The situation on the markets, which is being formed this week, fully confirms the growing fears among investors that the Fed may start raising interest rates, not in the second half of next year, but in the first.

Unfortunately, the American central bank continues to exert a strong influence on the dynamics of world financial markets, while remaining at the center of the global financial system. The strong US inflation growth and economic problems of a systemic nature, which the local authorities call "the rupture of supply chains", lead to an increase in the shortage of goods, which only contributes to increased inflationary pressure in the country and, as a result, will prompt the Fed to take active action.

The reaction of the markets to these expectations is unequivocal – a decline in stock indices and an increase in demand for protective assets, which traditionally include the yen, franc, gold, as well as government bonds in the last 10 years. In this regard, the reaction of the markets on Wednesday is indicative. The expectation of the next wave of COVID-19, the slowdown in global economic growth amid increased pressure on inflation led to a local strengthening of safe-haven currencies, an increase in demand for gold and government bonds.

At the same time, the US dollar is being held back from a serious fall by the expectation of an increase in interest rates in America. But commodity and commodity asset prices declined, stimulated by general concerns about the sustainability of demand amid the weakening economic growth in China and the United States.

As previously thought, the expectation of a change in the Fed's monetary policy will destabilize the markets, increasing volatility, which is a direct consequence of the uncertainty about the timing of the start of the rate hike process. This factor is the main one and we believe that its impact will be comprehensive, at least until the publication of updated US inflation values for November, which will be presented in December.

What is the coming day preparing for us?

We believe that high volatility in the markets will continue. If today's presented data on applications for unemployment benefits turn out to be no higher than the forecast of 260,000, then this may locally support stock indices in America and Europe, which may serve as a basis for a limited increase in demand for risky assets. On this wave, the US dollar may be under pressure against major currencies with the exception of the yen. Meanwhile, crude oil prices will try to partially recover, and the price of gold will adjust downwards. At the same time, if the values of the number of applications turn out to be higher and noticeably higher, this will lead to the opposite process presented above.

Forecast of the day:

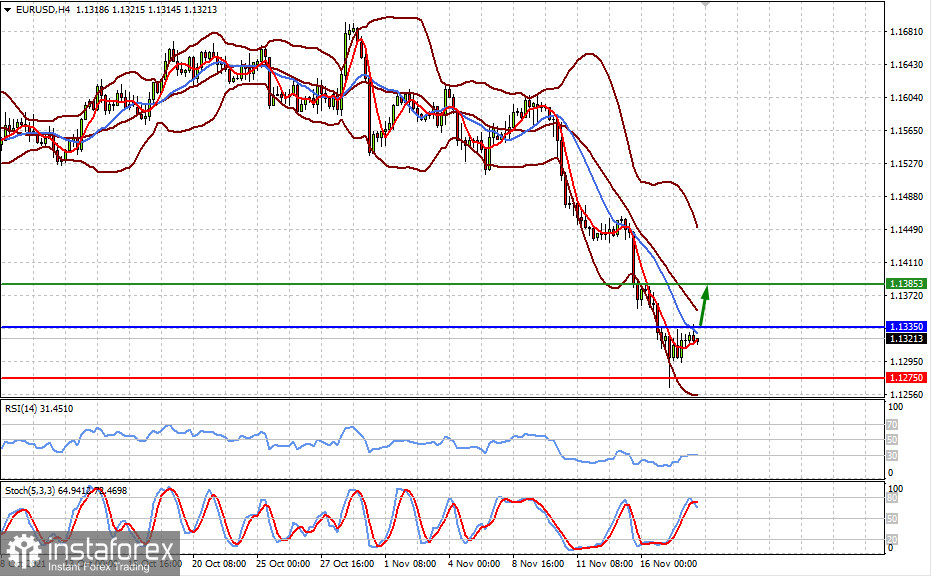

The EUR/USD pair remains under strong pressure, but it may partially recover to the level of 1.1385 after rising above 1.1335 if US job data is no higher than forecast. But in general, we continue to expect the pair to further fall.

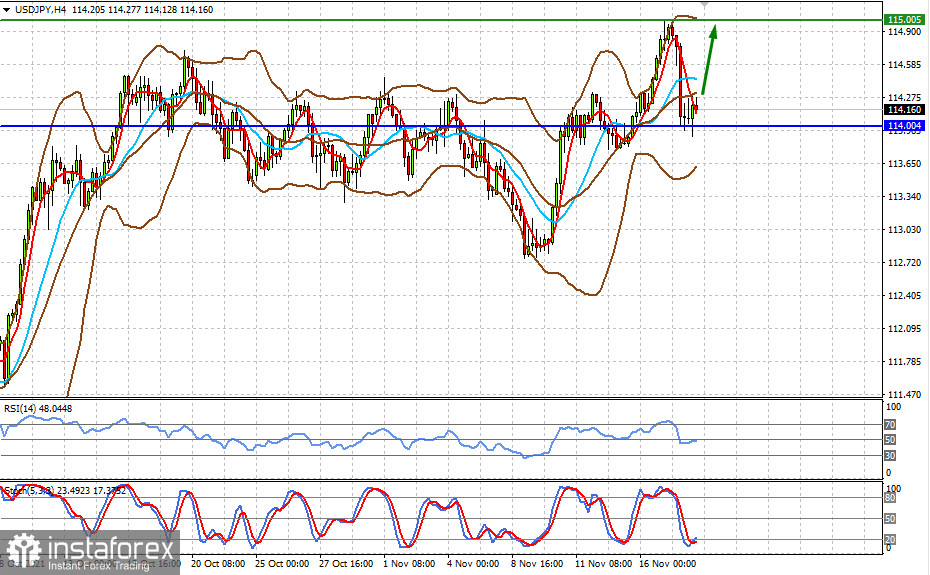

The USD/JPY pair is trading above the level of 114.00. An improvement in market sentiment may push the pair to local growth by 115.00.