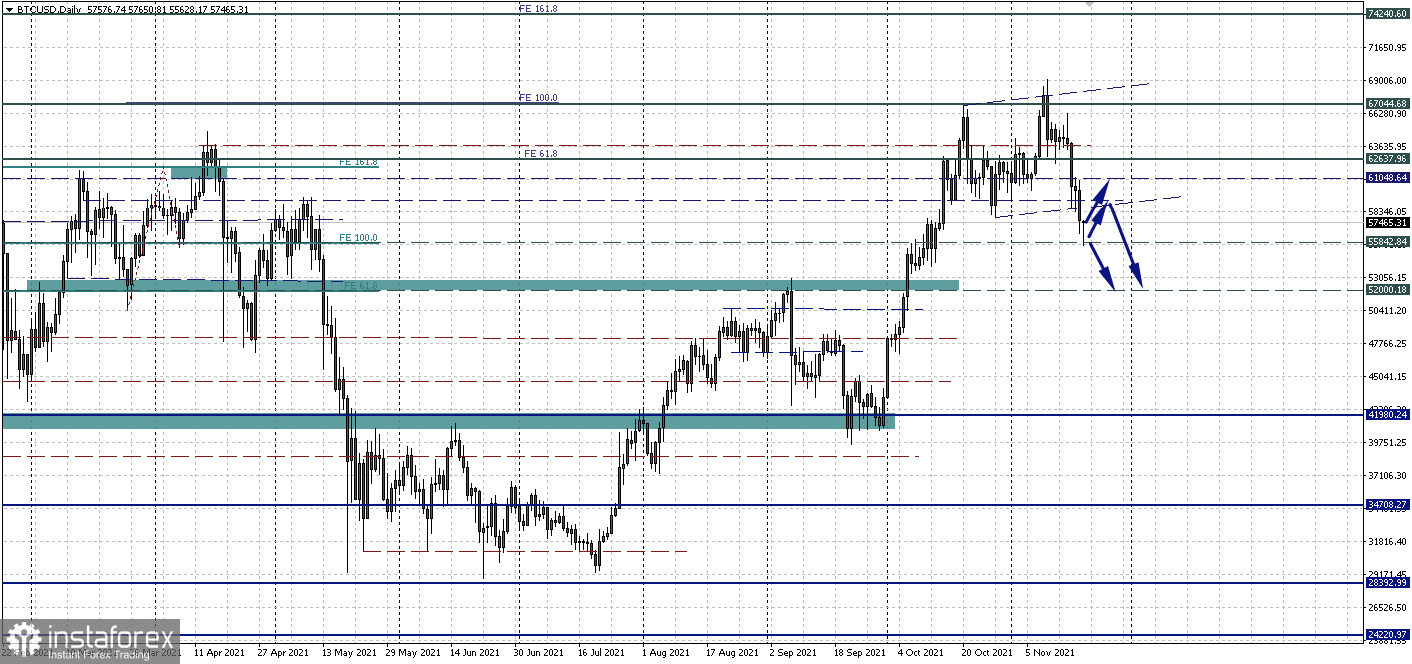

Bitcoin failed to hold above the $60,000 area. The main cryptocurrency bounced off the resistance of 61,048.64 and, as expected, technically descended to the support of 55,842.84.

Against this background, events can develop as follows. The first scenario is an attempt to return to the level of 61,048.64. And from there, perhaps, to growth. The second scenario is a fall to the next support of $52,000 per coin.

In the meantime, we are waiting for things to calm down, I propose to shift our attention to long-term prospects, in particular, to issues of regulation of the crypto industry.

Regulation of the crypto market: to be or not to be

The question of taking control of the rapidly developing crypto industry has been raised a long time ago. Market participants fear that the authorities will shut off the air to the market and stop innovations. Now it is still unclear what measures to apply, and this was clearly shown by the situation with the infrastructure law.

On this occasion, an interesting article came across Bloomberg. Industry participants are proposing to take on this issue and engage in self-regulation.

What is a cryptocurrency self-regulatory organization?

Major exchanges, including Coinbase and Gemini, and well-known investors such as Andreessen Horowitz, have pushed the idea of a Self-Regulatory Organization (SRO). They argue that the organization is better at overseeing a new and complex industry than traditional agencies that are now trying to apply old rules to a new market.

Proponents of this idea believe that the SRO could be more flexible in making decisions about the rules regarding new products since its members have both the experience and the resources.

"The job of a regulator is not easy when you're confronting something new. The question is, how do you get to an environment where the regulatory infrastructure can be more nimble?" said Greg Xethalis, chief compliance officer at crypto investment firm Multicoin Capital.

Market experience of self-regulation

Self-regulation on Wall Street has a long history. SROs, which are funded and run by their own members, set rules, conduct audits, and impose fines. They have powers delegated by Congress and regulatory bodies such as the Securities and Exchange Commission (SEC). Several years after Congress formed the SEC as part of President Franklin D. Roosevelt's New Deal, the agency delegated some oversight of brokers and brokerage firms to the National Association of Securities Dealers (NASD).

This organization has now become the Financial Industry Regulatory Authority (FINRA). Its functions include oversight and licensing, it now controls commodity brokers, and the major stock exchanges themselves are self-regulatory organizations.

What functions will cryptocurrency SRO take on?

A self-regulatory organization, according to Bloomberg, can take responsibility for suppressing at least some of the violations by outsourcing serious fraud to agencies such as the SEC.

For example, an SRO can decide whether a newly issued token should be classified as a security, commodity, or something else. Or deal with mundane tasks such as setting product disclosure rules or standards governing customer data management.

Its behavior will be monitored by the SEC and other agencies, who will have the final say if they disagree with the SRO's decisions.

What are the prospects for such a regulation scenario?

Most supporters of an SRO agree that such an organization would likely need an act of Congress allowing the SEC, CFTC, or other regulators to register and potentially delegate authority to it.

Such a bill could take years to pass. However, senators, including Wyoming Republican Cynthia Lummis, have said they plan to create comprehensive cryptocurrency legislation that could give SRO supporters the opportunity to bring their plan to life.