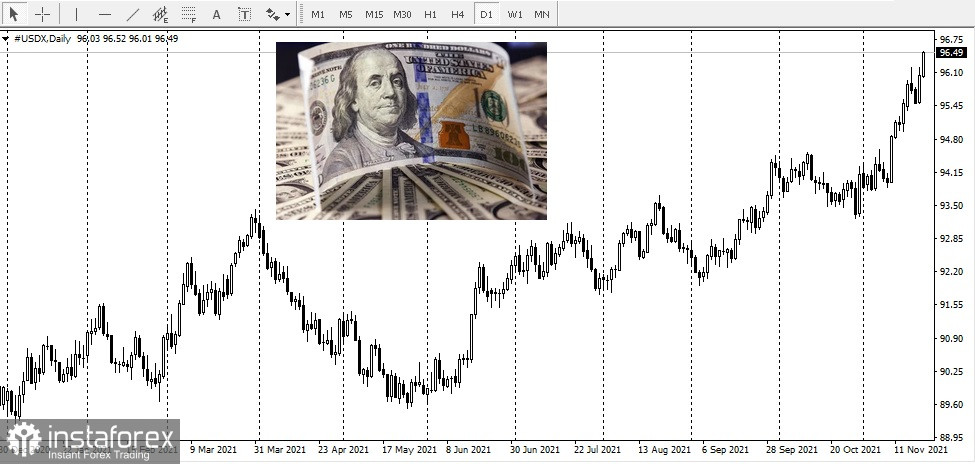

Gold prices have plummeted after the White House announced the re-appointment of Jerome Powell as Fed Chairman. In turn, the US dollar reached a new one-year high.

At a time when gold was reacting to the strengthening of the US dollar, precious metals Standard Chartered Bank's analyst Suki Cooper said that the correlation was beginning to break. She added that it would be better to observe the ratio of gold to real profitability.

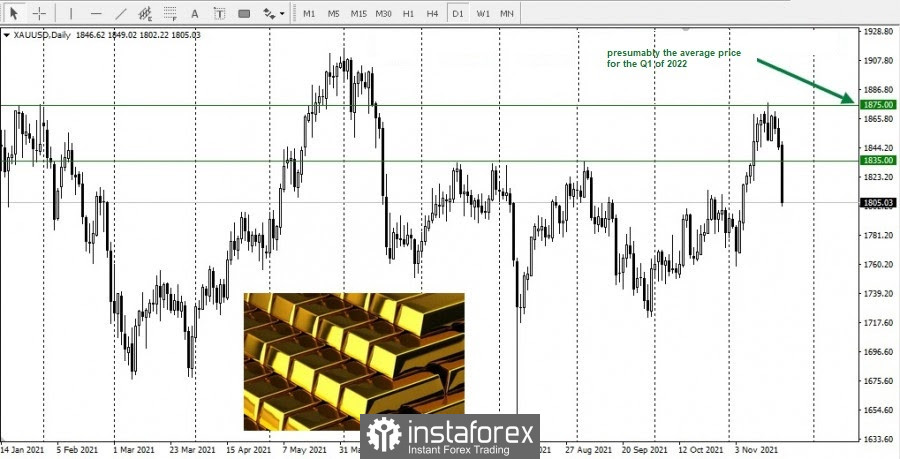

According to her, the latest drop in prices on the gold market may be an opportunity to buy, as it is expected that the Federal Reserve is still in no hurry to raise interest rates.

In a report released on Friday, Suki Cooper said she sees gold prices rising in the first quarter of 2022 as the market continues to focus on rising inflationary pressures and declining real bond yields.

Standard Chartered assumes that the average price of gold will be about $1,875 per ounce in the first quarter of 2022.

Gold is a mirror image of the threat of inflation. Suki Cooper noted that there will still be an inflation report this week when the personal consumer spending index data is published. According to Standard Chartered forecasts, PCE will grow by 4.2% for the year, which is the highest rate since 1991.