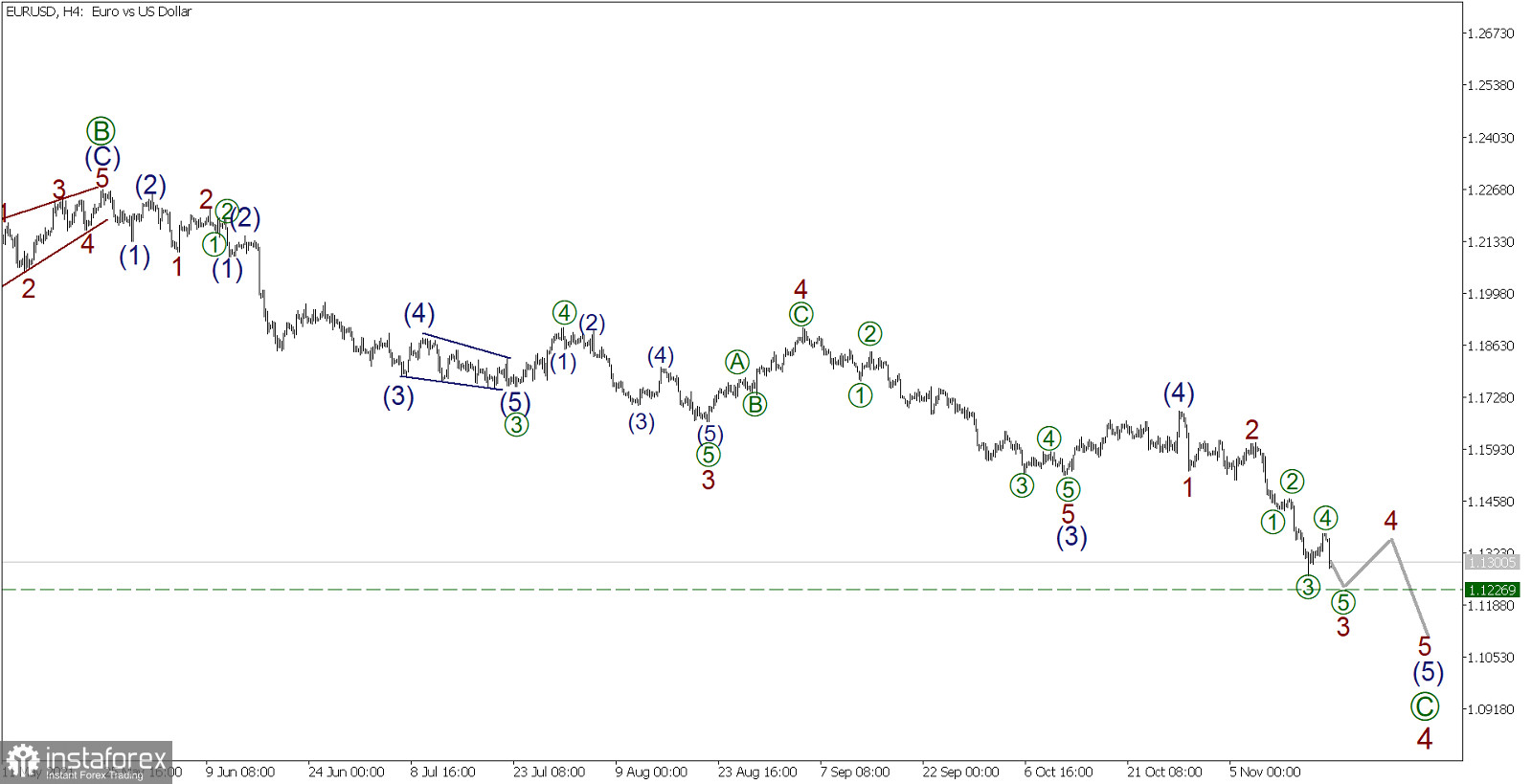

EUR/USD, H4 timeframe:

Let's continue to analyze the situation in the currency market using the Elliott theory.

The price continues to form a medium-term downward trend, which is the final part of a long correction wave 4. The last part of correction 4 is a bearish impulse [C], which includes sub-waves (1)-(2)-(3)-(4)-(5).

Wave (5) is currently developing, in which the formation of a long impulse wave 3 of a smaller wave level can be observed. This wave consists of sub-waves [1]-[2]-[3]-[4]-[5].

Considering the repeated speech of C. Lagarde, which is scheduled today at 18:00 Universal time, the last sub-wave [5] of the bearish impulse 3 may be completed. This means that there could be a decline to the level of 1.122. After that, the price may begin to rise in a bullish correction 4, as shown on the chart.

The approximate possible scheme of the future movement is indicated on the chart.

Trading decisions:

It is recommended to open short positions from the current level. The target is set at 1.122.