The bullish trend is alive, but a correction is just around the corner.

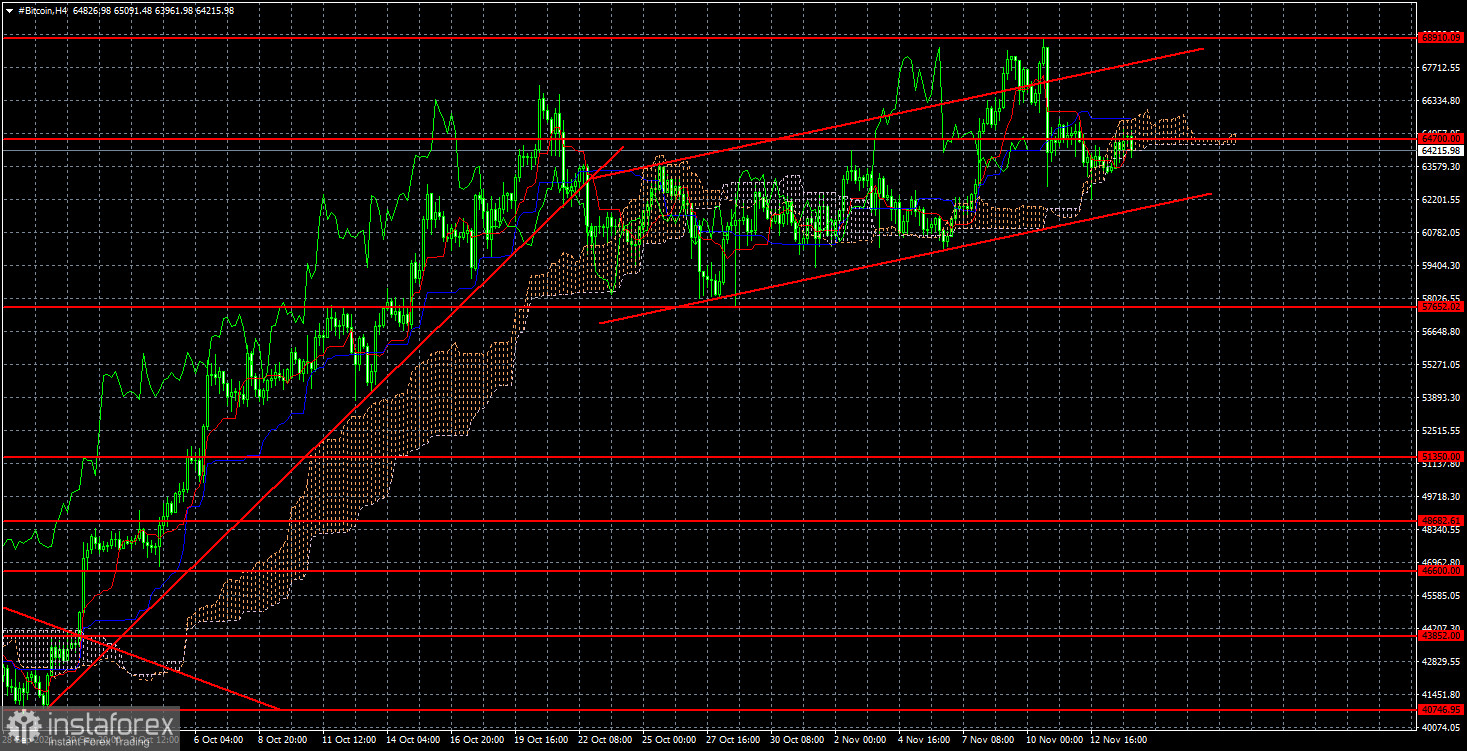

In the last few weeks, the growth of bitcoin quotes has continued. Thus, at this time, the upward trend continues but is weakening. Its weakening is visible in the illustration below, which represents a 4-hour TF. As in the case of the end of the last "bullish" trend in February-April of this year, the price is no longer too willing to overcome its highs, the angle of upward movement is getting smaller. Thus, from our point of view, a fairly strong correction may follow in the near future. On the 4-hour TF, it can be determined by fixing the price below the ascending channel.

The grounds for bitcoin's growth are starting to weaken.

The fundamental background for bitcoin remains controversial. On the one hand, there are still no concrete and visible reasons why bitcoin has been growing in recent months. Of course, BTC grew for a reason, but because it was bought. And they bought it because it is a highly profitable instrument that many investors use as an inflation hedge. This is far from the only reason for the growth. The second reason is the QE program from the US Federal Reserve, which has just begun to shrink in volume. When warehouses of money enter the economy, they should settle in the markets. Therefore, partially all those trillions of dollars that the Fed printed and created on its accounts have settled in the cryptocurrency market. Naturally, this led to the growth of many cryptocurrencies. The third reason is small traders. Recall that small players do not pursue the goal of risk diversification, inflation hedging, and so on. They pursue the goal of obtaining the maximum possible and short-term profit. And when they see that bitcoin is growing in price, as if by leaps and bounds, naturally, they also integrate into the "bullish" trend, which provokes an even greater increase in the value of the digital asset. These are the three reasons we consider to be the most logical explanation of what is happening in the market right now.

Accordingly, if there is no global fundamental event in the near future that will force investors and traders to buy bitcoin with renewed vigor, then we are more inclined to make corrections. Plus, do not forget that for a long time, there have been rumors about the excessive bloat of the markets. They have been pumped with liquidity, so they can "burst". And this applies not only to bitcoin but also to other cryptocurrencies, as well as the US stock market. This is a very likely scenario for the next six months. And market participants can also understand that sooner or later the fairy tale created by the Fed will end. Rates will rise, the QE program will end. Therefore, they can begin to get rid of many assets in advance, while the markets have not yet collapsed. In general, speaking of long-term prospects, we still believe more in a return to the level of $ 30,000 per coin than in an increase to $ 100,000. It should also be remembered that at this time, $ 64,000 is worth nothing, a piece of code that does not bring any benefit, but it pollutes the atmosphere very well. And this problem is now also very acute for the whole world – global warming.

The trend on the 4-hour timeframe continues to be upward. Therefore, at the moment, bitcoin purchases with the goals of $ 68,910 and $ 71,147 remain more preferable. But closing the price below the ascending channel will allow us to expect a round of corrective movement, within which the rate may fall to the level of $ 57,652. By the way, this consolidation may happen in the near future.