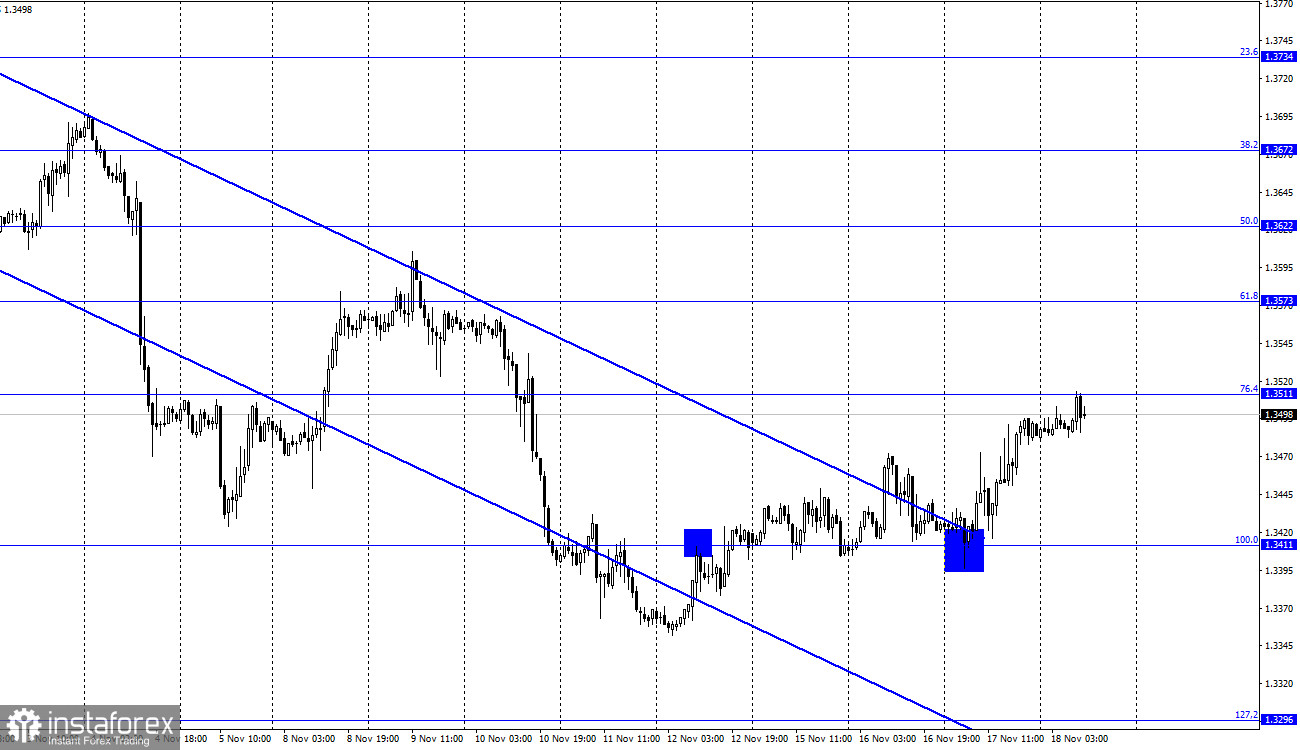

GBP/USD – 1H.

On the hourly chart, the GBP/USD pair on Wednesday performed a rebound from the 100.0% retracement level of 1.3411, a reversal in favour of the British currency and a rise towards the 76.4% Fibonacci level of 1.3511, which was broken today. Notably, the GBP has previously left the downtrend range, so a further rise is likely, and the mood of traders has changed temporarily to bullish. A rebound from the 76.4% level would allow us to expect the pair to fall slightly towards the 100.0% retracement level. The pair's retracement above the 76.4% level will work in favour of a further rise towards the 61.8% Fibonacci level of 1.3573. The only interesting event yesterday was the British inflation report for October. Today we can conclude that the pound was rising for most of the day, so traders gained from this report.

However, today and tomorrow there will be no important information from Britain and the USA. Tomorrow the UK retail trade report will be published. Thus, the pound is unlikely to receive additional support from the information background. However, there is chart analysis support on its side now, as the downward corridor is no longer holding it within itself. Consequently, traders will still expect the pair to rise further. The GBP has fallen quite seriously in recent weeks, but the Bank of England or a consensus in the EU-Britain negotiations on the Northern Ireland border may ease the tension. Notably, not only the Fed but also the Bank of England is actively considering tapering its stimulus programme as well as raising rates. London and Brussels are still trying to reach an agreement on the Northern Irish border so as not to go to court, not to clash with each other and not to begin a trade war.

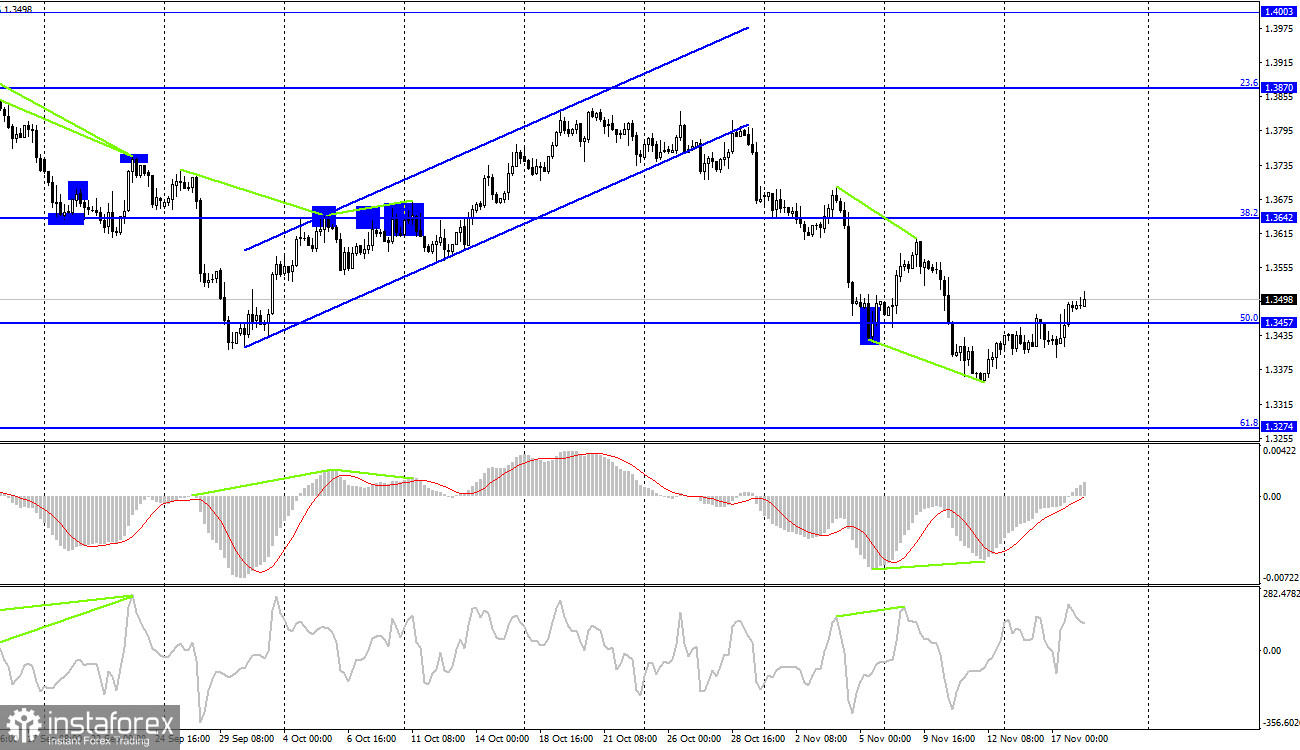

GBP/USD – 4H.

On the four-hour chart, the GBP closed above the corrective level of 50.0% (1.3457). Thus, the upside movement may continue towards the Fibo level of 38.2% (1.3642). Emerging divergences are not observed in any indicator today. A close below the 50.0% level would again favour the US currency and a renewed fall.

News calendar for the USA and the UK:

US - Number of initial and continued jobless claims (13-30 UTC).

On Thursday, the UK economic calendar is completely empty. The only US unemployment report is unlikely to be taken into account by traders. Thus, there is no information background today.

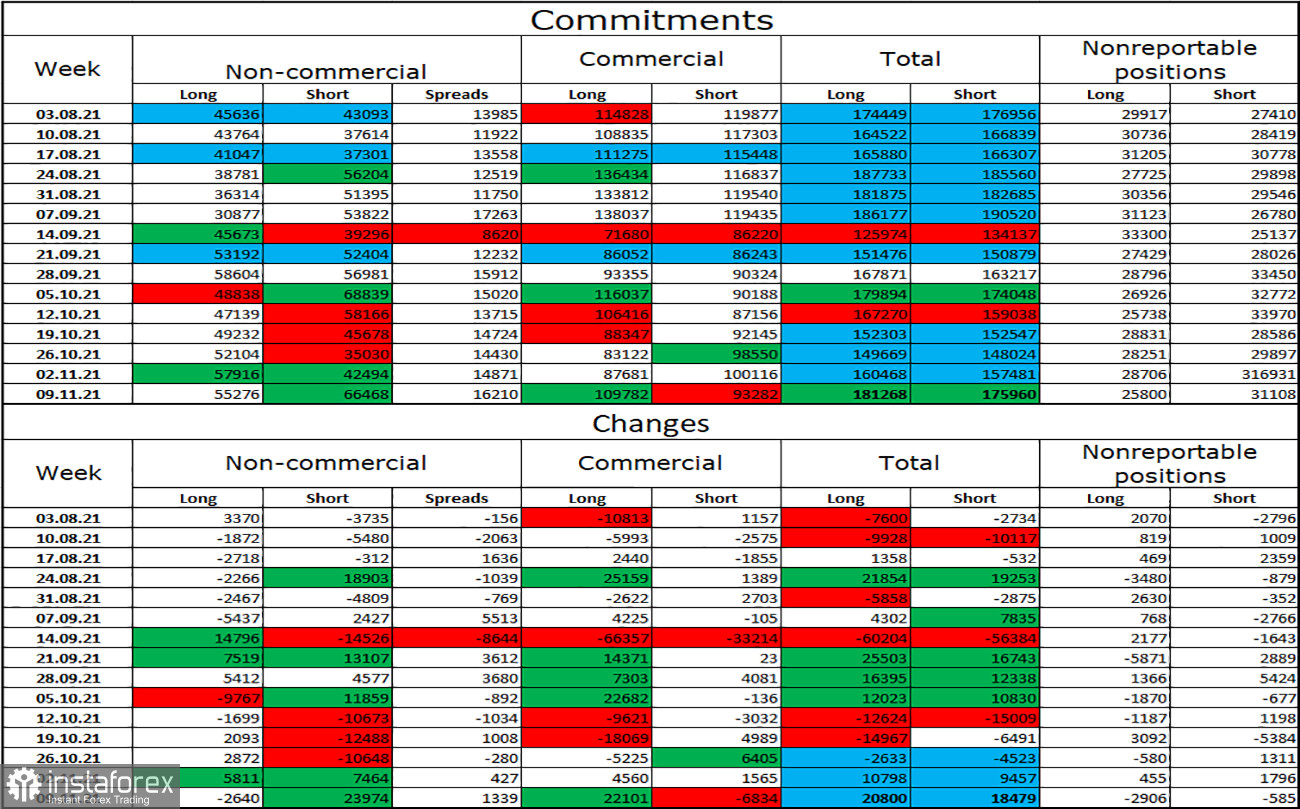

COT (Commitments of Traders) report:

The latest COT report from November 9 on the pound showed that the mood of the major players has become much more "bearish". In the reporting week, speculators closed 2,640 long contracts and opened 23,974 short contracts. Thus, the number of long contracts in the hands of major players in just one week has become more than the number of short contracts by 11 thousand. But a week ago, the advantage was reversed by 17 thousand. However, in recent weeks, speculators do not have any clear mood and then increase purchases, then increase sales, and the total number of long and short contracts for all categories of traders remains approximately the same (181K - 175K). Thus, after several weeks of an active buildup of shorts, a period of increasing longs may come.

GBP/USD forecast and recommendations to traders:

I recommend selling the pound if it rebounds from the level of 76.4% (1.3511) on the hourly chart with a target of 1.3411. I would recommend buying the British currency on a close above the downside corridor on the hourly chart with targets of 1.3511 and 1.3573. The deals can be kept open if there is a close above 1.3511.

Terms:

"Non-commercial" - major market players: banks, hedge funds, investment funds, private, large investors.

"Commercial" - commercial enterprises, firms, banks, corporations, companies that buy foreign currency not to make speculative profits, but to ensure current activities or export-import operations.

"Non-reportable positions" are small traders who do not have a significant impact on the price.