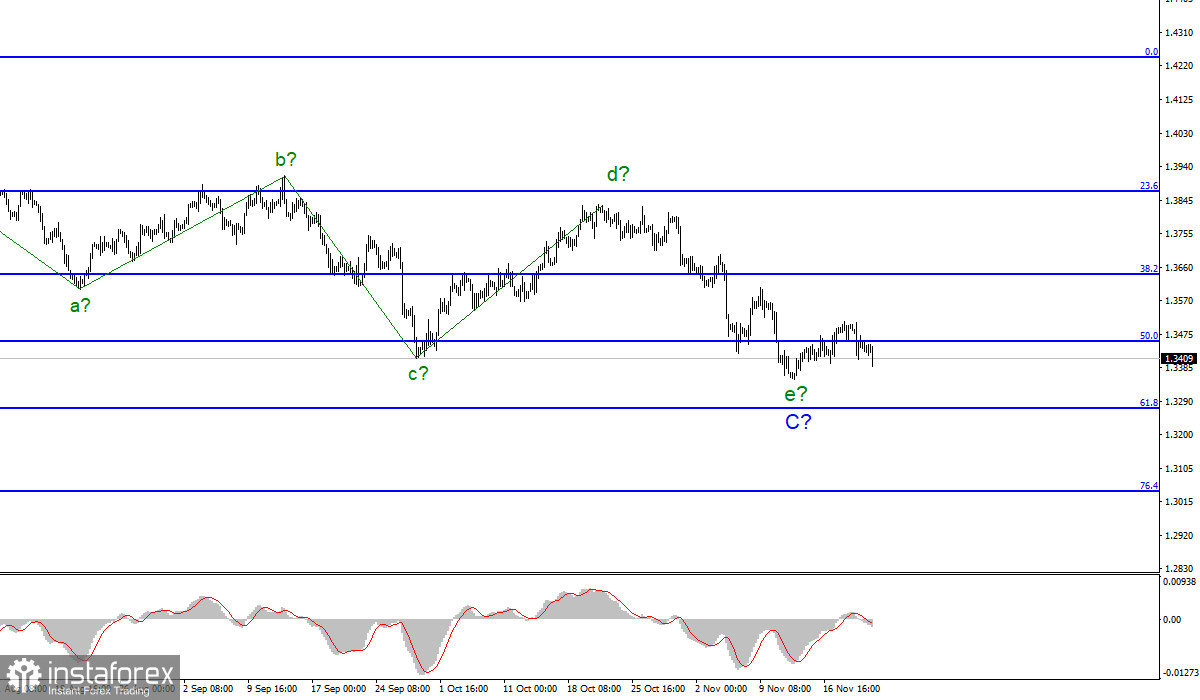

Wave pattern

For the pound/dollar pair, the wave marking is quite mixed due to deep corrective waves as part of the downward trend section. Five internal waves are visible inside the last wave C. Each subsequent one is approximately equal in size to the previous one. However, since all the waves in the composition of C or A are almost equal in size, the last wave e can already be completed. Thus, a new upward section of the trend which may also be corrective may appear. A pullback of the quotes from the lows reached on November 12 was not too strong. This is why the option with a new trend sector as the main one is still relevant. At the same time, if the pair breaks through its previous low, then the entire e wave will take a more complex and extended form. In the best-case scenario, only wave e will rise, not the whole wave C.

The pound sterling may regain ground yet demand is still weak

The pound/dollar pair decreased by 60 pips on Friday morning and by another 40 pips on Monday. Thus, over the past two days, demand has been growing for the US currency but not for the pound sterling as required by the current wave markup. Wave e in C may turn into an incomplete one. However, its internal structure includes almost any complication. Meanwhile, macroeconomic news from the UK is rather negative. In the UK, as in the entire European Union, energy prices (gas, petroleum, electricity) are rising, triggering a surge in price for other products. Energy is used in almost every sector. The automotive industry has suffered the most. Representatives of the UK automotive industry fear that their products will become less competitive in the foreign market. The main reason is high inflation in the country. Importantly, 90% of companies said they faced increased costs after leaving the European Union. More than half pointed out that an increase in costs exceeded forecasts. The European Union is the biggest importer of British cars. However, trading relations between the two parties have turned sour. In addition, they cannot reach an agreement on the Northern Ireland Protocol. It may further escalate the conflict.

Conclusion

The wave pattern for the pound/dollar pair looks quite comprehensive now. The expected wave e may be nearing its completion or has already been completed. The MACD indicator has given a new short signal. If the quotes continue to decline, then wave e may be considered incomplete. so, the downward movement will continue. Some analysts believe that the pair may rise today or tomorrow, indicating the resumption of the construction of a new upward wave. A successful attempt to break through the 50.0% Fibonacci retracement level will confirm the above-mentioned scenario.

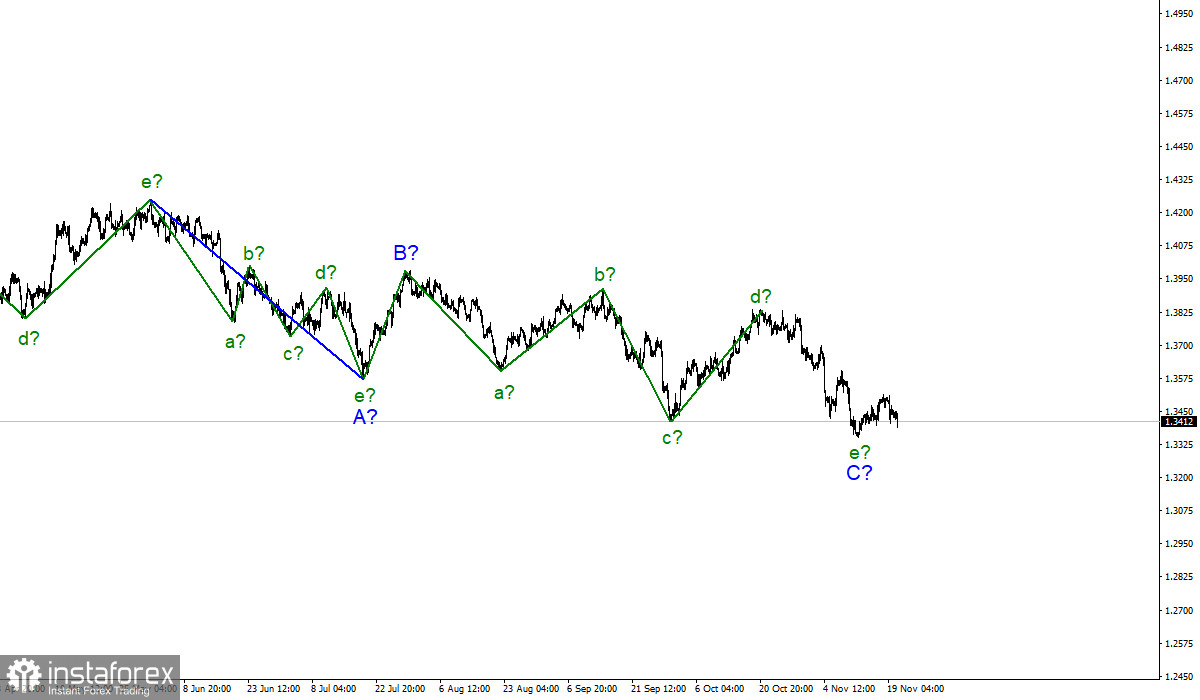

Large timeframe

Starting from January 6, the construction of a new downward trend section began, which may turn out to be almost any size and any length. At this time, wave C may be nearing its completion but there is no confirmation of this yet. The entire downward section of the trend may extend but there are no signals about this as well.