GBP/USD

Analysis:

The direction of price fluctuations of the major pair of the British pound is set by the descending wave algorithm of February 24. Oncoming movements do not go beyond the correction. The unfinished section of the wave has been counting since October 19. Within its framework, the price has been rolling up since November 12.

Forecast:

In the next day, the general upward mood of the movement is expected to continue, until its complete completion in the area of the resistance zone. A change, of course, is likely not earlier than tomorrow.

Potential reversal zones

Resistance:

- 1.3490/1.3520

Support:

- 1.3410/1.3380

Recommendations:

Trading transactions in the pound market can be risky. It is optimal to refrain from entering the pair's market until the appearance of sell signals in the area of the calculated resistance.

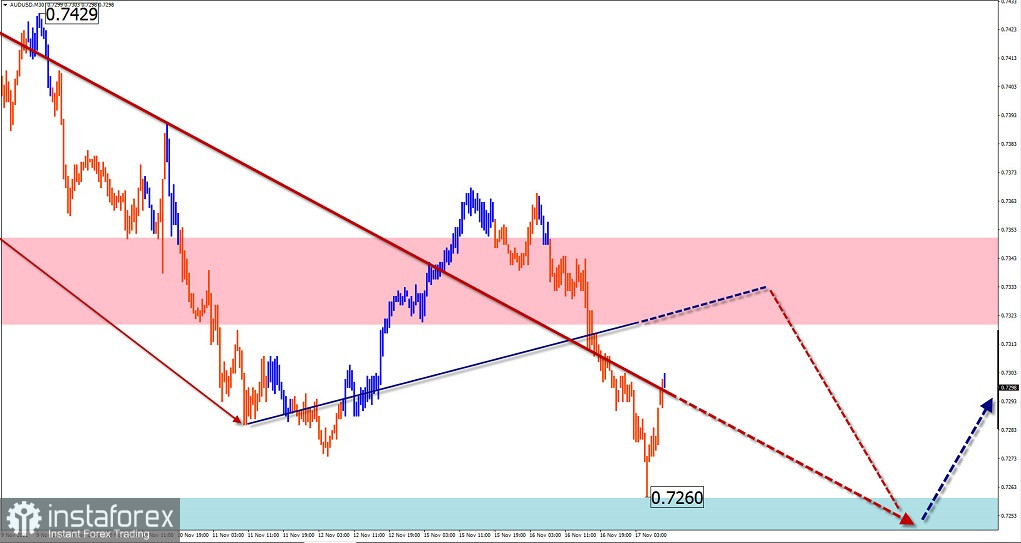

AUD/USD

Analysis:

Since the end of August, the quotes of the main pair of the Australian dollar have been forming an upward wave. It precedes a new round of the dominant bullish trend on a weekly scale. In the structure of the wave, the middle part (B) is nearing completion.

Forecast:

Today, the pair's price is expected to move mainly in the lateral plane between the opposite zones. After a probable pullback to the resistance level in the afternoon, you can expect a reversal and a second attempt to pressure the support zone.

Potential reversal zones

Resistance:

- 0.7320/0.7350

Support:

- 0.7260/0.7230

Recommendations:

Trading on the Australian dollar market today is more risky and can be unprofitable. Short-term sales from the resistance zone with a fractional lot are possible.

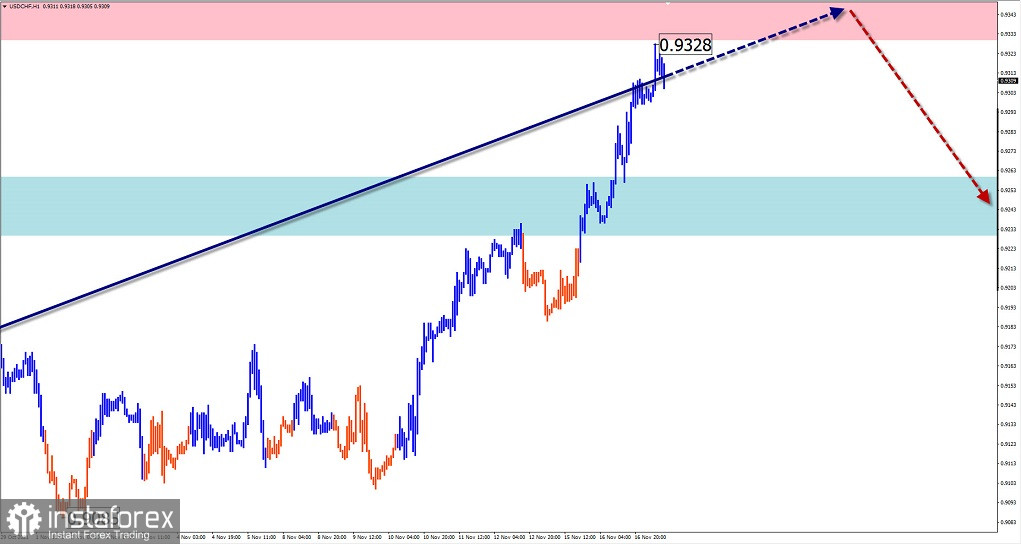

USD/CHF

Analysis:

The descending plane, which started in mid-June on the Swiss franc chart, continues its development. The upward segment from November 1 shifted the price of the instrument to the area of a strong potential reversal zone of a large TF.

Forecast:

On the next day, the completion of the upward course of the pair's movement is expected, a reversal and the beginning of the downward course of the price. The last phase of the movement is likely at the end of the day or tomorrow.

Potential reversal zones

Resistance:

- 0.9330/0.9360

Support:

- 0.9260/0.9230

Recommendations:

There are no conditions for purchases on the franc market today. It is recommended to refrain from entering the market of a major pair until clear signals appear in the sale in the area of the calculated resistance.

USD/CAD

Analysis:

Within the framework of the downward plane that began on July 19 in the main pair of the Canadian dollar, quotes reached the resistance level of the weekly scale of the chart. The descending section from November 11 has a reversal potential and may be the beginning of the final part (C).

Forecast:

In the coming days, the price is expected to move between the nearest zones in the opposite direction. In the first half of the day, an upward vector is more likely. A change, of course, can be expected by the end of the day, or tomorrow.

Potential reversal zones

Resistance:

- 1.2600/1.2630

Support:

- 1.2520/1.2490

Recommendations:

Purchases in the Canadian dollar market today can lead to losses and are not recommended. The main attention is proposed to be paid to the search for signals for the sale of the pair in the area of the calculated resistance.

Explanations: In the simplified wave analysis (UVA), waves consist of 3 parts (A-B-C). The last incomplete wave is analyzed. The solid background of the arrows shows the formed structure, and the dotted one shows the expected movements.

Attention: The wave algorithm does not take into account the duration of the movements of the instrument in time!