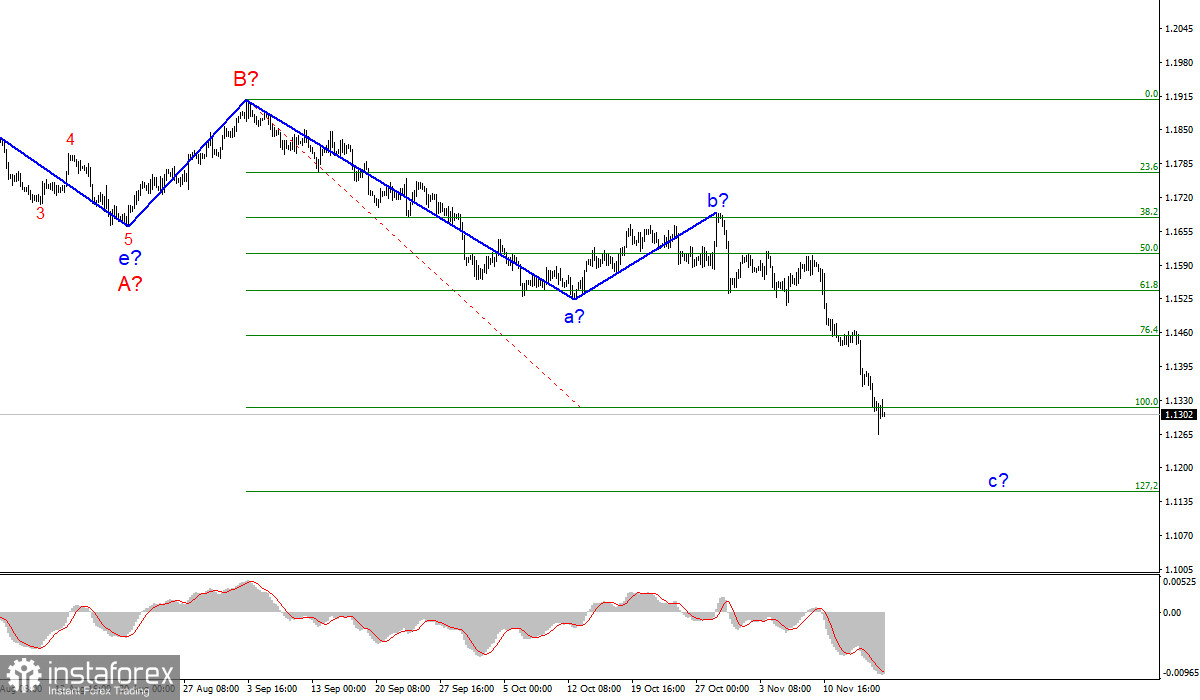

Wave pattern.

The wave marking of the 4-hour chart for the euro/dollar instrument continues to remain integral. The a-b-c-d-e trend segment, which has been forming since the beginning of the year, is interpreted as wave A, and the subsequent increase in the instrument is interpreted as wave B. Thus, the construction of the proposed wave C is now continuing, which can also take a very extended form. If the current wave marking is correct, then now the construction of the proposed wave c-C. And the entire wave C can also turn out to be a five-wave one. Its targets are located near the calculated marks of 1.1314 and 1.1153, which corresponds to 100.0% and 127.2% Fibonacci. A successful attempt to break through the 1.1314 mark will indicate the readiness of the markets for further sales of the instrument. An unsuccessful attempt to break 1.1314 may herald the completion of the construction of wave c-C. However, I believe that wave c may take on an even more extended form.

The members of the Fed's monetary policy committee do not have a common opinion.

The news background for the EUR/USD instrument has been very weak in recent days, despite the fact that Christine Lagarde has already made a speech several times, as well as several members of the Fed's PEPP committee at once. However, in my humble opinion, the information shared by the officials has long been known to the markets. What did Christine Lagarde say? Only that inflation may remain high for a longer time, and rates will not rise in 2022. But she repeats it for the nth time. The markets have already heard and known all this. The same applies to the Fed and its representatives. James Bullard, president of the St. Louis Fed, said today that monetary policy needs to be tightened to keep inflation from accelerating further. In addition, he said that the Fed should adhere to a more "hawkish attitude." However, the president of the Federal Reserve Bank of Minneapolis, Neil Kashkari, echoes Jerome Powell and believes that high inflation is temporary, so you should not rush to radical decisions. According to Kashkari, if the Fed reacts to inflation too quickly by changing the parameters of monetary policy, this could lead to much more serious consequences for the American economy in the future. Kashkari also drew attention to the fact that another 4 or 5 million Americans are out of work, and the Fed should monitor not only inflation but also the labor market. Kashkari's colleague Thomas Barkin, president of the Federal Reserve Bank of Richmond, also adheres to the "pigeon" rhetoric. He also said that there should be no rush to accelerate the curtailment of the QE program. "It will be useful for us to take a few more months to assess the situation with inflation," Barkin said. Thus, a new tightening of the PREP already in December has a low probability, despite strong inflation.

General conclusions.

Based on the analysis, I conclude that the construction of the downward wave C will continue. Therefore, now I advise you to continue selling the instrument for each signal from the MACD "down", with targets located near the estimated mark of 1.1153, which corresponds to 127.2% Fibonacci, and below. The attempt to break through the 1.1314 mark looks successful so far.

Senior schedule.

The wave marking of the higher scale looks quite convincing. The decline in quotes continues and now the downward section of the trend, which originates on May 25, takes the form of a three-wave correction structure A-B-C. Thus, the decline may continue for another month or two until Wave C is fully staffed.