The main question next week will be: Will the US dollar be able to find grounds for further growth? Although we have been questioning the validity of the strengthening of the US currency for several months, it should be recognized that the latest macroeconomic statistics from overseas and recent fundamental events still supported the dollar, and they did it reasonably and logically. However, if we do not take into account the usual statistics, which cannot have a long-term impact on the pair's rate, then what remains? There remains the general state of the economy, the presence/absence of crises, and the monetary policy of central banks. It is these concepts that should be compared with each other. What is happening in the European Union now? By and large, nothing interesting. Much more interesting news is coming from States where politicians cannot approve Joe Biden's two $5 trillion packages in any way, cannot decide how much to raise the debt limit in order not to fall into a "technical default". However, by and large, there is nothing urgent or important right now. We're moving on. The state of the economies of the European Union and the United States at this time is quite different. There was good economic growth in the States (+4.5% q/q, +6.3%, +6.7%) in the last three quarters, and only in the third quarter of 2021 did the pace fall to 2%. In the European Union, everything is exactly the opposite. The last three quarters were completed with GDP values -0,4%, -0,3%, +2,1%, and in the third quarter of this year, the maximum increase over the last year was recorded by 2.2% q/q. Thus, the following conclusion can be drawn: the American economy is slowing down, and the European economy is accelerating.

Next, we should compare the monetary policies of the ECB and the Fed. The Fed has already embarked on the path of gradual tightening, but the only thing they have done so far is to start curtailing the giant quantitative stimulus program. The markets expect that this program will be fully completed between April and June next year. The European Union has also begun to wind down the PEPP program, but unlike the Fed, there are no specific figures. The only thing that is known is that this program expires in March 2022 and so far there has been no information about the extension. Consequently, the European Union may even more quickly abandon the incentive program, but only from its emergency part (PEPP). The APP program will most likely operate after March 2022 and may even be increased in volume from the current 20 billion per month. Thus, it can probably be concluded that the Fed and the States are still winning in terms of tightening monetary policy.

However, as we can see, the United States does not have an unambiguous advantage now. Moreover, we recall that the United States itself, which has increased its debts by almost one and a half times over the past year and a half, does not need an expensive dollar. Then the more expensive the dollar, the less attractive American products become on international markets, and the trade balance of the States is already eternally negative. In addition, the more expensive the dollar, the more expensive it is to service your debts. Thus, from our point of view, the US currency is growing and can continue to do so, but this growth is still corrective. However, from the point of view of trading the euro/dollar pair, the downward trend continues, therefore, sales should continue to be considered.

Next week, there will be at least two important reports in the European Union that should not be missed. First, this is the GDP for the third quarter in the second estimate. Recall that the first estimate showed an increase of 2.2%, which is a little and a lot. Exceeding this value may support the European currency. Second, this is the consumer price index for October in the final value. In general, the markets are already familiar with the values of both indicators, so there are unlikely to be serious deviations from the forecasts, and there is also unlikely to be a strong reaction to these reports. ECB President Christine Lagarde will also give a speech on Monday, but the same can be said here. It is unlikely that Lagarde herself will report anything new and important, and the markets are unlikely to show at least some reaction to this event. However, the speech of the head of the Central Bank is always potentially important, since no one can ever guarantee that nothing important will sound or, on the contrary, something important will be said. By the way, the head of the ECB will speak only three times next week; her speeches are also scheduled for Tuesday and Friday. As you can see, Lagarde has no shortage of communication with the press, which means that potentially important information from her will not come at every speech.

Trading recommendations for the EUR/USD pair:

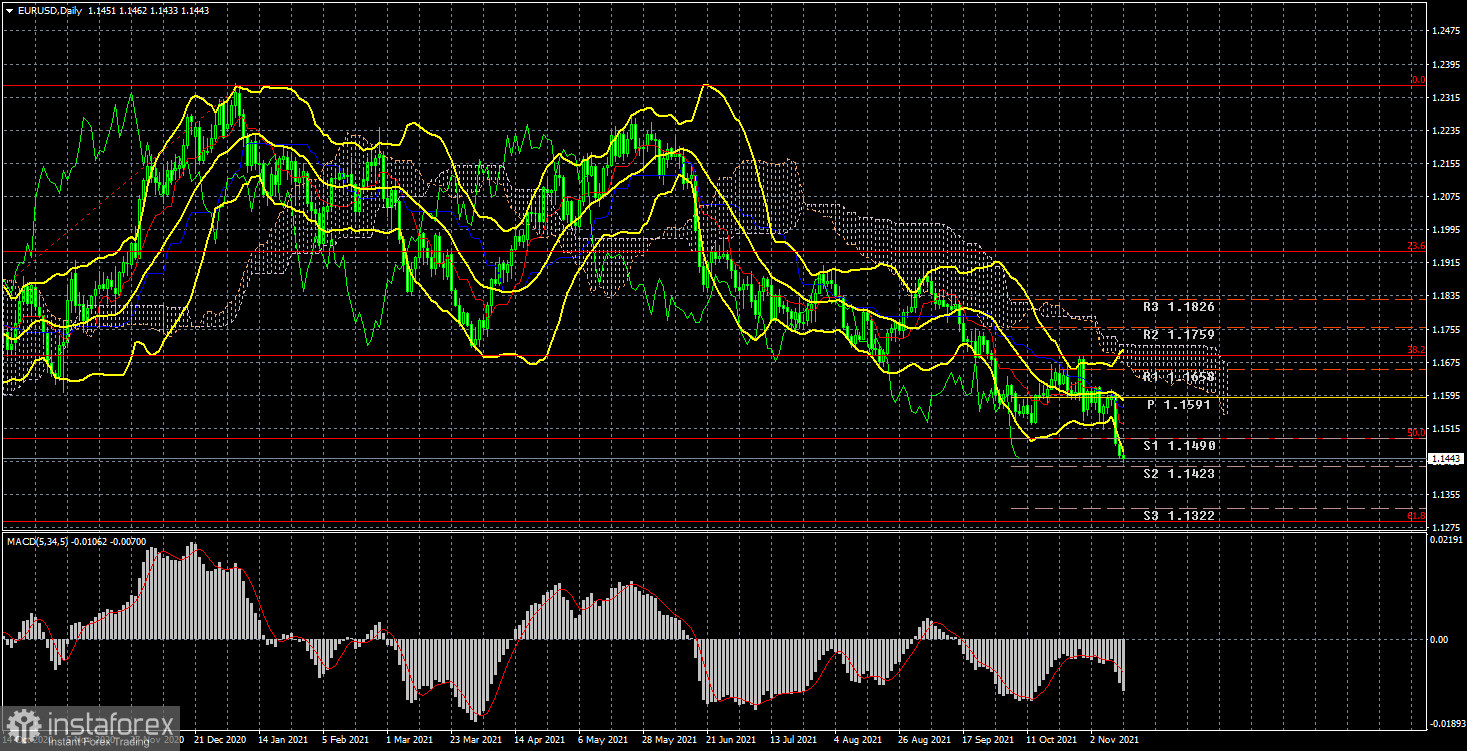

The technical picture of the EUR/USD pair on the 4-hour chart is as ambiguous as possible. Last week, there was a collapse in the quotes of the European currency, but it happened based on a single report on inflation in the United States. A week earlier, we observed the same drop in the pair due to the results of the Fed meeting. The euro as a whole is falling, the dollar is rising, but this usually happens on important fundamental and macroeconomic events. Thus, there is a trend now, but this does not mean that the pair will decline every day. Rather the opposite. As we said earlier, now the pair shows a good, volatile, and trending movement about once every five trading days. The rest of the time, it spends in indistinct movements with a volatility of 40-50 points. Next week, therefore, we are waiting for an upward correction of the pair.

Explanations to the illustrations:

Price levels of support and resistance (resistance /support), Fibonacci levels - target levels when opening purchases or sales. Take Profit levels can be placed near them.

Ichimoku indicators(standard settings), Bollinger Bands(standard settings), MACD(5, 34, 5).