The Asian trading session on Tuesday was quite calm amid the summit between Xi Jinping and J. Biden, the signing of an infrastructure decree by the US president, as well as waiting for a comment from the Fed members and the ECB President C. Lagarde.

Since there are no positive drivers that would stimulate investors' activity, the world markets focused all their attention on the meeting of Xi Jinping and J. Biden, hoping that the achievement of compromises between the world's leading economies will allow the world economy to finally breathe easy and to strengthen the growth rate in the future after recovering from the coronavirus pandemic.

In addition to the positive hopes among market participants for the summit of leaders of China and the United States, today's speeches of Fed members Bostic, Daly, Barkin, and Harker will also be in focus. They will be expected to clarify the position of the Fed representatives on the issue of the likely timing of the start of the process of raising interest rates by the regulator. This topic is the most important since it is clear that only the Federal Reserve is the only largest world Central bank that is preparing to change its monetary policy in the near future. And in the future, this will definitely affect not only the local financial market in America but also all world markets without exceptions. Assessing what they can talk about, we believe that their general tone will be an attempt to mitigate the effect of the beginning of the process of reducing asset repurchase (QE), and then from the upcoming increase in interest rates. The markets will try to understand the possible timing of the start of rate increases.

With regard to the expected speech of ECB President Lagarde, it can be noted that she supported the local stock market with her speech yesterday and had a significant negative impact on the euro exchange rate, saying that the regulator will adhere to the previous soft monetary rate. We believe that she can talk about other topics today, emphasizing the ECB's overall view of the situation in the eurozone.

Assessing the likely reaction of the euro to the US dollar, we believe that an outright discrepancy in monetary policy between the Fed and the ECB will not be in favor of the euro, which means we should expect its further decline in pair with the USD.

In this situation, when the world's central banks clearly do not want to follow the Fed, the RBA and its leader Lowe also made it clear today that it will leave its monetary policy unchanged. Therefore, we expect the US currency to continue to rise against the basket of major currencies. In this case, the ICE dollar index will resume its growth to the nearest level of 96.00 points.

Forecast of the day:

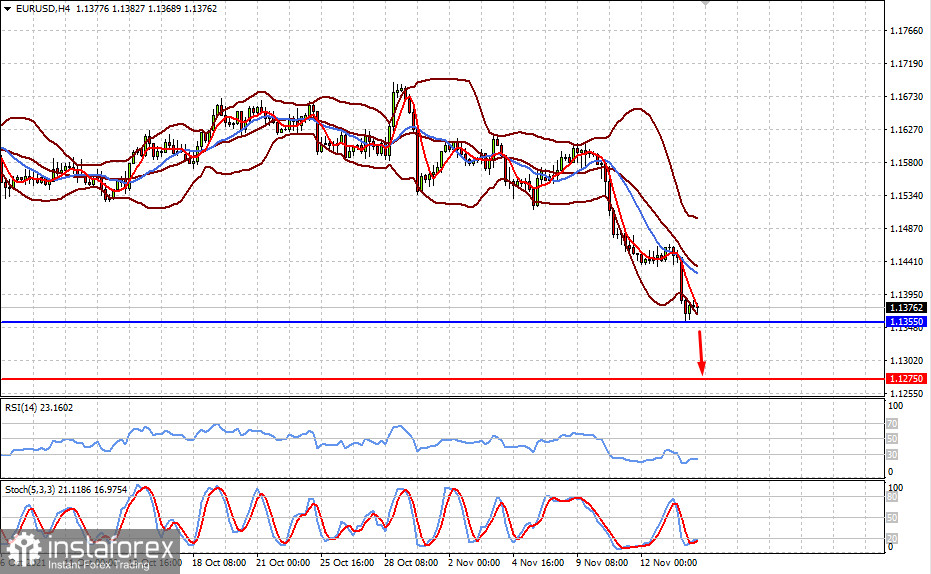

The EUR/USD pair remains under strong pressure. A decline below the level of 1.1355 will lead to a further decline to 1.1275.

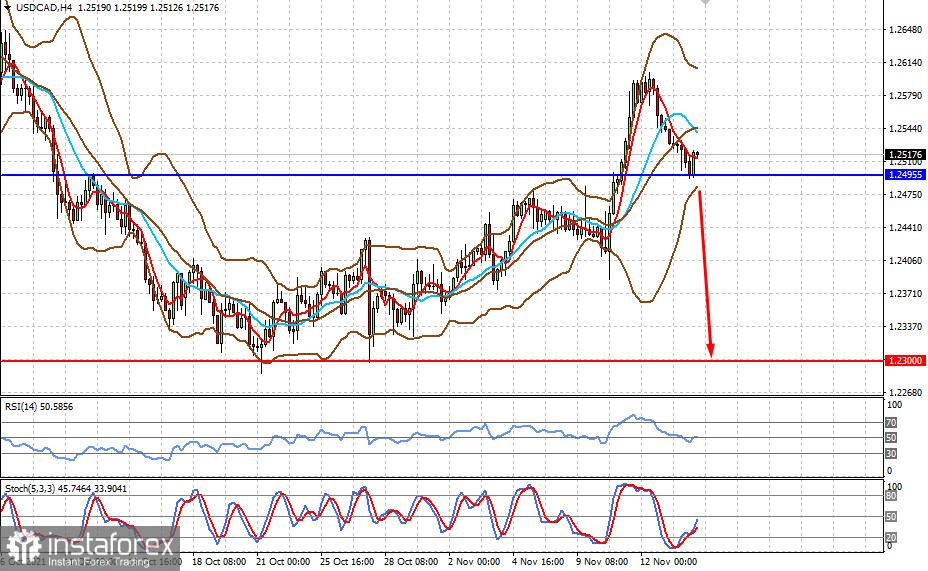

The USD/CAD pair is trading above the level of 1.2495. A decline below it will lead to a fall to the level of 1.2300.