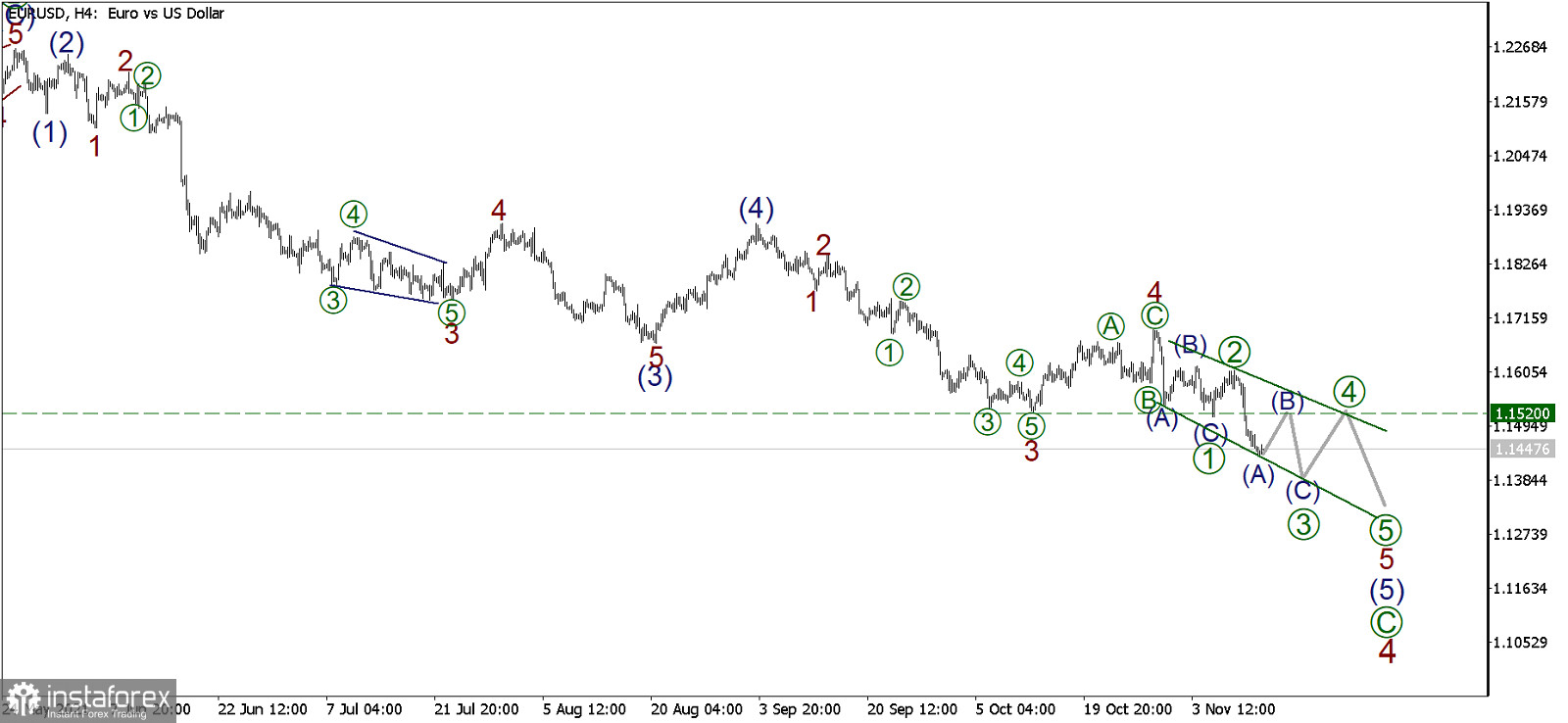

EURUSD, H4:

The market continues to move in a long-term downward trend. Most likely, the last part of this trend is forming.

This bearish trend consists of sub-waves (1)-(2)-(3)-(4)-(5), now its last wave (5) is forming, in which we see sub-waves 1-2-3-4-5, marked with red numbers. Wave 4 was completed in the form of a zigzag, but wave 5, which is now forming, is the final diagonal.

It should be noted that the final diagonal always appears at the end of the trend. Now we see the formation of wave [3] of this diagonal, consisting of sub-waves (A)-(B)-(C). Impulse (A) has been completed, correction (B) has just begun its construction. Consider the markup on H1 to clarify judgments.

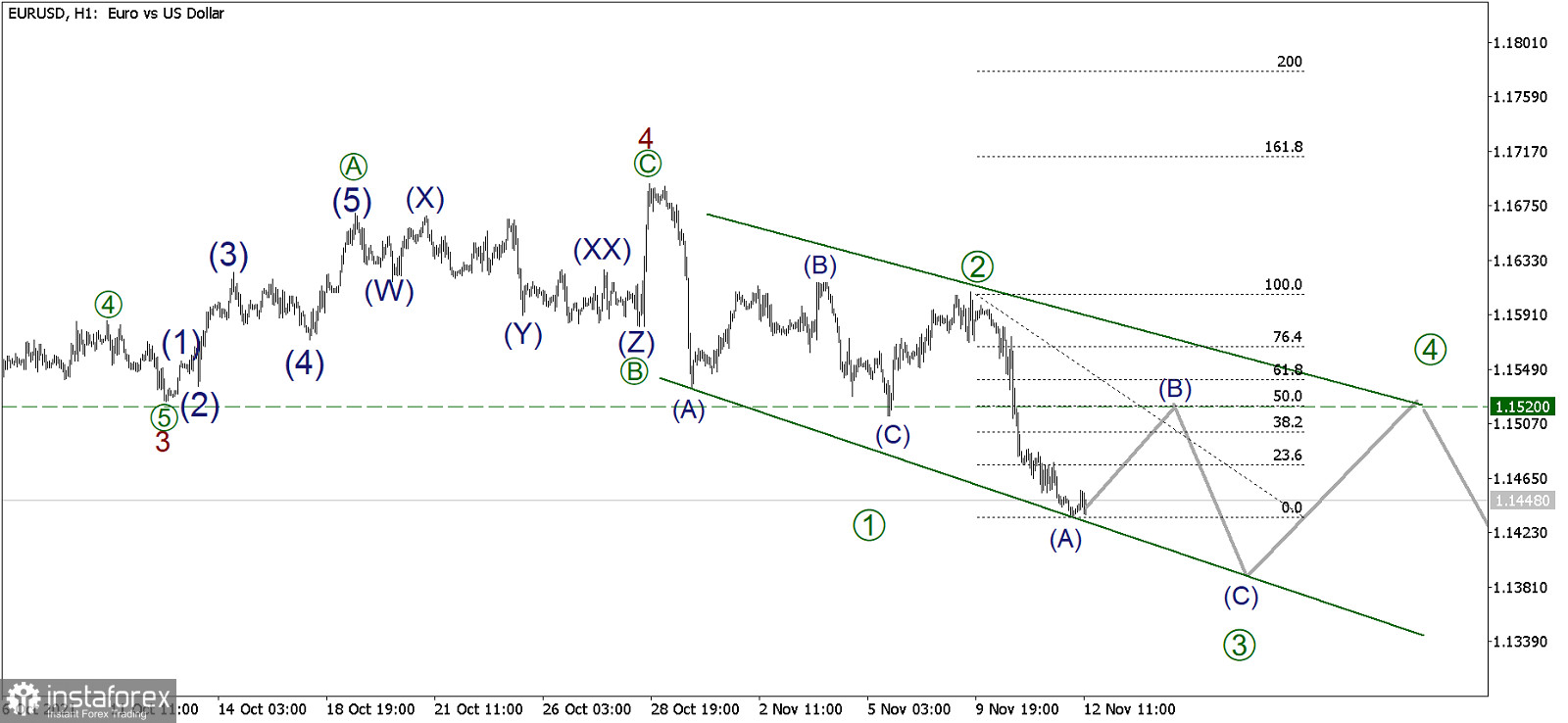

We see that the impulse (A) has been completed. Now the development of a bullish correction (B) is in the initial phase, within which the price may rise in the coming trading days.

We can see a rise to the 1.1520 area, at which the value of the entire correction (B) will be 50% of the previous downward impulse (A). In this regard, in the current situation, it is possible to open long positions with the target at 1.1520.

Also, the upward movement of the price may be influenced by the data on the number of job openings from the Job Openings and Labor Turnover Survey (JOLTS) at 15:00 UTC.

Trading recommendations: Open long positions from the current level of 1.1448 and the target at 1.1520.