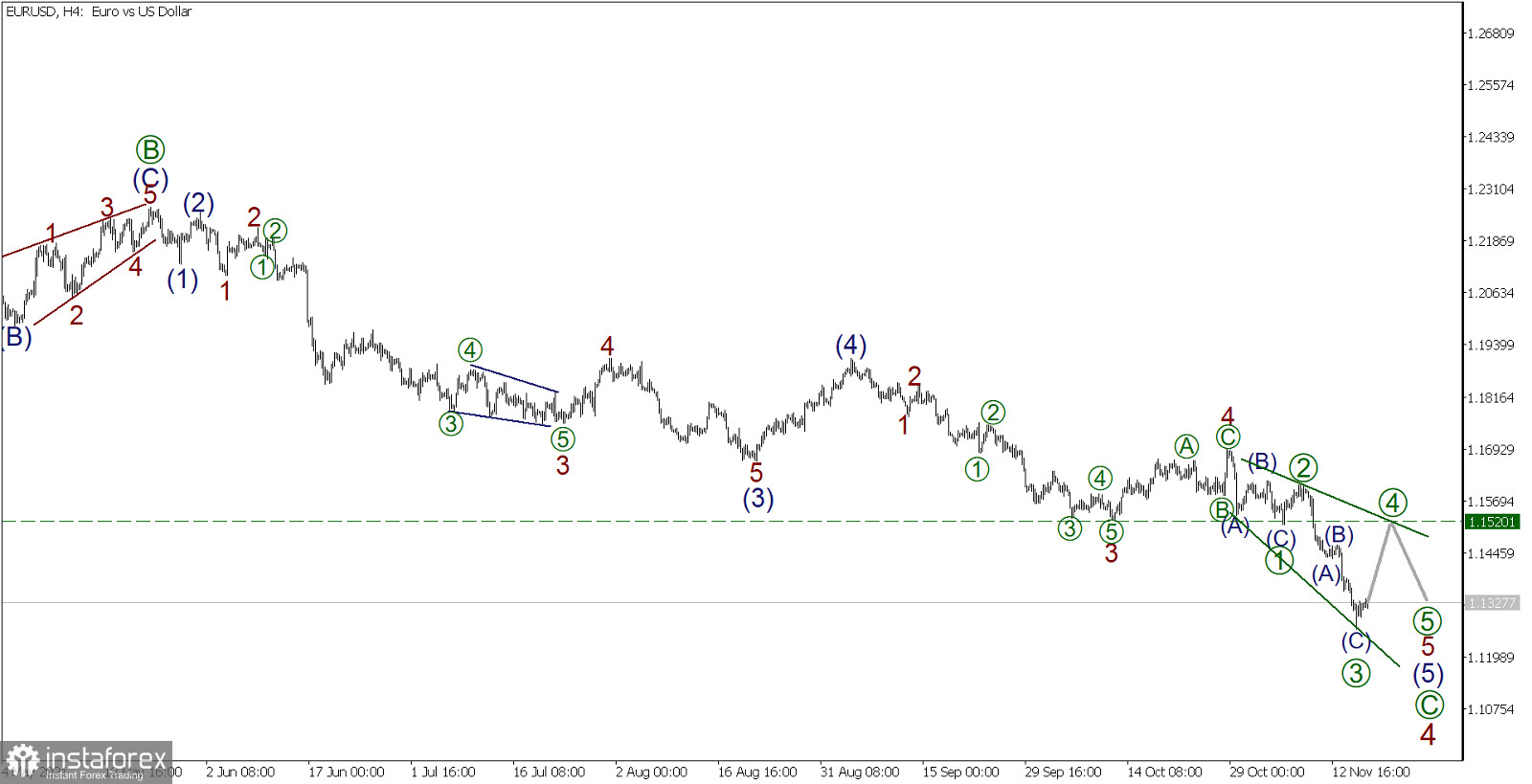

EUR/USD, H4 timeframe:

Let's continue to analyze the EUR/USD pair's situation by using the Elliott theory.

The market still adheres to the chosen scenario. We are now in the final part of a large bullish impulse, as part of which the correction wave 4 was completed. On the four-hour timeframe, the final wave [C] is observed, which is part of the specified correction.

Therefore, an upward movement is expected in the near future in the initial part of the last fifth sub-wave, which can take the form of either an impulse or a finite diagonal.

The first target, where the bulls can push the market, is at the level of 1.1520. Earlier, correction wave 4 was completed at this level.

Important news is expected to be released at 13:30 Universal time today, which may affect the market: the index of production activity from the Federal Reserve Bank of Philadelphia (USA) will be published, as well as the number of initial applications for unemployment benefits in the United States. Currently, it is recommended to consider opening deals for purchases.

Trading recommendations:

It is recommended to buy from the current level and take profit at 1.1520.