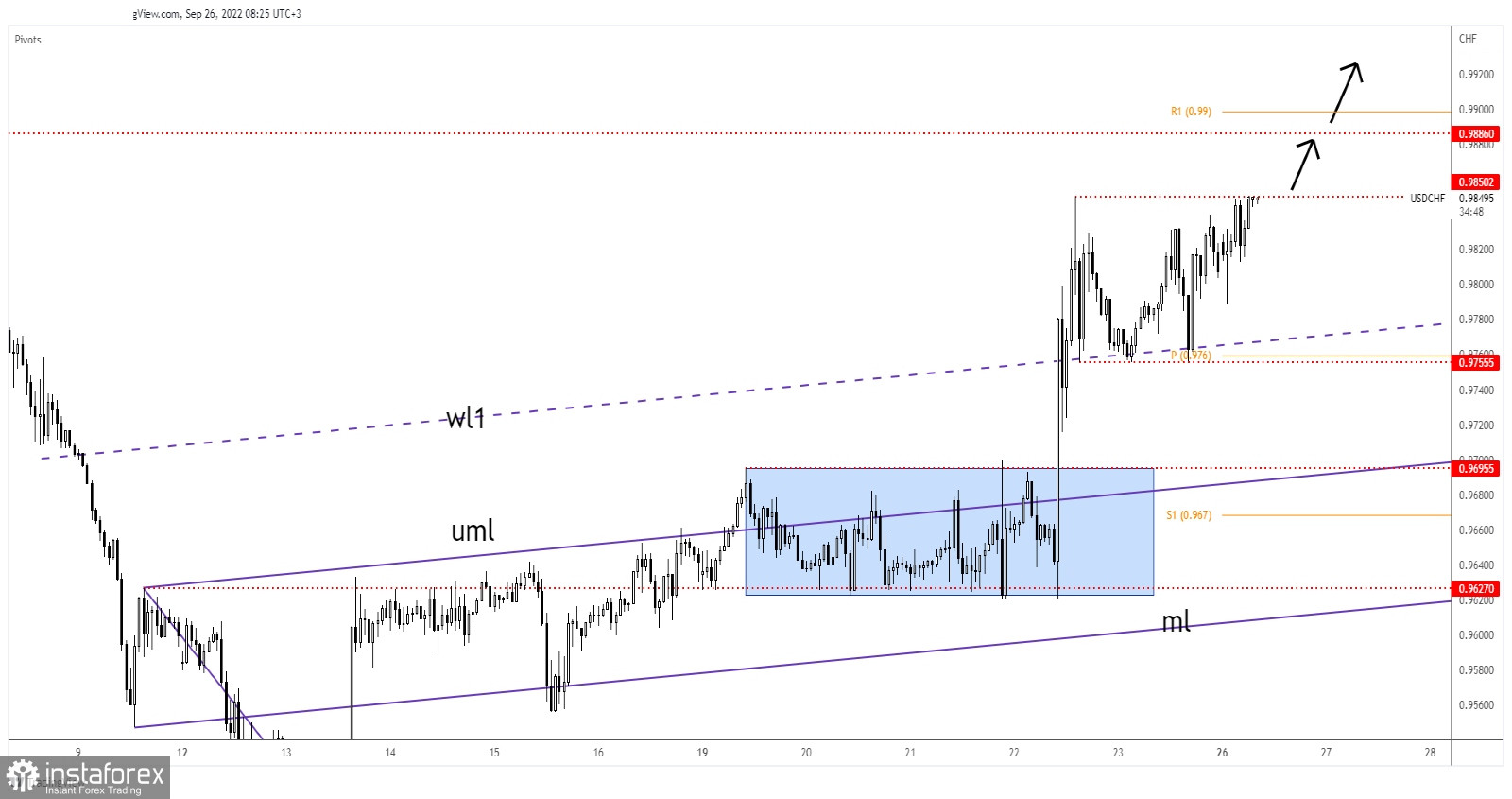

The USD/CHF pair rallied in the short term and now it stands at 0.9848 right below the 0.9850 key resistance. After its strong growth, we cannot exclude a temporary retreat. The rate could come back down to test and retest the near-term support levels before jumping toward new highs.

Technically, the bias is bullish as the Dollar Index is strongly bullish. The USD/CHF pair jumped higher after the US Flash Services PMI and Flash Manufacturing PMI reported better than expected data on Friday. Today, ECB President Lagarde Speaks, and the FOMC Member Collins and FOMC Member Mester's remarks could move the USD.

USD/CHF Breakout Attempt!

The USD/CHF pair edged higher after retesting the ascending pitchfork's warning line (wl1) and the 0.9755 former low (static support). Now, it has reached the 0.9850 former high which represents a static resistance.

In the short term, it could come back to test and retest the former highs trying to accumulate more bullish energy. Only false breakouts through the 0.9850 could signal an extended sideways movement.

USD/CHF Outlook!

A valid breakout through 0.9850, jumping and closing above this level may activate further growth at least towards the 0.9886 historical level. This scenario brings potential long opportunities.

A larger upwards movement could be activated by a valid breakout above 0.9886.