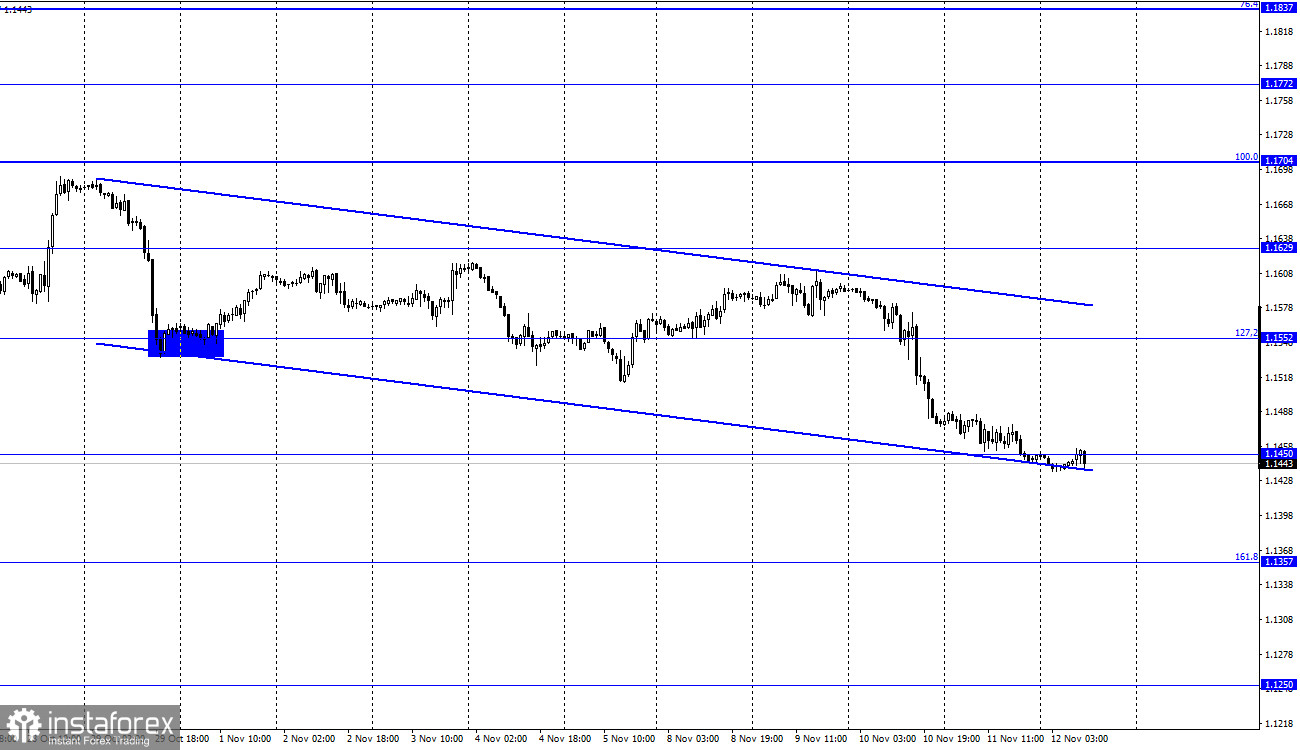

EUR/USD – 1H.

The EUR/USD pair continued the process of falling on Thursday and reached the level of 1.1450 by the end of the day. Fixing just below this level allows us to count on a further fall of the pair, and it has already managed to rebound from this level. However, on the other hand, the pair is trading at the very bottom of the downward trend corridor. Thus, before closing under it, there is a high probability of a reversal in favor of the European and some growth in the direction of the corrective level of 127.2% (1.1552). The information background of yesterday was rather weak. This explains the absolute reluctance of traders to trade actively. There are a few pressing topics for discussion and analysis right now. Especially in the European Union. Thus, traders continue to trade based on the previously received information (in particular, Nonfarm Payrolls reports, inflation, and the results of the Fed meeting) and also try to add "modern" topics to this, such as the question of who will become the new Fed president, or whether Democrats and Republicans will be able to agree on a new increase in the national debt limit.

Let me remind you that Jerome Powell's term of office expires in February 2022, and at the beginning of December 2021, the US Treasury will again reach the debt ceiling, and to continue financing government institutions and paying its obligations, he will need to continue to place bonds of various terms to raise funds. But if the debt ceiling is not raised (which is unlikely), then formally the US will have to declare a default, a technical default. Since absolutely no one in the government needs this, Democrats and Republicans will most likely agree. But what the solution will be is very interesting. Since the last decision was temporary, the limit was increased by $ 0.5 trillion, and these funds were enough for about 2 months. It is unlikely that congressmen and senators want to meet every couple of months to discuss another increase in the debt ceiling.

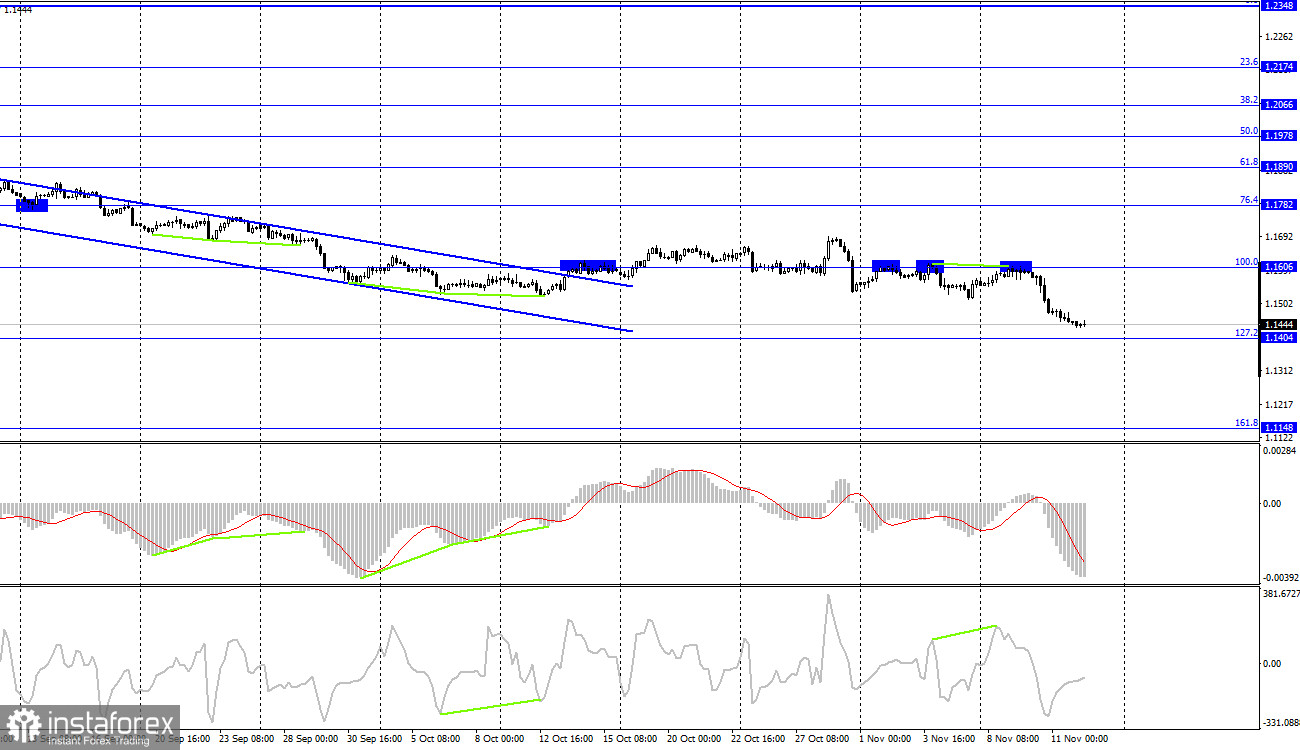

EUR/USD – 4H.

On the 4-hour chart, the quotes continue the process of falling in the direction of the corrective level of 127.2% (1.1404). The bearish divergence of the CCI indicator also worked in favor of the US currency. The rebound of quotes from the level of 127.2% (1.1404) will allow us to count on a reversal in favor of the euro and some growth in the direction of 1.1606. Closing at 1.1404 will increase the probability of continuing the fall in the direction of the next corrective level of 161.8% (1.1148).

News calendar for the USA and the European Union:

EU - change in industrial production (10:00 UTC).

US - consumer sentiment index from the University of Michigan (15:00 UTC).

On November 12, the US calendar is almost empty, and the European Union has already released a report on industrial production in September, which decreased in volume by 0.2% and did not allow the euro currency to begin the growth process. In general, the information background will be weak today.

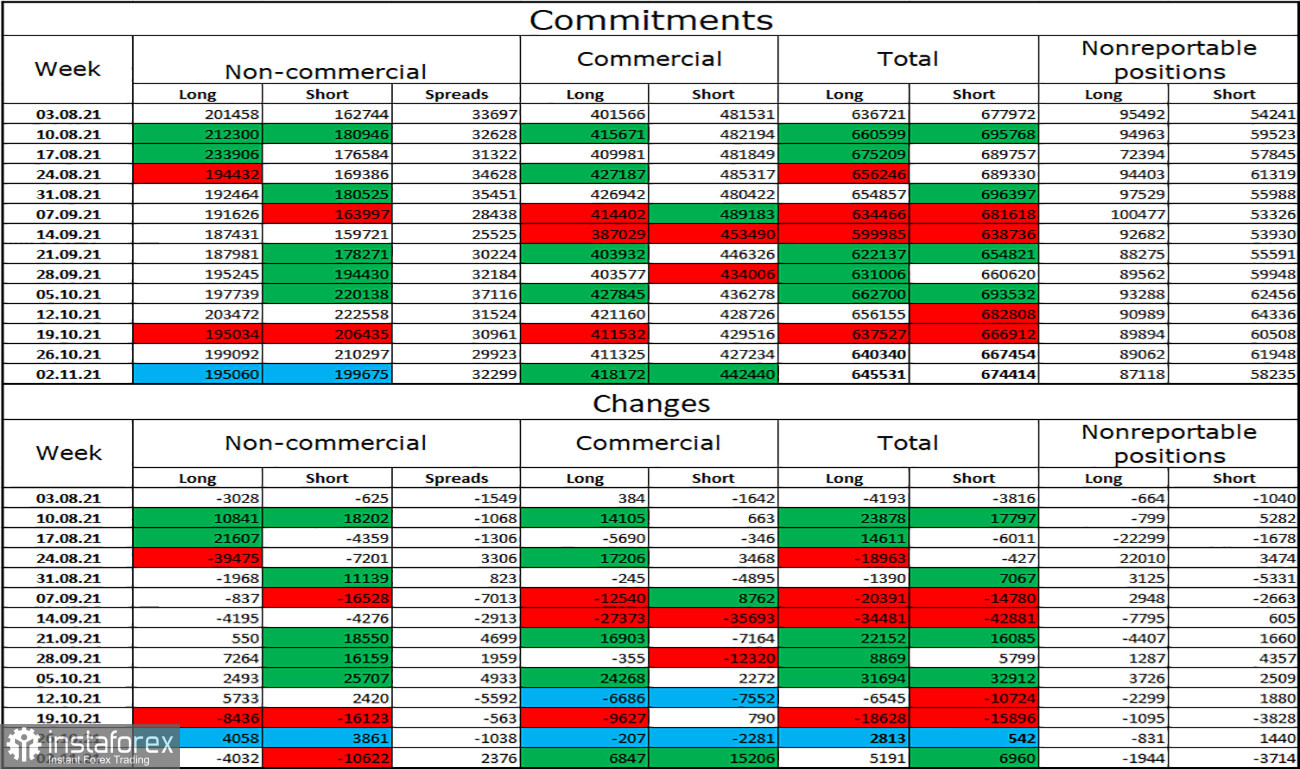

COT (Commitments of Traders) report:

The latest COT report showed that during the reporting week, the mood of the "Non-commercial" category of traders became more "bullish". Speculators closed 4,032 long contracts on the euro and 10,622 short contracts. Thus, the total number of long contracts in the hands of speculators decreased to 195 thousand, and the total number of short contracts - to 199 thousand. Now, these numbers practically coincide, which gives reason to assume that there is no clear mood among speculators. In general, in recent months, there has been a tendency to strengthen the "bearish" mood. Perhaps, now the mood of traders is at a point where no one has an advantage. Perhaps in a week or two, the "bearish" mood will continue to strengthen, which will allow the European currency to continue falling.

EUR/USD forecast and recommendations to traders:

Earlier, I recommended trying to sell the pair if an exact rebound from the level of 1.1606 is performed on the 4-hour chart. As a result, the quotes performed a drop to the level of 1.1450 on the hourly chart. The deal can be closed. New sales – at a close below the level of 1.1450. Purchases – when rebounding from the level of 1.1404 on the 4-hour chart with a target of 1.1552.

Terms:

"Non-commercial" - major market players: banks, hedge funds, investment funds, private, large investors.

"Commercial" - commercial enterprises, firms, banks, corporations, companies that buy foreign currency not to make speculative profits, but to ensure current activities or export-import operations.

"Non-reportable positions" are small traders who do not have a significant impact on the price.