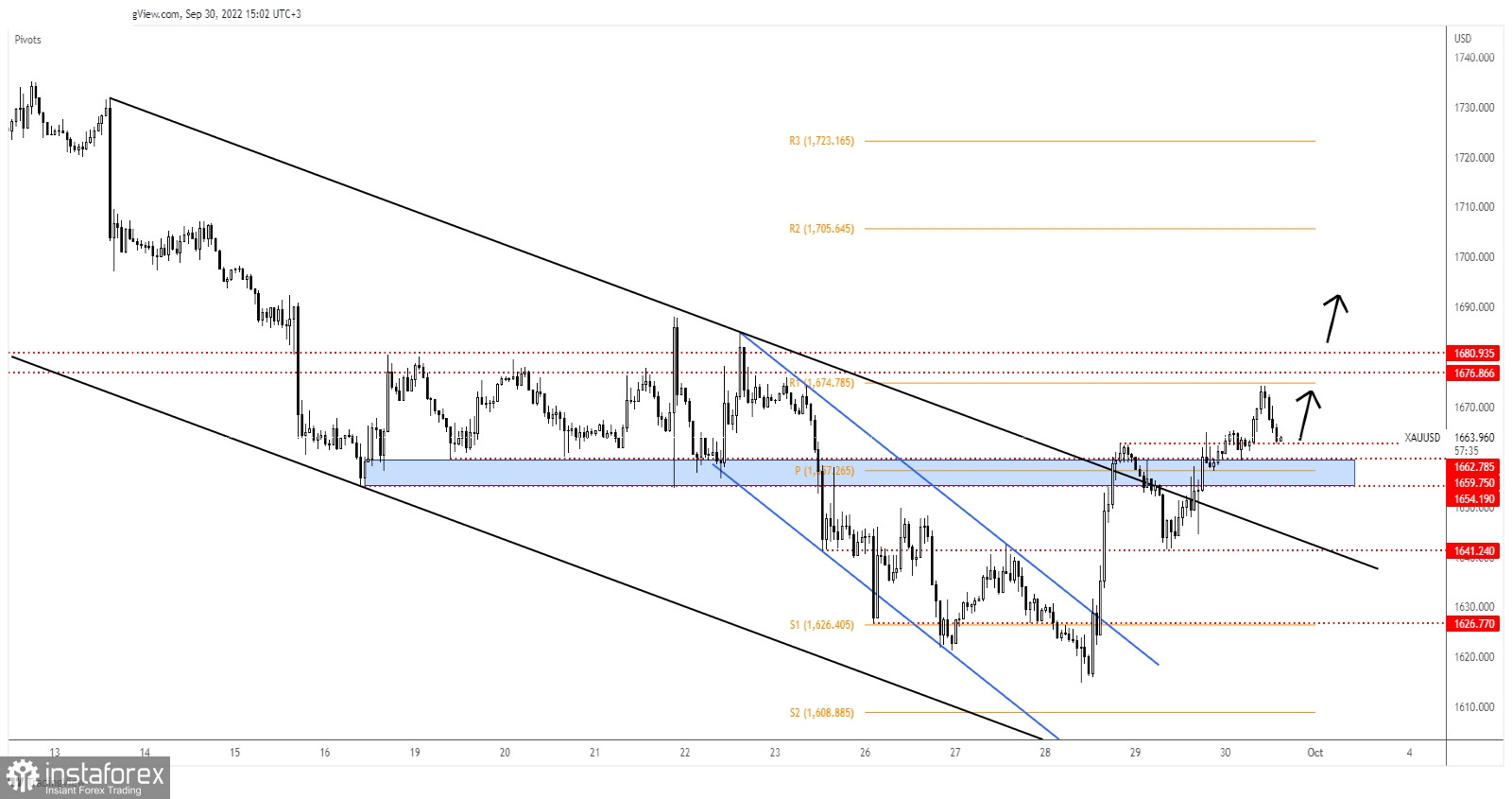

The price of Gold retreated after reaching 1,674 and now it was trading at 1,663. The yellow metal could come back to test and retest the near-term downside obstacles before resuming its growth.

XAU/USD rallied as the Dollar Index is in a corrective phase. USD's further depreciation could help the price o gold to approach and reach new highs. In the short term, the bias is bullish, but it remains to see how it will react after the US data. The Core PCE Price Index is expected to report a 0.5% growth while the Revised UoM Consumer Sentiment could be reported at 59.5 again. Moreover, Chicago PMI, Personal Spending, and Personal Income could bring more volatility as well.

XAU/USD Temporary Retreat?

XAU/USD retested 1,641 before resuming its leg higher. It was almost to reach the R1 (1,674) which represents an upside obstacle. Now, it could test and retest the 1,662 former high and the 1,659 - 1,654 support area.

The 1,657 weekly pivot point represents a downside obstacle as well. As long as it stays above these levels, Gold could resume its swing higher.

XAU/USD Forecast!

Testing and retesting the support levels, registering only false breakdowns could announce a new bullish momentum. Also, a new higher high, a valid breakout above 1,680 bring great long opportunities as well.