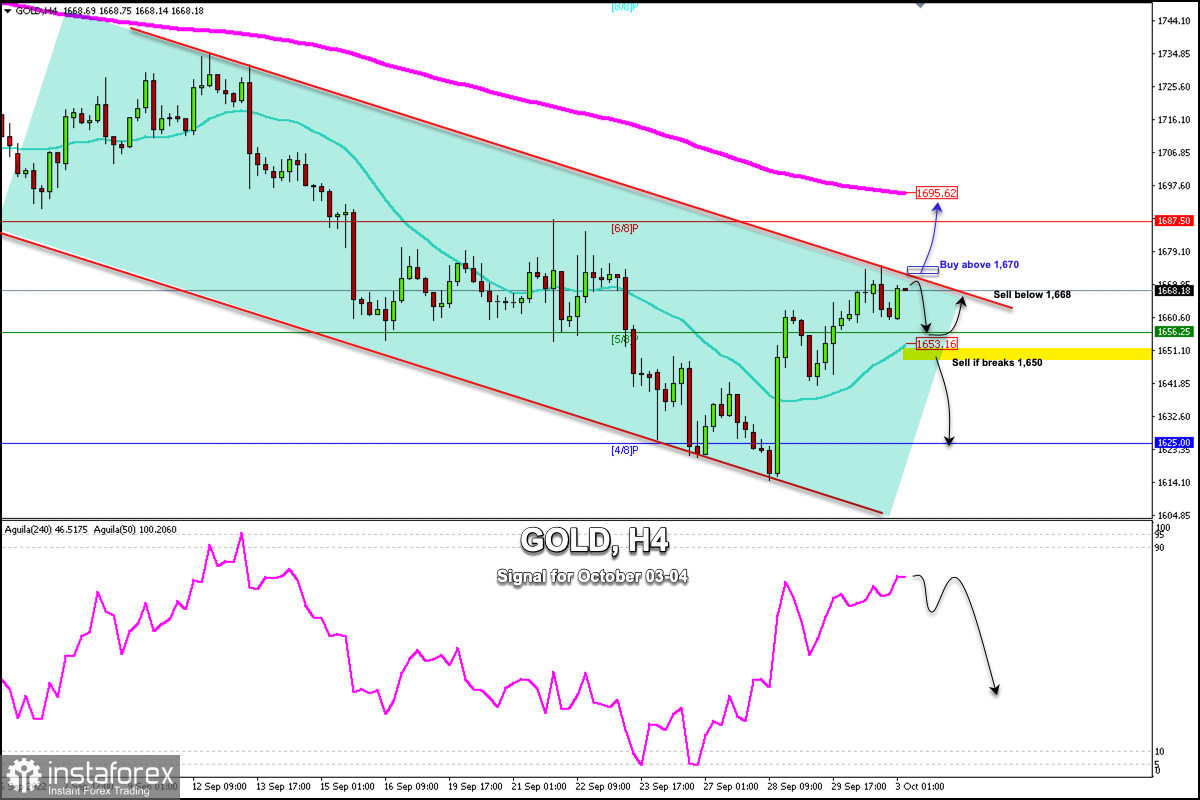

Early in the European session, Gold (XAU/USD) is trading at around 1,668 with a short-term bullish bias. It is located above the 21 SMA and below the 200 EMA.

The outlook could remain positive for gold. If it remains above 5/8 Murray (1,656) in the coming days, the price could reach the area of 6/8 Murray and even the 200 EMA at 1,695.

The technical correction of the US Dollar (USDX) and the decline in Treasury bonds have benefitted gold and this trend is likely to continue this week.

Another factor that could favor the strength of gold is the growing fears of recession and geopolitical risks, thus making the precious metal more attractive as a safe haven in times of crisis.

A bearish scenario could mean that gold consolidates below 1,650 and then we could expect a move towards the area of 1,625 (4/8 Murray) and it could even reach the psychological level of 1,600.

There is strong resistance around the level of 1,695-1,700. In case gold closes and consolidates above this level on the daily chart, we could expect a bullish move towards 8/8 Murray located at 1,750.

The eagle indicator is giving a positive signal. hence, gold is likely to continue the upward movement in the coming days.

According to the 4-hour chart, we can see that gold is trading within a downtrend channel which has been formed since early September. In case gold breaks out of this channel and consolidates above 1,670, it is expected to rise to 1,695 (200 EMA) and 1,700.

Our trading plan for the next few hours is to sell below the top of the downtrend channel around 1,668, with targets at 1,656. In the event of a sharp break and a daily close below 1,650, it will be a signal to continue selling with targets at 1,625.