The US President J. Biden chose the next Fed chairman for the coming years on Monday. It was J. Powell, who is now the head of the Central Bank.

We believe that the decision of the American president is reasonable. Indeed, it makes no sense to change the leader in a difficult economic situation in a country that is burdened by the coronavirus pandemic. Powell is experienced and understands all the pros and cons of the current situation in the country's economy. But what about L. Brainard? It looks like she was appointed as Powell's deputy as a consolation prize, and that was it.

What threatens the markets with Powell's re-election for a second term and why did the stock markets both in America and in Europe as a whole decline on Monday, and is now generally trading in the "red" zone?

It has been previously pointed out the difference investors saw between Brainard and Powell. Now, we will only briefly recall this. The current head of the Federal Reserve is associated with a high probability of a more vigorous process of normalization of monetary policy, considering that by spring the regulator may raise interest rates by 0.25% to 0.50% for the first time. And although most members of the Central Bank have previously stated that they do not believe it is possible to start raising rates simultaneously with the process of reducing asset repurchase in the market, many of its participants consider this probability to be high. If a softer approach was expected from Brainard, then Powell's retention of the post of Fed head dispelled these hopes. That's why the US stock market as a whole was under pressure on Monday, as well as Europe and Asia this morning.

Given the new reality, the continuation of growth in the yield of treasuries, and the strengthening of fears of a more vigorous increase in interest rates, we should also expect an increase in demand for the US dollar, which has confidently consolidated above the level of 96.00 points according to the dynamics of the ICE index.

Before the opening of Europe's trading, both European and American stock index futures are declining, which indicates negative sentiment in the markets, which can only intensify if the data published today on business activity indices in the services sector and in the manufacturing sector turn out to be below forecasts. This will only raise the overall bar of negativity. In this case, it will be possible to say with high confidence that the decades-old tradition of stock market growth in America before Thanksgiving will be broken.

However, the troubles may not end there if the data of the basic price index of personal consumption expenditures released tomorrow on Wednesday shows an increase against the expected value. This will only strengthen the prospects for an increase in inflationary pressure, and therefore will bring the Fed's first interest rate hike next year closer.

And with regard to Powell's election, we can say that it is useless to change the leader in between the chaos in the American economy amid the pandemic.

Forecast of the day:

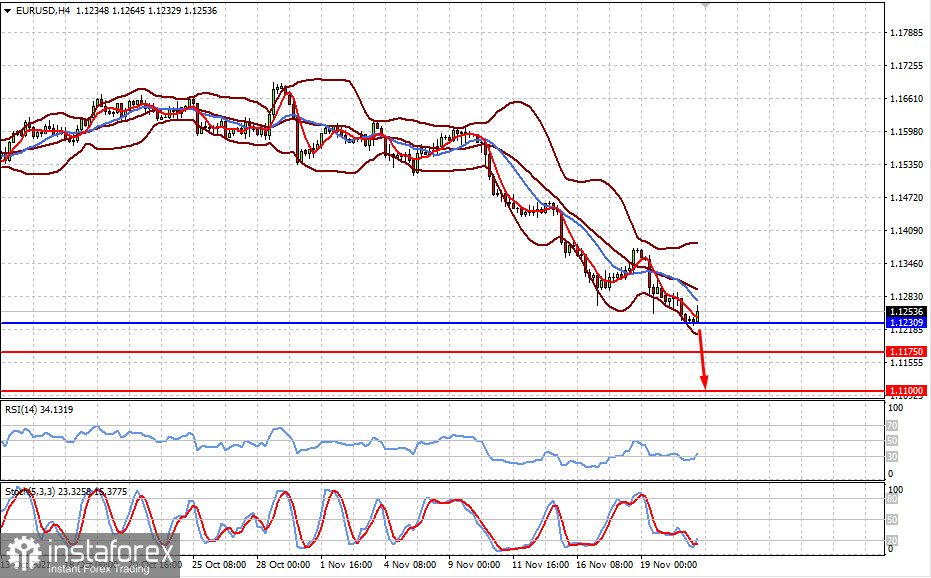

The EUR/USD pair intensified the decline on the growth of expectations of an earlier start of an interest rate hike in America. A decline in the pair below the level of 1.1230 may lead to its fall first to 1.1175, and then to 1.1100.

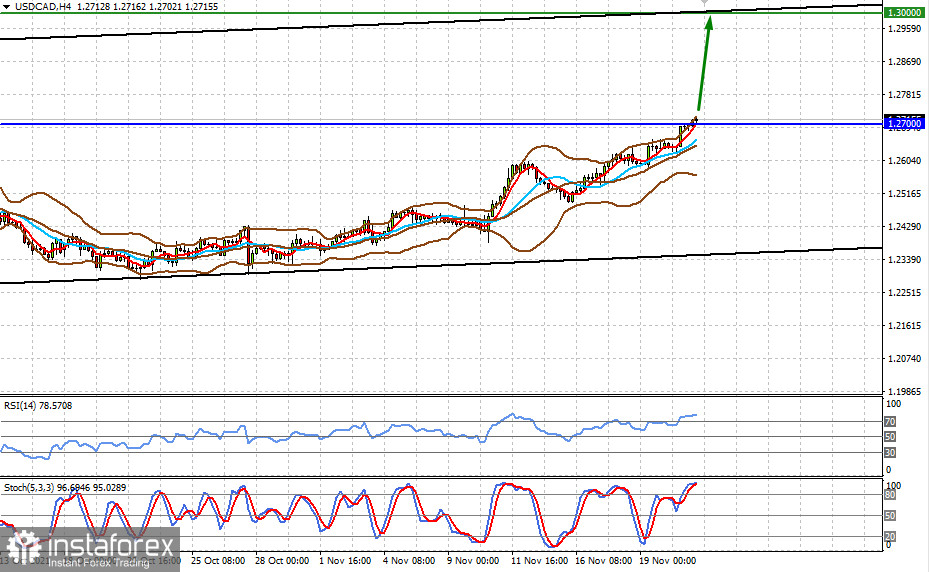

The USD/CAD pair is trading above the level of 1.2700. A consolidation above it on the wave of support for the US dollar from the expectation of an earlier Fed rate hike and lower crude oil prices will allow the pair to rise to the level of 1.3000.