EUR/USD under bearish pressure

Hi, dear traders!

First, let us start with the recently published economic forecasts by the European Commision. On Thursday, the EC improved its outlook for the Euro region. GDP is forecasted to grow by 5% this year and by 4% in 2022. As Europeans return to the workforce, the economy is set to bounce back from the pandemic recession. The economic activity in the eurozone sees a revival.

Inflation rose by 4.1% in October due to the base effects - soaring energy prices and supply chain disruptions. Further economic recovery in the eurozone depends on the COVID-19 situation, as well as changes in the supply-and-demand balance. Issues with production and shipments could push prices higher. Overall, the European Commission's economic forecast is positive. Nevertheless, it did not give support to the euro against the dollar. Here are the trading charts.

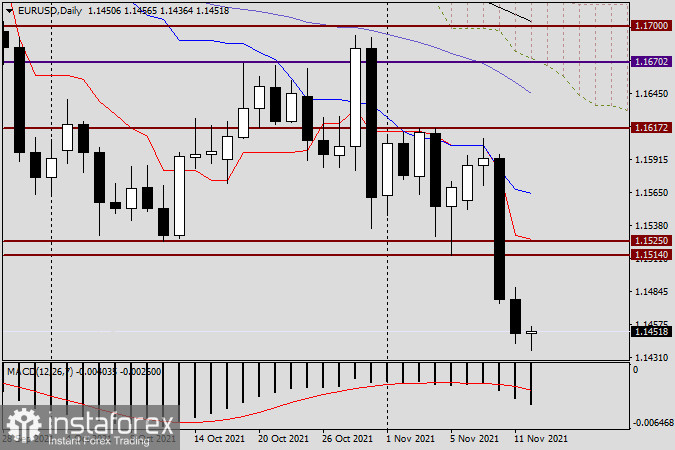

Daily

The daily chart confirms yesterday's forecast of a further downward movement for the pair. EUR/USD fell to 1.1442, but bounced back and closed at a strong level of 1.1450 - its earlier target for the downtrend. At the moment of this article, the price has surpassed yesterday's low of 1.1442, reaching the 1.1436 level. Currently, the currency pair is trading at near 1.1445. According to the daily chart, opening short positions could be attractive after a retracement to the 1.1514-1.1525 price zone, where the two broken support levels are. Right above 1.1525 is the Tenkan-Sen line of the Ichimoku cloud, which can give strong resistance and reverse the price downwards. However, this retracement is unlikely to happen today.

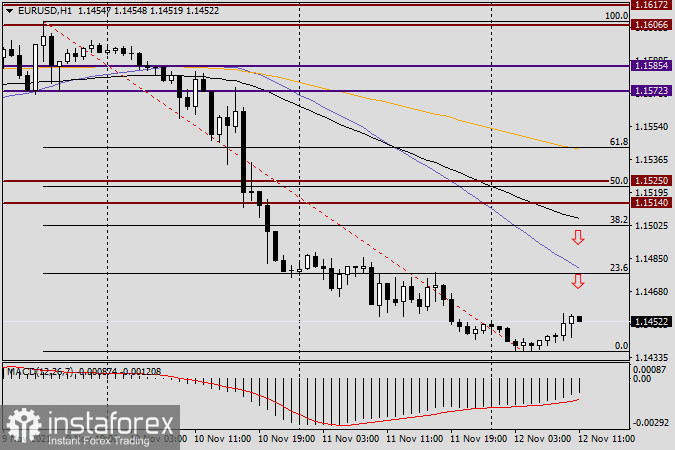

H1

According to the H1 chart, traders are recommended to sell the pair. As market players take profits in the final trading day of the week, the pair may retrace to the price zone of 1.1475-1.1485, and/or the 1.1500 area. This retracement would signal traders to open short positions.

Good luck!