To open long positions on GBP/USD, you need:

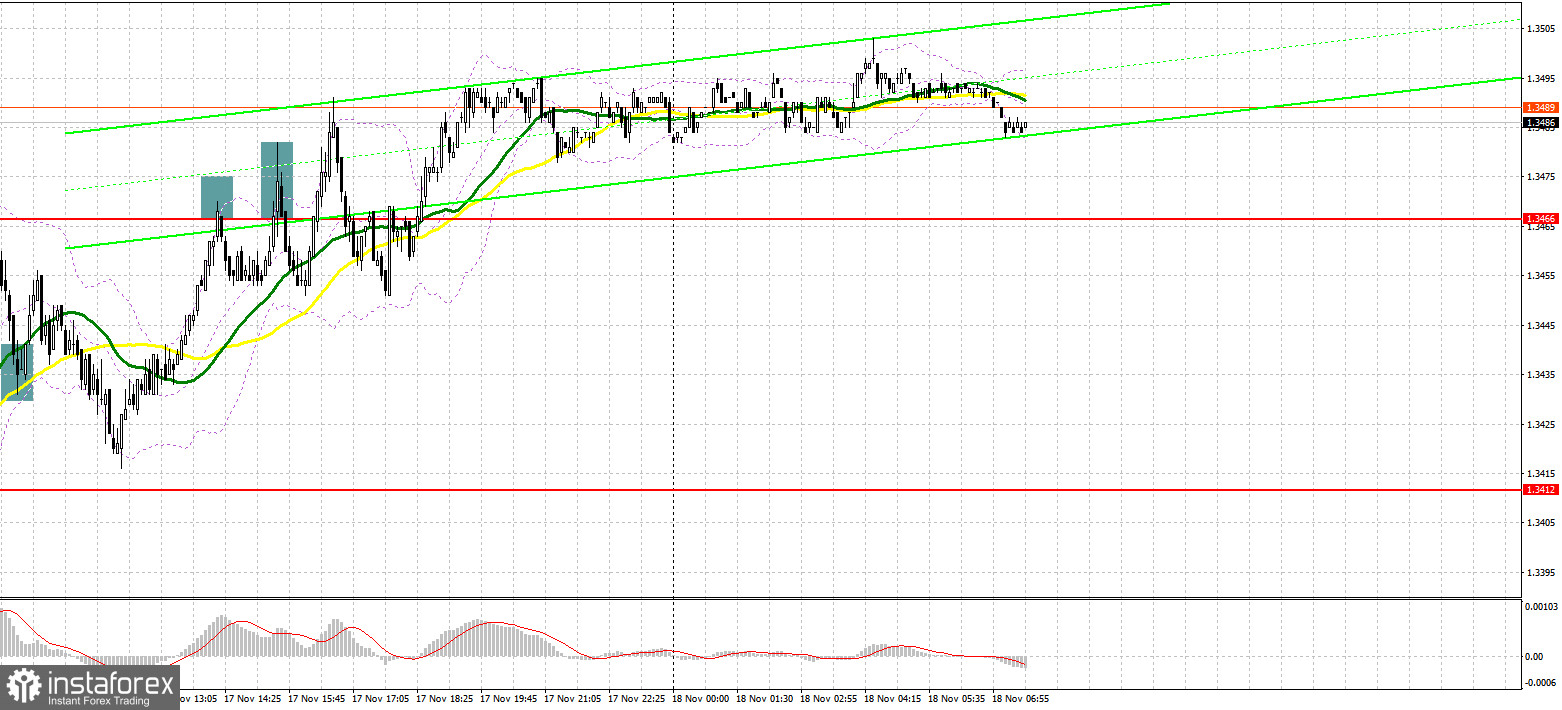

Several signals to enter the market were formed yesterday. Let's take a look at the 5 minute chart and see what happened. In my morning forecast, I drew attention to the level 1.3441 and advised you to make decisions on entering the market. Another round of inflation in the UK led to a breakdown and consolidation above the resistance of 1.3441, and a reverse test of this level from top to bottom formed a signal to open long positions in the hope of implementing a bullish scenario. But the first time there was no upward movement. And the demand for the pound returned only after a slight correction and the removal of stop orders, which led to a renewal of resistance at 1.3466. Forming a false breakout there during the US session made it possible for the bears to count on the pair's decline, as the trend continued downward - however, nothing good came of this entry. After a slight downward movement of 15 points, the GBP/USD continued to rise.

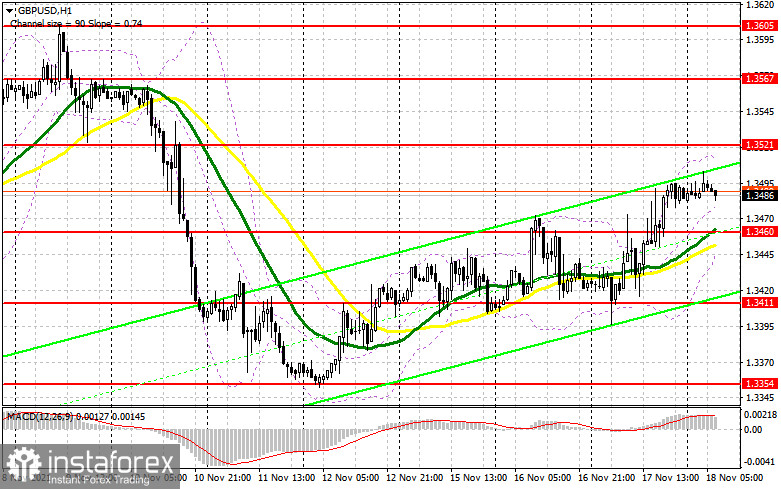

It is likely that the bulls will continue to drive the pair up today, as there are no fundamental reasons for selling it. However, any negative news on the UK-EU negotiations on compliance with the Northern Ireland protocol could spoil consumer sentiment by the end of the week. Therefore, I consider a downward correction to the support area of 1.3460 and the formation of a false breakout there as the optimal buying scenario in the current conditions against the trend. Moving averages that play on the side of the bulls also pass at this level. Only this will keep the chance for an upward correction of the pair to the 1.3521 area. A breakthrough and test of this level from top to bottom will open the way to a high of 1.3567, where I recommend taking profits. The next target will be the level 1.3605. In case the pair falls in the first half of the day and the bulls are not active at 1.3460, the pressure on the pound may seriously increase. In this case, I advise you to open new long positions only after a false breakout in the 1.3411 area. You can watch buying GBP/USD immediately for a rebound from the low of the week 1.3354, or even lower - from the support of 1.3308, counting on a correction of 25-30 points within the day.

To open short positions on GBP/USD, you need:

The bears have run out of arguments, as the fundamental statistics released this week are entirely on the side of the pound bulls. Today, there is nothing to count on, since Great Britain will not release any reports, no speeches by representatives of the Bank of England, and no serious reports on the American economy - everything speaks of the continuation of the upward correction. Therefore, in order not to "fall face down in the mud", the bears should try very hard to protect the resistance at 1.3521. Forming a false breakout there will lead to the formation of a new entry point for short positions, followed by a decline in GBP/USD to the 1.3460 area, where the moving averages, limiting the downward potential of the pair, pass. Breaking through this range will be equally important for the bears. Testing 1.3460 from the bottom up forms an additional signal to open new short positions with the goal of falling to the weekly lows: 1.3411 and 1.3354, where I recommend taking profits. In case the pair grows during the European session and there are no bears at 1.3521, it is best to postpone selling until the larger resistance reaches 1.3567. I advise you to open short positions immediately on a rebound from 1.3605, or even higher - from a new high in the 1.3649 area, counting on the pair's rebound down by 20-25 points within the day.

I recommend for review:

The Commitment of Traders (COT) report as of November 9 logged an increase in short positions and a decrease in long ones, which led to a negative delta. Disappointing Q3 GDP results in the UK and a possible plunge in retail sales in Q4 amid a spike in inflation pushed the sterling down and exerted pressure on it. Another important factor for a bearish pound is the escalation of tension over the Northern Ireland protocol the British authorities plan to terminate in the near future. The European Union is preparing to introduce certain retaliatory measures. At the same time, inflation in the United States keeps rising, increasing the likelihood of earlier interest rate hikes, which provides support to the greenback. Nevertheless, I recommend sticking to the strategy of buying the pair after every large fall that is likely to occur amid uncertainty surrounding the central bank's monetary policy. According to the COT report, long non-commercial positions declined to 54,004 from 57,255 and short non-commercial positions increased to 66,097 from 42,208. The delta came at -12,093 versus 15,047 a week earlier. The weekly closing price dropped to 1.3563 from 1.3654 due to the Bank of England's stance on monetary policy.

Indicator signals:

Moving averages

Trading is carried out above 30 and 50 moving averages, which clearly indicates the continuation of the upward correction of the pair.

Note: The period and prices of moving averages are considered by the author on the H1 hourly chart and differs from the general definition of the classic daily moving averages on the daily D1 chart.

Bollinger Bands

A breakthrough of the upper border in the 1.3510 area will lead to a new wave of growth in the pound. A break of the lower border of the indicator around 1.3455 will increase the pressure on the pound.

Description of indicators

- Moving average (moving average, determines the current trend by smoothing out volatility and noise). Period 50. It is marked in yellow on the chart.

- Moving average (moving average, determines the current trend by smoothing out volatility and noise). Period 30. It is marked in green on the chart.

- MACD indicator (Moving Average Convergence/Divergence — convergence/divergence of moving averages) Quick EMA period 12. Slow EMA period to 26. SMA period 9

- Bollinger Bands (Bollinger Bands). Period 20

- Non-commercial speculative traders, such as individual traders, hedge funds, and large institutions that use the futures market for speculative purposes and meet certain requirements.

- Long non-commercial positions represent the total long open position of non-commercial traders.

- Short non-commercial positions represent the total short open position of non-commercial traders.

- Total non-commercial net position is the difference between short and long positions of non-commercial traders.