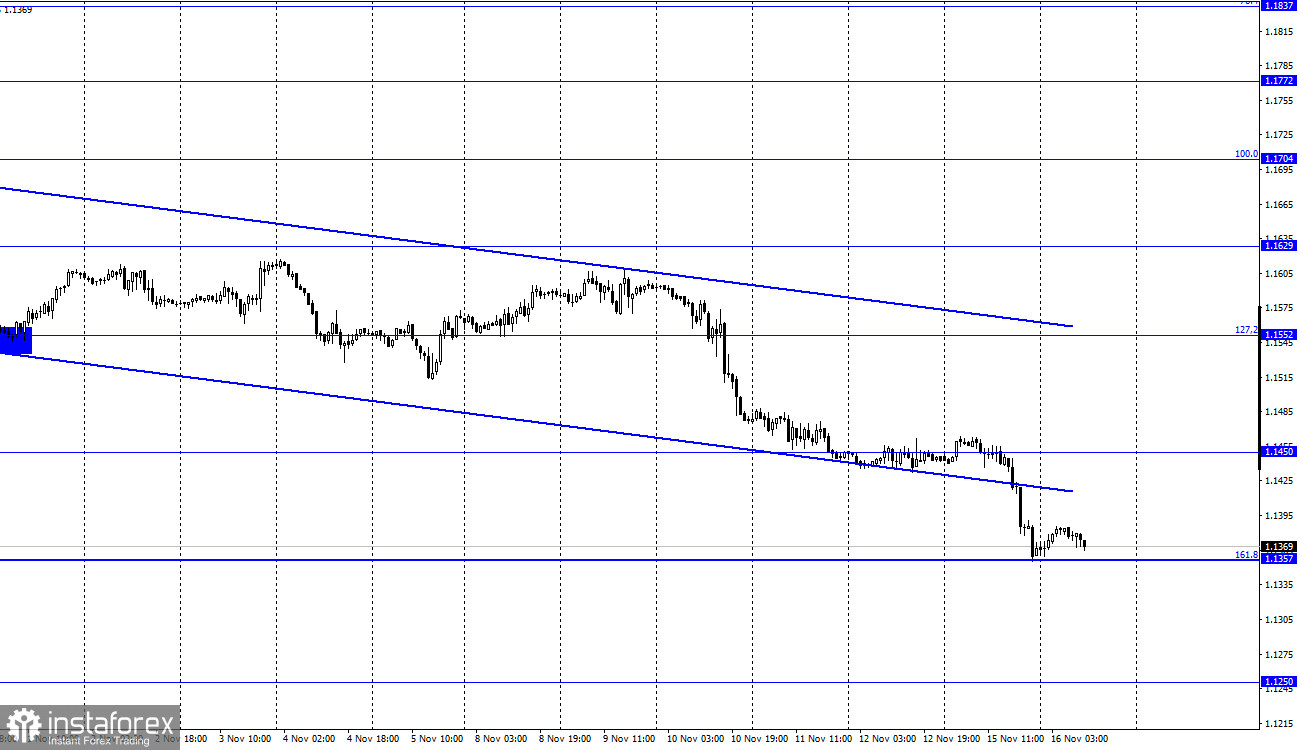

EUR/USD – 1H

Hello, dear traders! On Monday, the EUR/USD pair fell to the 161.8% correction level at 1.1357. Initially, there was a rebound from this level. However, this morning the quotes reached it again. Therefore, a new rebound will again enable traders to expect a reversal in favor of the EU currency and some growth towards the level of 1.1450. Closing the pair's rate under 161.8% will raise the probability of further decline towards the next level of 1.1250. The US dollar keeps rising. This fact poses the question of what are possible reasons for this growth. Besides, there was no significant information background yesterday. Christine Lagarde's speech is a momentous event. However, traders react not to the event itself, but to its essence. The ECB president on Monday stated inflation and the central bank's lack of plans to raise interest rates next year.

Therefore, no hawkish comments were made concerning the European currency. However, its further decline started only a few hours later after Lagarde's speech. Probably, US inflation exerted the key influence. The Fed, unlike the ECB, makes it clear to traders that it intends to tighten monetary policy, taper the stimulus program and raise interest rates. It is obvious that all this will be done gradually. However, as US inflation continues to rise, it may force the Fed to accelerate its plans to tighten monetary policy. Some Fed board members and former Fed members also regularly add fuel to the fire. They all believe the regulator should hurry to stem rising inflation and keep it from soaring. These comments may cause additional dollar's growth as traders anxiously await new measures to tighten monetary policy. And this factor is bullish for the greenback.

EUR/USD – 4H

On the 4-hour chart, the pair has consolidated under the 127.2% correctional level at 1.1404 and it keeps falling towards the next correctional level of 161.8% at 1.1148. There are no divergences in any of the indicators today. If the pair closes above the level of 127.2% it is possible to expect some growth towards the 100.0% Fibonacci level at 1.1606.

US and EU news calendar:

EU - Change in GDP volume (10-00 UTC).

U.S. - Change in Retail Sales (13-30 UTC).

U.S. - Change in Industrial Production (14-15 UTC).

European Union - ECB President Christine Lagarde will deliver a speech (16-10 UTC).

On November 16, the EU and US economic calendars contain significant events. In particular, I recommend paying attention to the EU GDP report and also Christine Lagarde's speech, which may continue to stand bearish ground, resulting in probable further euro's fall.

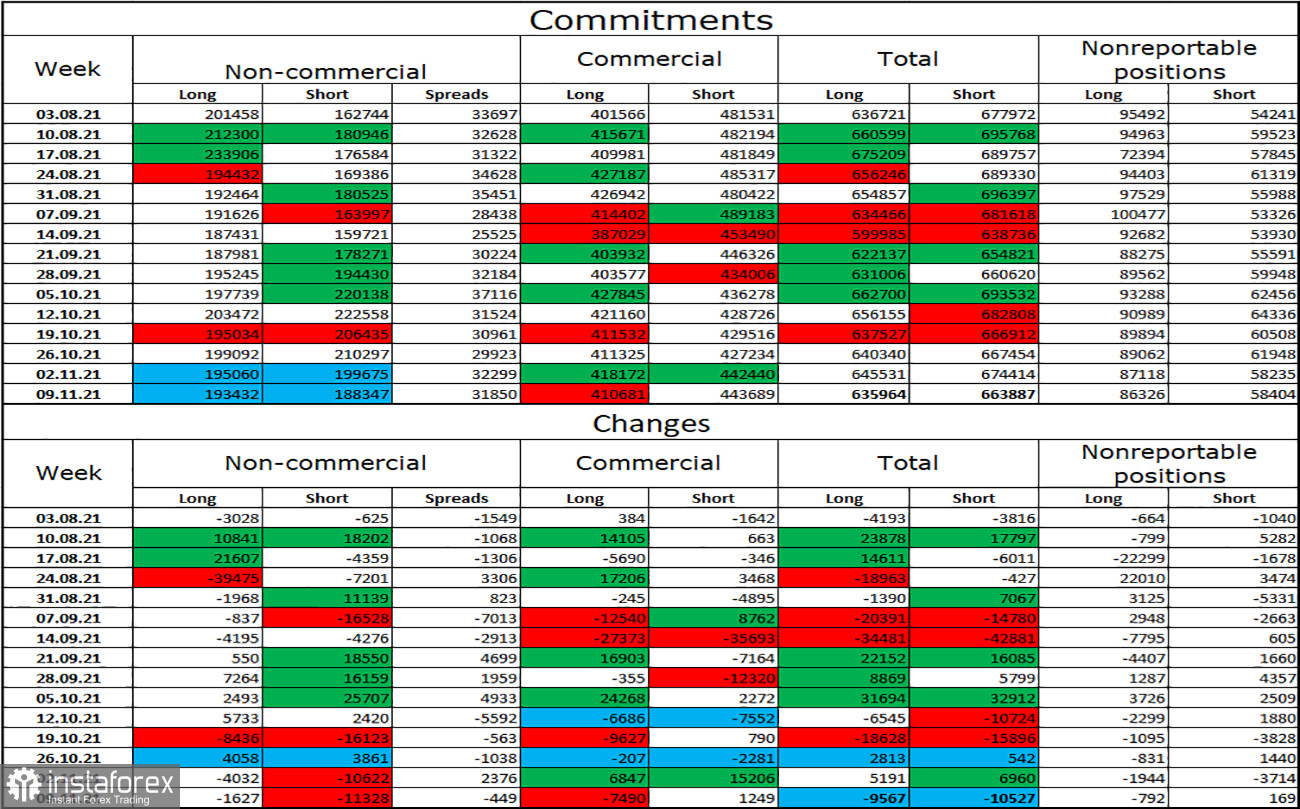

COT report (Commitments of traders):

The latest COT report showed that the sentiment of "non-commercial" traders became more bullish during the reporting week. Speculators closed 1,627 long euro contracts and 1,328 short contracts. Consequently, the total number of long contracts held by speculators has decreased to 193,000 and the total number of short contracts fell to 188,000. These figures almost coincide for the second week in a row, indicating that speculators do not have a clear mood. However, there was a tendency of strengthening bearish mood in the last months. Probably, traders' mood is now at a point where neither bulls nor bears have advantage. However, at the same time the European currency continues falling, so the trend of strengthening bearish mood is evident.

EUR/USD forecast and recommendations for traders:

I recommend new sales of the pair at closing under the level of 1.1357 from 1.1250 on the hourly chart. I advise buying at the rebound from the level of 1.1357 with a target of 1.1450 on the hourly chart.

Terms:

"Non-commercial" - major market players: banks, hedge funds, investment funds, private, large investors.

"Commercial" - commercial enterprises, firms, banks, corporations, companies that buy currency not for speculative profit, but for ensuring current activities or export-import operations.

"Non-reportable positions" - small traders who have no significant influence on the price.